If you look at China-focused public enterprises like JD.com (NASDAQ:JD), it’s difficult not to get a chill down your spine. While tech names have generally soared higher this year, JD stock ranks among the obvious exceptions. Since the beginning of January, the security slipped almost 17%. What’s perhaps more problematic is the trailing six-month performance, which is also down about 14%.

Table of Contents

Fundamentally, the problem appears tied to a potential slowdown in the world’s second-largest economy. According to a report by The Wall Street Journal, retail sales in China grew by only 1.3% in November, which represents a slowdown from the 2.9% year-over-year growth seen in October. It’s also the weakest overall growth since 2022.

It’s worth pointing out that Chinese officials have launched initiatives to bolster consumer spending, which has lagged since the pandemic. Still, unfavorable comparative dynamics and other difficulties could potentially lead to a worse read in December before starting to recover in 2026. For now, JD stock appears to be absorbing the brunt of the damage.

That said, the market is a reflexive environment. Colloquially, investors’ perceptions often shape reality through shared convictions reinforced through feedback loops. Eventually, the extended downturn in JD stock could be viewed as a discounted opportunity. If so, speculators would be wise not to give up on it prematurely.

Of course, it’s never wise to intuit value; you want to actually verify the probability of this expectational arbitrage. To that end, we can use quantitative analysis — layered through the context of a distributional framework — to trade JD stock.

Exposing the Limitations of Traditional Trading Methodologies

Under the context of traditional market analysis, price or value is plotted as a function of time. However, the truth of the matter is that price really should be considered a function of state. The passage of time has no bearing on whether a security moves higher or lower. Instead, a gazillion variables — from institutional order flows to reflexive demand among retail traders — go into what we call the share price.

While arguments can easily erupt, I believe that fundamental and technical analysis represent ineffective methodologies for advanced trading — especially strategies that involve multi-leg transactions. For example, fundamental analysts often attempt to rerate future earnings or cash flows to current market dynamics. Such an approach, though, begs the question because it presupposes that the current relationship is the “right” one.

As it stands, there are no clean, causal relationships tying one or two fundamental metrics to share price appreciation. If that were the case, companies that beat earnings targets would never see their shares drop. However, seemingly contradictory outcomes like that (i.e., strong results, poor stock performance) occur quite frequently.

As for technical analysis, the basic premise seems reasonable: that we can use past data to better predict future outcomes. However, the problem here is that the “analysis” of past data usually means drawing lines of support and resistance. There is no first-order principle cited as to why those levels are meaningful. Subsequently, the insight is really intuition.

That’s dangerous because human intuition is designed to spot kinetic threats, like a poisonous snake slithering in the bushes. Our senses — as the famous psychologist Dr. Ellen Langer demonstrated in her illusion of control studies — are not designed to decipher patterns within heteroskedastic environments.

In other words, if a technical analyst has to look up what heteroskedasticity means, their opinion on the probabilistic dynamics of the market should be taken with a grain of salt.

Shifting the Analytical Landscape of JD Stock

To really understand how to tackle JD stock, you need the trading topography. It’s like driving to a neighborhood that you’ve never been to before. You wouldn’t just go there to feel out where you need to be. You’d use a map or get the directions beforehand. It’s the same principle in the market.

Most analyses feel superficial in that pursuit because they are layered as single-path domains arranged chronologically. However, the stock market — and especially the options market — is a multiverse. In other words, multiple alternative realities are competing with each other to establish the right to become the one true timeline.

Given that the ecosystem is a multiverse — that is, an environment of competing worldviews — we need to look at JD stock as a distribution. That can be accomplished by breaking apart its single strand of continuous price data into multiple rolling trials or sequences.

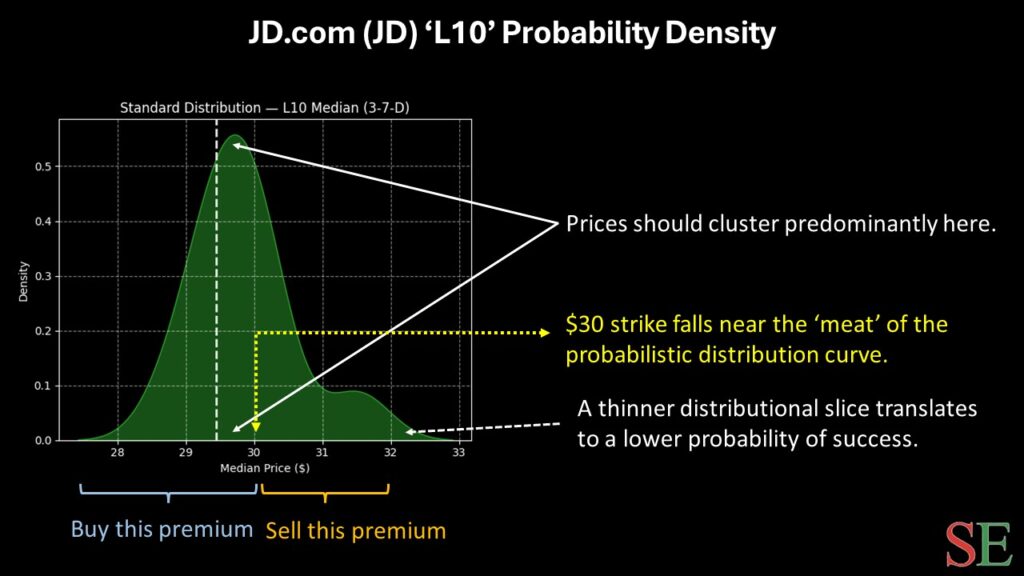

For example, if we took a single 10-week cycle, JD stock’s return during that period won’t tell us much about the probability of other weeks. However, if we stacked hundreds of 10-week cycles in a distribution, then the most heavily represented price levels would see a bulge in probability density. This bulge represents the security risk geometry. It tells us within the multiverse of possibilities where JD prefers to materialize.

Using this analysis, we can calculate that, on average, JD stock’s 10-week returns would form a distributional curve ranging between $28.70 and $31 (assuming an anchor price of $29.44, Friday’s close). However, we’re interested in isolating for the current quant signal, which is the 3-7-D sequence; that is, up to Friday’s close, JD printed only three up weeks out of the past 10 weeks.

Despite the extended bearishness, this signal tends to shift the distribution positively, with outcomes mostly ranging between $27.20 and $33. Price clustering would also likely be predominant at $29.80.

To be fair, there’s not much structural difference between the current signal’s probabilistic intent and the aggregate signal. However, because probabilistic mass appears so concentrated near $30, this price point represents a natural target for upside.

Taking the Smart Trade

With the risk geometry calculated above, arguably the smartest trade to consider is the 29/30 bull call spread expiring Feb. 20, 2026. This wager involves two simultaneous transactions on a single ticket or execution: buy the $29 call and sell the $30 call, for a net debit paid of $49 (the most that can be lost).

Should JD stock rise through the second-leg strike ($30) at expiration, the maximum profit would be $51, a payout of over 104%. Breakeven would land at $29.49.

Fundamentally, this trade makes sense not just because of probability density but because of probability decay. Between $30 and $31, the probability density drops by about 80%. That’s a massive leap for just a $1 in strike price. To put it differently, that one buck would cost you an 80% penalty in relative probability.

If we assume that the empirical premise of the above analysis will hold true over the next 10 weeks, that’s a bad deal. The scary part is, you wouldn’t know it if you were conducting fundamental or technical analysis.

You’re forewarned, though, with distributional analysis. That’s why I think the quant approach is superior when trading options.

Leave a Reply