Amazon.com Inc. (NASDAQ: AMZN) stock dropped sharply the day after the company had what could be cheekily expressed as a “hold my beer” moment. In its fourth-quarter earnings report, the tech giant announced a $200 billion capital expenditure (capex) plan to build out its artificial intelligence (AI) infrastructure.

Table of Contents

During this earnings season, many of the mega-cap technology companies, particularly the hyperscalers, have made it clear that the AI bubble is not deflating. In fact, they have plans to blow massive amounts of air into it.

- Microsoft Corp. (NASDAQ: MSFT) announced a 2026 capex spend of over $100 million.

- Meta Platforms (NASDAQ: META) announced $115 billion to $135 billion in 2026 capex spend.

- Then Alphabet Inc. (NASDAQ: GOOGL) topped those numbers with a forecast spend between $175 billion and $185 billion.

So, you can see why investors may have been a little gobsmacked and a little nervous about Amazon coming in with a $200 billion forecast. We’re talking about real dollars here. But more importantly, investors are becoming skeptical, or simply impatient, about the likely return on investment for all this spending.

That’s why investors need to dive into Amazon’s game plan. At this price and this valuation, it will still be a leap of faith, but this pullback in AMZN stock may be a great buying opportunity.

A Single Graphic That Helps You Understand Your Risk Tolerance

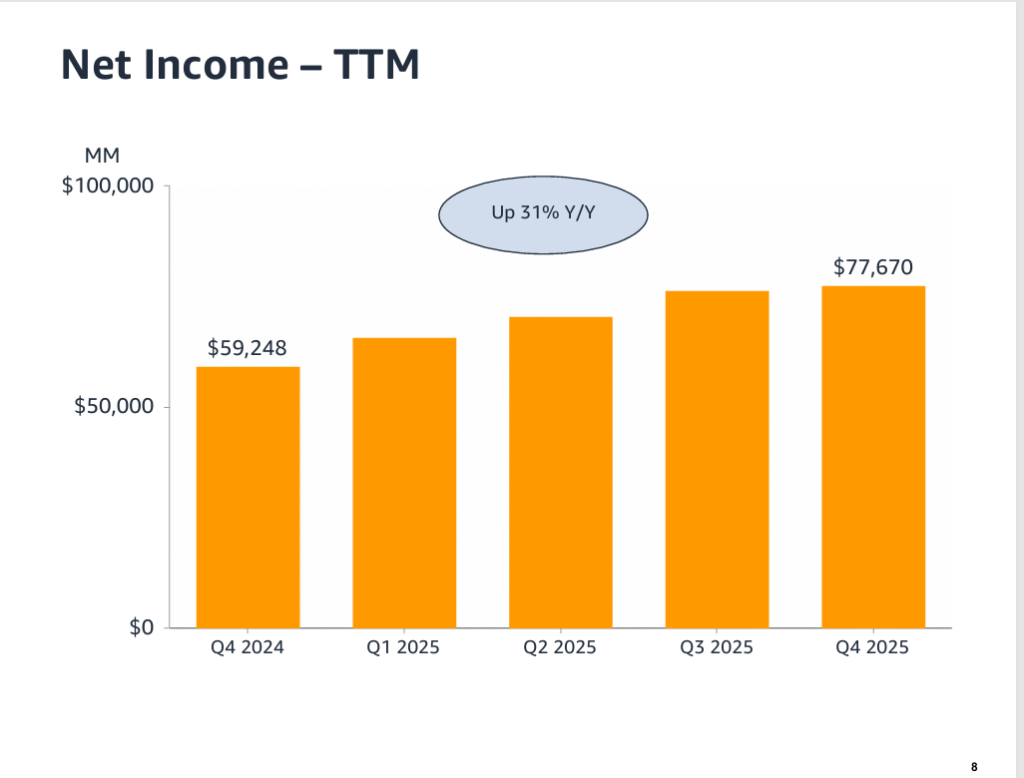

For the full year 2025, Amazon booked net income of $77 billion. That was up 31% on a year-over-year (YoY) basis. However, even if the company grows that number at a similar rate in 2026, it will still have to take on debt to pay for the $200 billion capex spend.

It’s one thing for a company like Microsoft, with a boatload of cash on its balance sheet, to announce a hefty spend. But as investors saw with the price action in Oracle (NYSE: ORCL) stock, when a company is financing its AI ambitions with debt, it’s a different story.

A more risk-tolerant investor may absorb this news as the cost of doing business. With an appropriately long time horizon, it’s not hard to see a scenario where buying and holding would be a good strategy. And if AMZN stock moves lower, all the better.

On the other hand, $200 billion is a large number. And it’s one that risk-averse investors aren’t going to swallow without understanding how the company will recoup that spending.

When Good Isn’t Good Enough

Another headwind for AMZN stock post earnings came from the results themselves. The company cleared a high bar, but not in the impressive way that investors may have secretly hoped for.

- Earnings per share (EPS) of $1.95 was in line with analysts’ expectations.

- Revenue of $213.39 billion was 1.02% better than the $211.23 billion analysts were forecasting.

We’ve already seen this earnings season that companies are facing high expectations this earnings season. And those expectations are even higher when a company is forecasting a capex spend of $200 billion.

Trainium Could Be the Catalyst Hiding in Plain Sight

One of the largest line items in the current AI infrastructure buildout comes from semiconductor chips and GPUs, mostly from NVIDIA Corp. (NASDAQ: NVDA). However, Amazon is developing its own Trainium chip. And understanding what this could mean is central to any bull case on AMZN stock.

According to Amazon, the Trainium chip will deliver 30-40% better price performance than comparable GPUs. By designing its own chips, Amazon can significantly lower its per-unit compute costs. If the company can make this transition to more cost-effective chips at scale, it could see a dramatic expansion in cloud margins.

The math is simple but will require successful execution. To that end, Amazon reported an expectation that revenue for its Trainium and Graviton processors have an annual run rate of more than $10 billion. And the expectation is that this growth will accelerate, as will demand from core enterprise production workloads.

Analysts Love AMZN Stock

Amazon was the poster child for the dot-com era. At that time, however, AMZN stock was a penny stock driven by retail sentiment. That’s not the case today, with 72% of Amazon stock being owned by institutional investors.

That means that it’s the “big money” causing the 11% pullback in AMZN stock in the five trading days ending Feb. 6. But that’s contradicted by the opinion of several analysts. To be fair, several analysts lowered their price targets on AMZN stock, but the stock hasn’t been fundamentally rerated. And virtually all the targets are above the stock’s consensus price target of $284.30, which would provide 35% upside.

Challenges to the Bull Case for Amazon

The market’s initial verdict on Amazon’s $200 billion capex plan is that the company is pulling growth forward at the expense of near‑term profitability and free cash flow. Even with AWS backlog up sharply and AI workloads accelerating, investors are staring at a spending figure that is roughly 50% above 2025 levels, which heightens execution risk if the macro backdrop softens or early AI projects fail to scale as expected.

Unlike Microsoft, Amazon does not have the same net cash fortress, so funding this surge in infrastructure will likely lean on a mix of operating cash flow and additional leverage, a setup that draws uncomfortable comparisons to Oracle’s debt‑funded AI push.

There is also a growing concern that key foundation‑model partners such as Anthropic and OpenAI remain unprofitable, which could limit near‑term pricing power on AI services even as Amazon shoulders most of the upfront build‑out. At the same time, the quarter itself was “good, not great”: revenue beat by only about 1% and EPS slightly missed, while operating‑income guidance came in light relative to elevated expectations.

When you pair modest upside with a capex shock of this magnitude, it becomes easier to argue the stock may need time to digest both valuation and the new risk profile before the next leg higher.

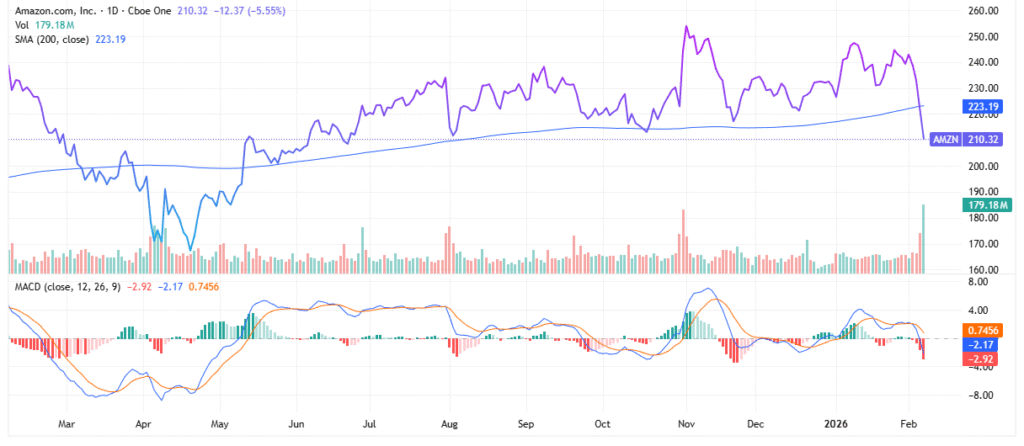

Technical Analysis – Oversold but Vulnerable

The post‑earnings sell‑off drove AMZN through its 200‑day moving average for the first time since late 2025, a technical break that often flips medium‑term trend followers from buyers to sellers. The chart now shows the stock probing levels last seen in mid‑2025, with downside momentum picking up as volume expands on down days, a sign that institutions are actively distributing rather than merely trimming around the edges.

With the relative strength index hovering around 28, AMZN is technically oversold. But that alone does not guarantee an immediate bounce; in prior growth‑stock washouts, RSI has stayed sub‑30 for weeks while prices ground lower or moved sideways.

From here, a pragmatic trading roadmap might center on two reference points: the recent gap zone near the earnings print, which could act as resistance on any reflex rally, and the pre‑break cluster around the 200‑day moving average that may now serve as an important ceiling. Short‑term traders may look for a bullish MACD cross or a quick recapture of the 200‑day as confirmation that the worst of the de‑rating is over, while longer‑term investors could scale in gradually, accepting that volatility will likely remain elevated as the market handicaps the AI capex cycle.

Some Final Thoughts on AMZN Stock

Amazon’s AI‑driven capex offensive has the potential to deepen its moat in cloud and custom silicon, but it also raises the stakes for execution and balance‑sheet discipline. With shares technically oversold yet sitting below key moving averages, investors may want to treat AMZN as a high‑beta compounder that now demands a higher tolerance for drawdowns—and a longer runway for the AI payoff to materialize.

Leave a Reply