Walmart (NYSE: WMT) stock slipped about 1.3% after the company’s Q4 2026 earnings report. The retailer delivered exactly what long‑term investors should want: mid‑single‑digit top‑line growth, double‑digit operating income growth, strong free cash flow, and another step forward in its digital transformation. But the market felt “guidance came in light” and in came the sellers.

Table of Contents

That feels more like a positioning excuse than a fundamental issue, especially when the market is clearly rotating between winners and laggards. In my view, this looks more like near‑term indigestion than a change in Walmart’s bullish long‑term thesis.

So what did the report say? Total revenues grew 5.6% to $190.7 billion, with net sales up 4.9% in constant currency, driven by strength across all segments. Adjusted operating income in constant currency climbed 10.5% to $8.6 billion, meaning profits are growing roughly twice as fast as sales, helped by a 13‑basis‑point improvement in gross margin and 19‑basis‑point leverage on adjusted operating expenses.

Adjusted EPS came in at 0.74, up 12.1% year‑over‑year, even as reported EPS was pressured by mark‑to‑market losses on equity investments like Symbotic. On top of that, Walmart boosted the dividend and secured a fresh 30 billion share repurchase authorization after buying back 1.1 billion of stock in the quarter at an average price just above 111.

If that’s what “light” looks like, I’ll take it. Walmart’s FY 2027 guidance calls for 3.5% to 4.5% net sales growth and 6% to 8% adjusted operating income growth, which is very much in line with a durable compounder. However, the real key is what’s happening inside the revenue mix: higher‑margin, capital‑efficient digital businesses that can let earnings compound faster than the headline sales number over the next several years.

Solid Quarter, Conservative Guide Supports the Bullish Thesis

Under the surface of the “light” guide is a quarter that checks almost every box for long‑term shareholders.

- Total revenues rose to $190.7 billion, up 5.6% (4.9% in constant currency), driven by broad‑based strength across Walmart U.S., Sam’s Club, and International.

- Global e‑commerce net sales grew 24% and now make up 23% of total net sales – that speaks directly to Walmart’s successful omnichannel pivot.

Profitability trends were equally constructive.

- Gross profit rate ticked up 13 basis points to 24.0%, led by Walmart U.S., better inventory management, and an improved business mix,

- Inventory grew just 2.6% in constant currency, roughly half the pace of full‑year sales growth.

- Adjusted operating expenses as a percentage of net sales fell 19 basis points to 20.3%, with leverage driven by Walmart International and the absence of prior‑year legal and restructuring noise.

The result: reported operating income rose 10.8%, and adjusted operating income in constant currency was up 10.5%, well ahead of sales.

Cash generation remains a quiet strength in the story:

- Operating cash flow for fiscal 2026 increased to 41.6 billion, up 5.1 billion year‑over‑year.

- Free cash flow improved 17.9% to $14.9 billion even as the conpany stepped up capital expenditures by $2.9 billion to support its omnichannel and automation strategy.

That cash supported both dividends and buybacks — returns to shareholders in Q4 totaled $3.0 billion — and underpins the board’s confidence in authorizing a new $30 billion repurchase program. When you combine this with a business that sports a below‑market beta and defensive end‑markets, it’s hard to argue the fundamentals suddenly got worse because management chose not to over‑promise on FY 2027.

Walmart’s E‑Commerce Engine is Becoming a Credible Amazon Counterweight

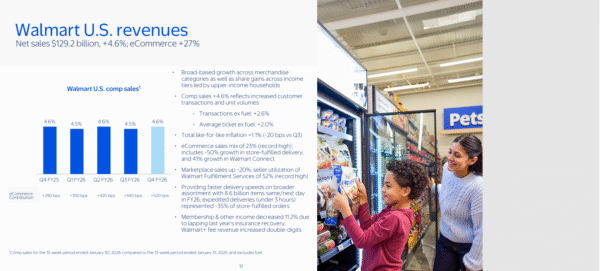

The most underappreciated part of the quarter is how quickly Walmart is evolving into a genuinely scaled digital commerce and advertising platform. Global e‑commerce net sales grew 24% and now account for 23% of total net sales, with U.S. e‑commerce up 27% and contributing 520 basis points to Walmart U.S. comps.

In the U.S., e‑commerce represents 23% of segment sales, another record, powered by 50% growth in store‑fulfilled delivery and a 41% surge in Walmart Connect advertising. These are exactly the kind of high‑margin, low‑capital‑intensity revenue streams investors prize in Amazon (NASDAQ: AMZN).

Marketplace and fulfillment metrics look more and more like a flywheel. Marketplace sales climbed 20%, and 52% of marketplace sellers now use Walmart Fulfillment Services, a record level that tightens the ecosystem and improves assortments.

Walmart fulfilled 8.6 billion items on a same‑day or next‑day basis in FY26, and expedited deliveries under three hours represented 35% of store‑fulfilled orders. Store‑fulfilled fast delivery is now available to 95% of U.S. households in under three hours, a scale that leverages Walmart’s brick‑and‑mortar network in a way Amazon simply can’t replicate.

Internationally, the digital story is just as powerful. Walmart International net sales in constant currency grew 7.5% to 34.6 billion, with e‑commerce making up 28% of net sales and e‑commerce units increasingly delivered in under three hours.

In China, digital mix is now more than 50% of total sales, with e‑commerce net sales up 28%, while markets like Walmex and Canada posted double‑digit or near‑double‑digit online growth.

As advertising, marketplace take‑rates, and fulfillment fees scale, every incremental digital dollar should carry meaningfully higher margins than a traditional in‑store grocery basket. That’s how a “boring” retailer quietly evolves into a structurally higher‑return, higher‑margin platform over time. That’s a key reason I think earnings could grow materially faster than consensus estimates over the next couple of years.

What Would it Take for the Bulls to Be Wrong?

There are a few ways the bullish thesis could break, and they’re worth spelling out, even if they may be unlikely. First, if consumer spending weakens more than expected, particularly among lower‑income cohorts, Walmart could see traffic or ticket slow despite its value positioning, pressuring comp sales and limiting operating leverage.

Second, the digital and advertising engines need to keep compounding; if e‑commerce growth slowed sharply or if Walmart Connect revenue growth rolled over, the margin‑mix story would look less compelling.

Third, the company is leaning into capital spending — capex was 26.6 billion in FY26, about 3.5% of net sales, as Walmart invests in fulfillment centers, automation, and store remodels. If those investments fail to deliver the expected productivity gains or margin lift, return on investment, which already dipped modestly to 15.1% from 15.5% due to higher invested capital, could face more pressure.

Finally, competitive intensity from Amazon and hard‑discounters could force Walmart to reinvest more of its gross margin into price, slowing the pace of earnings growth. Again, none of these risks are new or particularly likely, but they’re the levers to watch if you’re testing the bull case.

Conclusion: A Rotation‑Driven Dip in WMT Stock Looks Buyable

Put it all together, and Walmart’s Q4 2026 looks much better than the “light guidance” narrative suggests. The company is growing revenues in the mid‑single‑digits, expanding gross margin, leveraging operating expenses, and driving double‑digit growth in adjusted operating income and EPS, all while funding a higher dividend, a 30 billion buyback, and heavy investment in its digital infrastructure.

Global e‑commerce at 23% of net sales, 24% growth in online sales, and surging marketplace and advertising metrics suggest Walmart is increasingly playing in Amazon’s sandbox — but with the added benefit of a massive physical store base and a defensive, everyday‑needs demand profile.

In that context, a 1%–2% pullback on cautious guidance looks less like the start of a downtrend and more like a garden‑variety shakeout in a stock that many investors have come to view as “expensive defensive.” For investors willing to look past a quarter or two of guidance angst, this dip in WMT stock looks like an opportunity, not a warning sign.

Leave a Reply