Lithium continues to be one of the most strategically important commodities in the world today. It plays a central role in the global transition toward electrification, clean energy, and large-scale energy storage. From electric vehicles to renewable power grids, lithium is a critical building block — and demand for it is only accelerating.

Table of Contents

At the same time, supply growth is slowing. Lower mine activity and delayed expansion projects are tightening the market. And now, after a period of oversupply, lithium is now shifting back toward a meaningful deficit.

According to Seeking Alpha:

“Industry forecasts continue to point to lithium demand more than doubling by the end of the decade, with 2026 shaping up as a key inflection year where demand growth clearly outpaces new supply.”

In addition, many analysts now expect the lithium market to transition from surplus to deficit starting in 2026. That being said, investors may want to consider gaining exposure to lithium through select stocks and exchange-traded funds (ETFs).

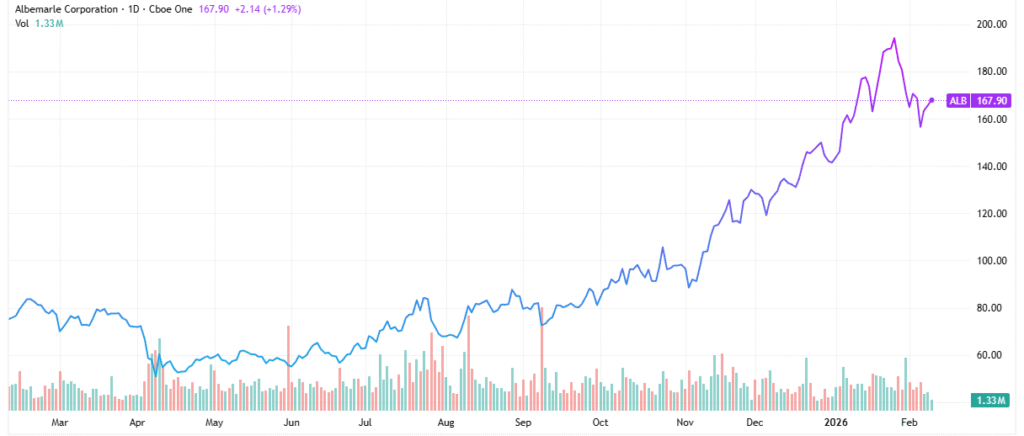

Albemarle Corporation (ALB)

Albemarle Corp. (NYSE: ALB) remains one of the most important and established names in the sector, making it a cornerstone holding for investors seeking direct exposure to the market. The company has recently attracted renewed attention from Wall Street, with several major banks raising both their price targets and ratings.

This growing optimism reflects expectations for tighter supply conditions and stronger lithium pricing ahead. Deutsche Bank, for example, recently upgraded Albemarle to a Buy rating and set a price target of $185.

Analysts at Baird upgraded ALB to a Buy and raised their price target to $210. As cited by Seeking Alpha, Baird analysts wrote: “We are incrementally positive given the recent increase in lithium prices and our view that demand strength stemming from stationary storage will continue to propel ALB higher.”

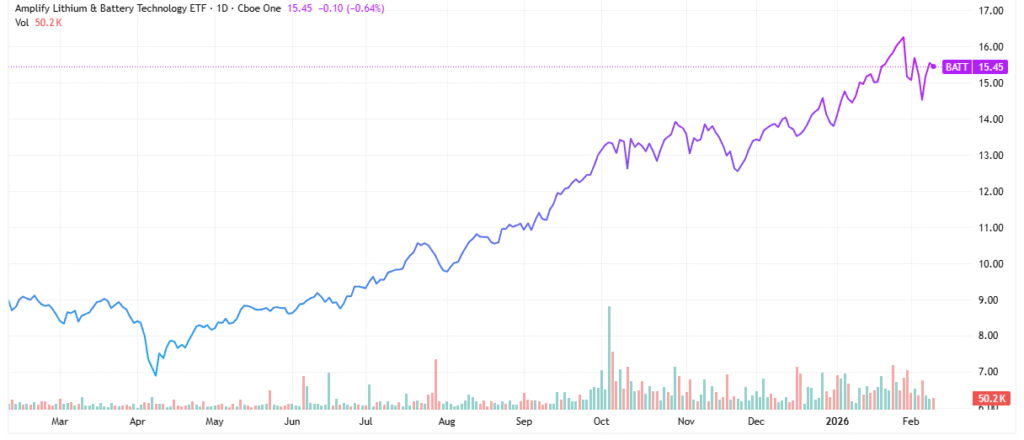

Amplify Lithium & Battery Technology ETF (BATT)

For investors looking for diversification on the cheap, there’s the Amplify Lithium & Battery Technology ETF (NYSEARCA: BATT) is worth considering.

With an expense ratio of 0.59%, BATT provides exposure to companies involved across the battery ecosystem, including battery storage, battery metals, materials, and electric vehicles. Its diversified approach reduces single-company risk while maintaining leverage to the broader lithium and battery technology trend.

Some of BATT’s top holdings include Tesla (NASDAQ: TSLA), BYD Co. (OTCMKTS: BYDDY), Panasonic Holdings (OTCMKTS: PCRFY), BHP Group (NYSE: BHP), Albemarle, and Ganfeng Lithium (OTCMKTS: .GNENF).

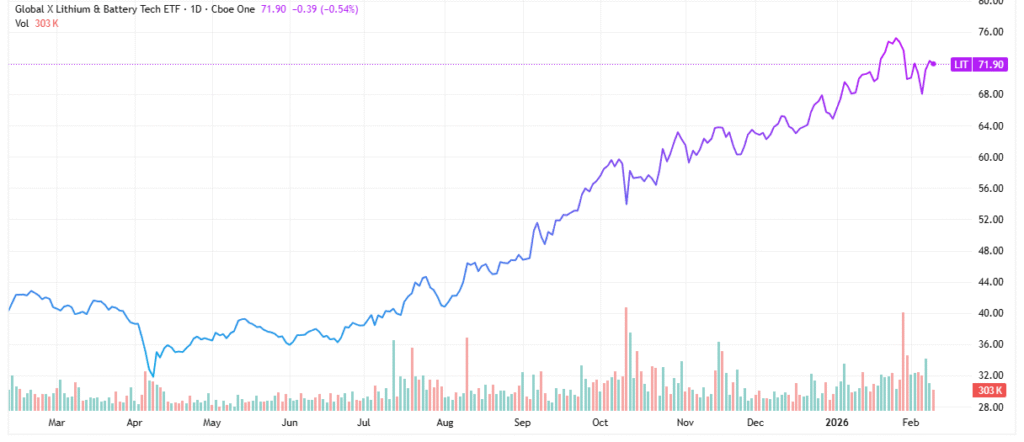

Global X Lithium & Battery Tech ETF (LIT)

Another popular option is the Global X Lithium & Battery Tech ETF (NYSEARCA: LIT). With an expense ratio of 0.75%, LIT offers exposure to the full lithium value chain — from mining and refining to battery manufacturing and electric vehicle production. The ETF holds 40 stocks: Albemarle, Tesla, Ganfeng Lithium, BYD Co., Lucid Group (NASDAQ: LCID), and Mineral Resources.

Challenges to the Thesis

A key challenge to the bullish demand thesis is the possibility that demand growth fails to materialize as quickly—or as broadly—as expected. Electric vehicle adoption, while still rising, is showing signs of slowing in some major markets due to higher interest rates, reduced subsidies, and affordability concerns.

At the same time, automakers and battery manufacturers are actively working to reduce lithium intensity through improved battery chemistries and efficiency gains. Alternatives such as sodium-ion batteries, while not yet mainstream, could also cap long-term lithium demand if they gain commercial traction, particularly in stationary storage.

On the supply side, lithium is not geologically scarce, and higher prices could incentivize faster project restarts, new brine extraction technologies, or government-supported supply expansion. If supply responds more quickly than anticipated, the projected deficit could be delayed or avoided altogether.

How to Approach This Supply and Demand Play

As lithium demand accelerates and supply growth struggles to keep pace, the market appears to be approaching a pivotal turning point. With forecasts pointing to a shift from surplus to deficit as early as 2026, pricing pressure could return just as global electrification trends continue to intensify.

Whether through established producers like Albemarle or diversified ETFs such as BATT and LIT, gaining exposure to lithium today may offer a compelling way to position for a tightening market and the next phase of growth in the global energy transition.

Leave a Reply