Newsmax (NYSE:NMAX) may not be everyone’s cup of tea, but for many people disillusioned with mainstream media coverage, the cable news and political opinion platform offers an ideological framework aligned with conservative interests. That might be perfectly fine for the debate trail, but when it comes to generating alpha, NMAX stock represents a clear warning.

Table of Contents

Of course, no one can know for sure what will happen when Newsmax releases its fourth-quarter earnings report, with a release date not exactly buttoned down. Kiplinger has indicated that the media company may disclose results on Thursday after the close. However, other sources give a date of March 3. Either way, circumstances don’t look particularly inviting if we’re looking strictly at technical data.

Since the beginning of January, NMAX stock has lost more than 29%. Since its March 2025 debut, the security has plunged over 93%. It’s wild to think that at one point, NMAX carried a triple-digit price tag.

Moving forward, analysts expect Newsmax to deliver a loss per share of 8 cents on revenue of $44.39 million. In Q3, the company posted a loss of 3 cents per share on revenue of $45.27 million, beating expectations on both ends. After an initial drop, NMAX did climb higher through early December, but the optimism was short-lived.

Basically, we may have a similar situation on our hands when the latest results come in. However, the smart money isn’t playing games and is decisively choosing to protect itself.

Volatility Skew Tells the Tale for NMAX Stock

As I’ve stated in prior articles, volatility skew is one of the most important first-order (observational) analyses available to retail traders. Definitionally, the skew is a screener that identifies implied volatility (IV) across the strike price spectrum of a given options chain. Oftentimes, the inference is nuanced as nobody can truly state with absolute authority what options traders are thinking.

While that meta limitation will not change, what is different about NMAX is that the skew is essentially broadcasting about as crystal clear an inference as you can get.

For the next available monthly options chain (expiring Feb. 20), the smart money is prioritizing downside insurance. Unlike other readings where the skew is relatively flat around the spot price and the IV spread between calls and puts is relatively modest, NMAX’s presentation is blatantly distinct. Almost from the get-go, the skew on both ends of the spot price jumps higher — and it’s the put IV that’s doing the biggest magnitude jumps.

From a structural perspective, the smart money isn’t wasting time. For those who haven’t simply sold out of NMAX stock, the engagement of its options is positioned so that if the security loses big, stakeholders will be protected, if not profitable.

Indeed, if you had to ask my opinion, I would surmise that the participants in NMAX options are bearish speculators rather than stakeholders looking to protect their exposure. Given the terrible performance of Newsmax in the capital markets, it would be surprising if big money interests actually wanted exposure to this rapidly deteriorating name.

Establishing the Trading Parameters of Newsmax Stock

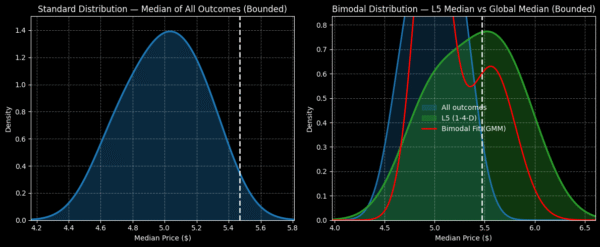

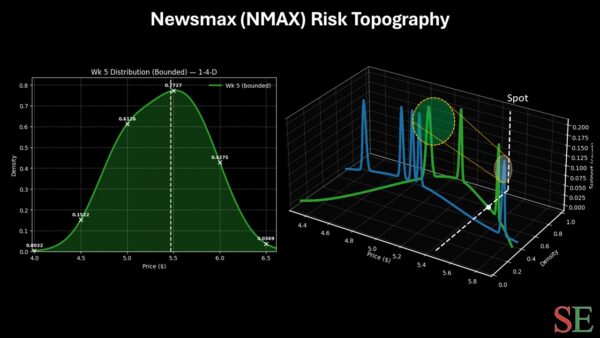

While we now have a basic understanding of how the smart money is positioned, we still need to figure out how this translates into actual price outcomes. For that, we may turn to the Black-Scholes-derived expected move calculator. Wall Street’s standard mechanism for pricing options projects that for the Feb. 20 expiration date, Newsmax stock may land between $5.30 and $5.70.

Where does this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this framework, the above range represents where Newsmax stock may symmetrically land one standard deviation away from spot (while accounting for volatility and days to expiration).

From a mathematical perspective, the model claims that in 68% of cases, we would expect NMAX stock to trade somewhere within the prescribed range at the end of the week. That’s a reasonable assumption because it would take an extraordinary catalyst to drive a security beyond one standard deviation from spot.

One special element to consider is the near-penny-stock pricing of Newsmax. With such a low baseline, it’s incredibly difficult to map out a projected surface area because anything can happen. Statistically, though, the overall smart money positioning in the options market lends itself to a rather narrow peak-to-trough range.

Is that an opportunity for the contrarian bulls? Perhaps, but only in the sense that there’s a non-trivial chance for chaos (because of the nominally low share price).

Either way, we’re still left with the classic search-and-rescue (SAR) conundrum. If we portray NMAX stock as a shipwrecked survivor, we still have no clue where the security may drift within the prescribed search area that Black-Scholes has identified.

To best estimate where NMAX may end up in these waters, we have to use probabilistic math. That’s where the Markov property comes into frame.

Narrowing the Probability Space

Under Markov, the future state of a system depends entirely on the present state. Colloquially, forward probabilities should not be calculated independently but should be assessed in context. Using the SAR analogy above, different ocean currents — such as choppy waves versus calm waters — will likely influence where a shipwrecked survivor may drift.

Here’s how the Markov property relates to Newsmax stock. In the last five weeks, NMAX printed only one up week, leading to an overall downward slope. There’s nothing special about this 1-4-D sequence, per se. However, this quantitative signal represents a unique ocean current. Thus, survivors caught in these waters would likely drift in a distinct manner.

Through enumerative induction and Bayesian-inspired inference, we can use past analogs to best estimate where NMAX stock may end up over the next five weeks. Basically, the idea is that we take the median pathway associated with the above quant signal and apply it to the current spot price.

Frankly, the projected result isn’t really that encouraging, with probability split down the spot price, with a possible leaning toward bearish outcomes. Because the volatility skew shows smart money traders positioned unambiguously for downside tail risk, I believe this is a highly volatile name.

Based on the data, I believe most objective analysts will state that it would be too risky to issue a bullish idea. If anything, a long-dated put option may be intriguing to a certain breed of gamblers. But even then, the low volumes involved make such wagers problematic.

Overall, NMAX stock serves as a cautionary tale: politics and profits don’t always mix.

Leave a Reply