Medtronic (NYSE: MDT) stock fell almost 3% on a day when it reported solid earnings, including 8.7% enterprise revenue growth in Q3 fiscal 2026. One of the key takeaways from that growth number was that 6% of the growth was organic. That was a theme that investors heard throughout the company’s presentation.

Table of Contents

By almost any metric, this was a strong report and one that investors have been waiting on for some time. But the company offered full-year guidance that was only in line with its prior forecast, which was due to the continued impact of tariffs.

That had analysts questioning how much growth was left in a stock that hit a 52-week high in December 2025. Analysts were bullish on MDT stock prior to the earnings report, so it’s a good idea to dive into the report to see if Medtronic belongs in your portfolio or on a watchlist.

Organic Growth is the Key

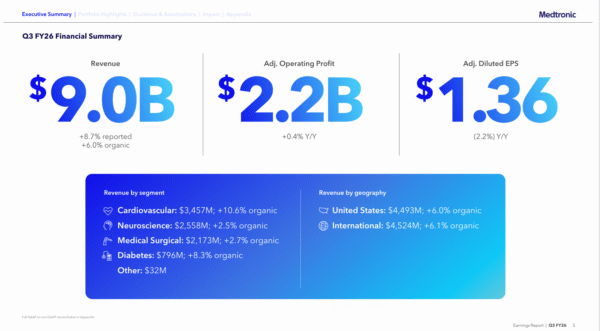

The core of Medtronic’s growth story lies in its robust organic revenue expansion. This metric strips away currency fluctuations, acquisitions, and divestitures to reveal the underlying health of a company’s operations. In Q3 fiscal 2026, Medtronic delivered worldwide revenue of $9.017 billion, reflecting 8.7% reported growth and a standout 6% organic increase. That was the company’s strongest quarterly performance in a decade. This exceeded internal guidance and market expectations, driven by broad-based strength across key portfolios rather than one-off events.

Digging deeper into the report, we see that organic growth shone brightest in Medtronic’s Cardiovascular business, which was up 10.6% organically, fueled by an astonishing 80% surge in Cardiac Ablation Solutions from pulsed field ablation technology rollouts and 4 percentage points of market share gain in a $13 billion addressable market.

Cardiac Rhythm & Heart Failure posted high-teens organic gains, while Diabetes grew 8.3% on MiniMed pump adoption and consumables. Neuroscience and Surgical Technologies added mid-single-digit organic advances, underscoring portfolio depth. Management highlighted recurring revenue streams through remote monitoring via CareLink, disposables like catheters and infusion sets as being the key to this sustainability, comprising 60-70% of the mix for annuity-like stability.

For the full FY26, Medtronic reiterated approximately 5.5% organic revenue growth guidance, absorbing a $185 million tariff headwind, with Q4 expected to mirror Q3’s momentum. Adjusted gross margins hit 64.9%, reflecting pricing discipline and efficiency, while R&D investments rose 7% to fuel pipeline launches like the Sphere-360 catheter and Hugo robot approvals.

The takeaway for investors is that Medtronic’s report wasn’t a one-off. This is execution on a roadmap that positions Medtronic for mid-single-digit growth amid demographic tailwinds such as aging populations and procedure volumes. Investors can trust these numbers as proof of operational leverage, not just hardware cycles, setting the stage for compounded returns.

Growth In This Sector Seems Inevitable

There are many reasons why thoughtful people can debate the merits of artificial intelligence (AI). But one of the most compelling applications for AI is in the field of robotics, particularly robotic surgery. This isn’t about removing the expertise of a doctor. It’s about providing the opportunity for a less invasive approach to surgery. And the applications are expanding.

That said, Medtronic doesn’t have a moat in this sector. Many would argue it isn’t even the sector leader with companies like Intuitive Surgical (NYSE: ISRG) in the picture.

However, this is an area that is primed for significant growth. According to Towardshealthcare.com, the industry will be valued at $16.07 billion in 2026 but is forecasted to grow to $63.73 billion by 2035. That’s a compound annual growth rate (CAGR) of 16.54%.

Medtronic won’t have that growth to itself. But there’s room for more than one company, and Medtronic is well-positioned to grab significant market share.

Two Ideas for MDT Stock

If you own MDT stock, your opinion about the stock will depend on how long you’ve held it. If you bought the stock in the last three years, you’ve done pretty well. The same is true if you’ve owned it for more than 10 years.

But if you bought the stock at its peak in 2026, it’s been a difficult hold. The total return for MDT stock is –5.24% over that span. That includes the company’s dividend, which has a yield of 2.95%.

That brings us back to right now. The good news is that MDT stock appears to have found support at its 150-day simple moving average (SMA). If the stock holds above that level, it could retest its 52-week high around $106. However, the chart also shows a potential double-top reversal around the $95-$100 pivot with weak relative strength and expanding volume on downside candles.

Simply put, the stock needs a catalyst to push it significantly higher. And with the company’s earnings outlook coming in line with expectations, upside may be limited. Nevertheless, Medtronic does pay a somewhat attractive dividend. The current annual payout is $2.84 per share. More importantly, the dividend is safe. In fact, if the company increases its dividend payout as expected, it will join the exclusive list of Dividend Kings. That means it will have increased its dividend payout for at least 50 consecutive years.

Still, if you feel MDT stock carries too much risk on its own, you can get exposure to the stock through several exchange-traded funds (ETFs). One of those is the iShares U.S. Medical Devices ETF (NYSEARCA: IHI). This is a market-cap weighted index, and 4.9% of the fund is invested in MDT stock.

Like many stocks in the sector, the performance of the fund has been choppy in the last five years. Still, if you’re looking for exposure to the field of robotic surgery without the risk of owning any particular stock, the IHI fund is a solid choice, particularly with an expense ratio of just 0.40%.

Medtronic: The Investment Verdict

Medtronic’s Q3 organic beat and recurring revenue resilience affirm a compelling growth thesis, even if near-term tariffs cap headlines. With support at the 150-day SMA and Dividend King status looming, patient holders stand to benefit from robotic surgery tailwinds and pipeline catalysts. For conservative exposure, IHI ETF offers diversified upside at low cost—buy the dip above key supports.

Leave a Reply