Marriott International (NASDAQ: MAR) has delivered a total return of over 193% in the last five years. MAR stock has been one of the best-performing hotel stocks and has crushed many consumer discretionary stocks.

Table of Contents

The revenge travel narrative has shifted into a boomer-fueled travel spree that continues to chug along. But after an 8.5% surge after earnings, investors who have been on the sidelines may want to wait for a pullback before getting involved.

Marriott Has Many Levers to Pull

Like many hotel companies, Marriott has a broad portfolio of hotels and related lodging facilities. The breadth of that portfolio has been on display in the past five years, with Marriott having properties that appeal to travelers in both legs of the K-shaped economy.

However, the company did say that its fortunes in 2026 will have to come from the higher income leg of the K. And that’s one reason why MAR stock may not have the juice to move higher.

Looking at Marriott International (MAR), you’re absolutely right that this stock has had quite a run. The current price of $359.35 is down about 8.5% today. But zoom out, and you can see the stock has climbed from around $265 in early October 2025 to a peak over $360 – that’s more than a 35% gain in just four months. That’s a significant move, and the question now is whether this is just a healthy pullback or something more concerning.

A Mixed Report That Delivered Where it Counted

Marriott delivered what could be called a mixed earnings report. Earnings per share of $2.58 came in four cents lighter than the $2.62 that was forecast. However, revenue of $6.69 billion came in just above expectations of $6.67 billion.

However, with hotels, the most important metric is RevPAR (revenue per available room). Marriott reported a 1.9% global increase in RevPAR for the quarter and 2% RevPAR growth for the full year. Those results come with a caveat. That is, the positive growth came entirely from the company’s international markets.

That points to the question of sustainability. Higher-income travelers are continuing to spend on international travel. But is that kind of performance repeatable in 2026? Marriott is forecasting 2026 RevPAR growth to come in around 1.5% and 2.5%.

However, the company did note that RevPAR did slump slightly in the fourth quarter. That was a period that included the government shutdown, so it may take another quarter to see if a new trend is forming.

Here’s Why MAR Stock Looks Extended

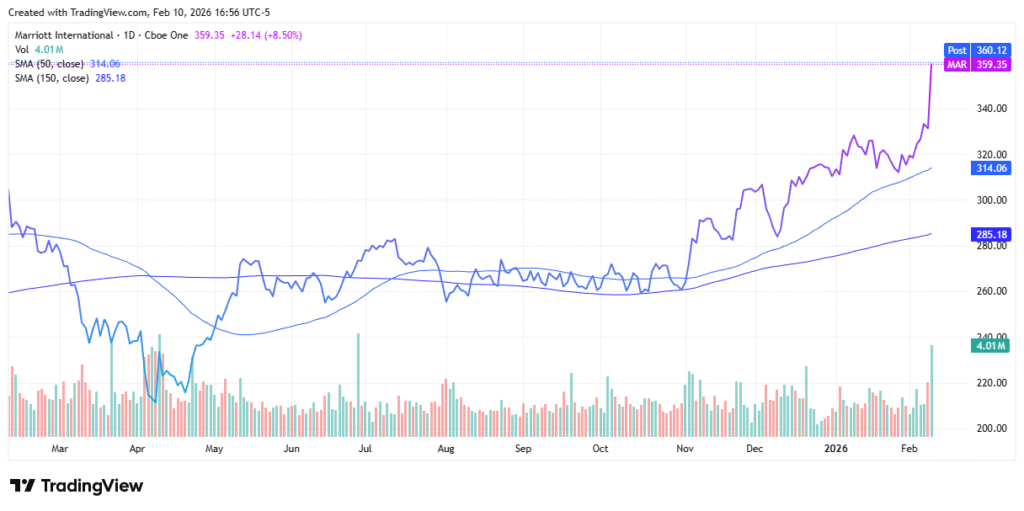

Rather than look at one chart, I’ve taken three different views of the MAR stock chart after the market closed on Feb. 10. Here’s what you need to know.

The graphic below shows two simple moving averages – the 50-day (lighter blue) at $314.06 and the 150-day (darker blue) at $285.18. The current price is well above both of these, which confirms the strong uptrend. It’s also a bullish sign that both moving averages are trending upward, though not substantially.

However, when a stock gets too far above its moving averages, it often needs to “cool off” and come back down to test support levels. That’s where the next image comes in.

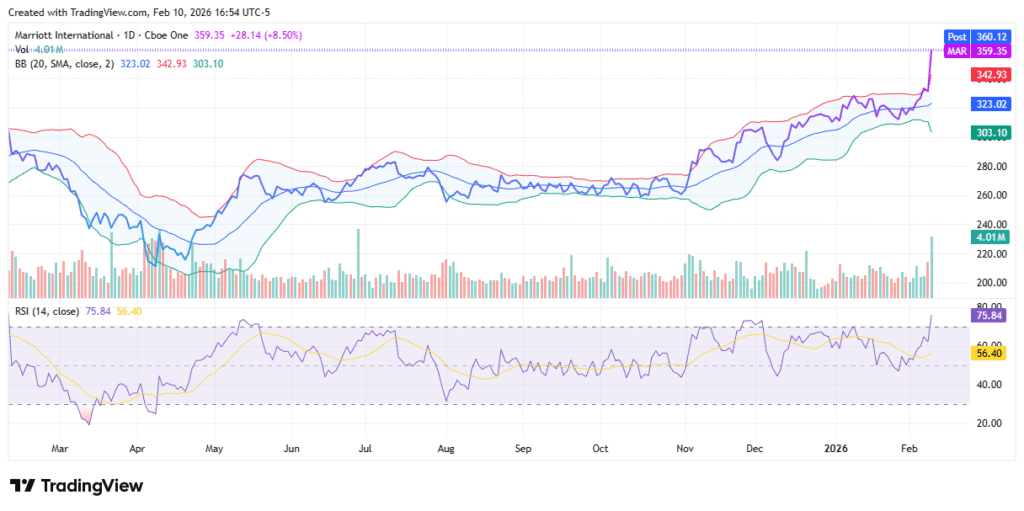

The RSI (Relative Strength Index) in images is currently at 75.84, which is in overbought territory. Generally, an RSI above 70 suggests a stock may be overextended. That said, strong stocks can stay overbought for extended periods, so this alone isn’t a sell signal – it’s just a yellow flag that momentum may be getting stretched.

The MACD indicator shows the lines are still positive but starting to converge, which suggests momentum is slowing. This is consistent with the idea that the stock needs a rest.

Where to Buy-the-Dip in MAR Stock

If you’re interested in buying MAR on a pullback, here are the key levels I’d be watching:

- $342-$343 area – This was recent resistance that broke in late January/early February. Old resistance often becomes new support, so this could be the first logical place where buyers step back in.

- $323 area – Looking at the next chart, you can see this was a consolidation zone in late January. The blue Bollinger Band middle line is also around this level ($323.07), which often acts as support during pullbacks.

- $314 – the 50-day moving average – Many institutional investors and algorithms use the 50-day moving average as a key reference point. A pullback to test this level would represent about a 12-13% correction from the recent highs, which would be healthy after such a strong run.

- $303 – the 20-day moving average – This is at $303.10. This would be a deeper pullback (around 15% from the highs), but still within the range of a normal correction in a strong uptrend.

What Would Signal a Breakout?

Even though the stock looks extended here, breakouts can still happen. Here’s what you’d want to see:

- A move above $360.12 (the recent post-earnings high visible in all three charts) on strong volume would be a clear breakout signal. You’d want to see the volume bars at the bottom of the chart significantly larger than average when this happens.

- RSI staying above 60 – If the RSI can hold above 60 even during minor pullbacks, that shows underlying strength and suggests the uptrend has more room to run.

- The 50-day moving average continues to slope upward – As long as this stays in an uptrend, the overall picture remains bullish.

Bottom Line on MAR Stock

The MAR chart shows classic technical signs of a stock that’s had a strong run and could use some consolidation. Does that mean it can’t go higher? Of course not. Strong stocks often defy expectations.

That said, at current levels, the risk/reward for chasing MAR stock isn’t ideal. If you still want to buy the stock, exercising patience will be a good strategy. Wait for a pullback to one of the support levels above, ideally with the RSI cooling off to the 40-50 range. That would give you a better entry point with less downside risk.

And if MAR stock does break above that $360 level with conviction, that would be your signal that the momentum is strong enough to potentially chase – though you’d want to be more cautious about position sizing given how far the stock has already come.

Remember, in trending markets, “buying the dip” works great until it doesn’t. Always use stop losses and don’t bet more than you can afford to lose on any single position.

Leave a Reply