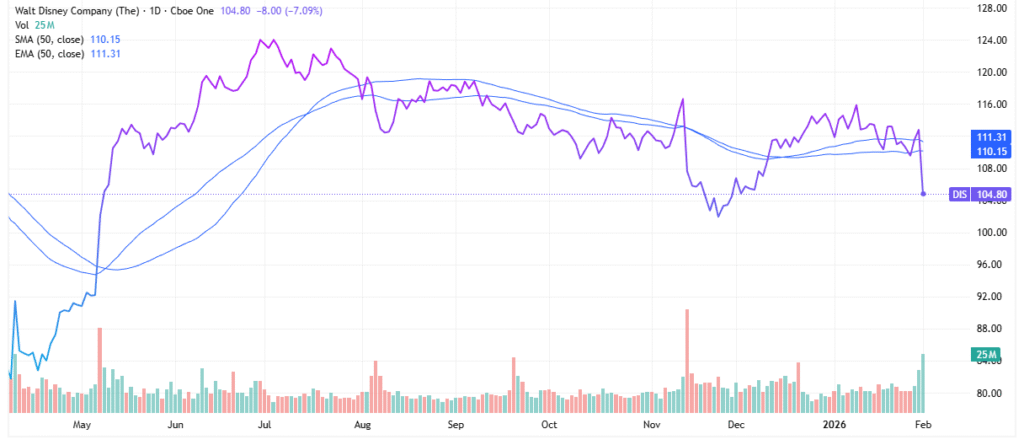

The Walt Disney Co. (NYSE: DIS) reported its first-quarter earnings report for fiscal year 2026 on Feb. 2. The report was good, but DIS stock fell over 6% in the first hours after the report. What may be more concerning is that the move lower happened with over twice the average volume for Disney stock.

Table of Contents

Disney reported strong headline numbers, particularly for its experience division. But analysts were expecting more.

One area that investors want “more” clarity on is who Disney’s new CEO will be. It’s widely expected that Josh D’Amaro, the current Chairman of Disney Experiences, will be the successor to Bob Iger. However, the decision ultimately lies with the Disney board, which meets this week and may announce a decision at that time.

Magic Has a Value

I know that betting against Disney may be a fool’s errand. I was a big fan of the company and DIS stock for many years. But that’s when the company was firing on all cylinders. That hasn’t been the case over the last six years.

Granted, not all of that is the company’s fault. It’s hard for companies to model for a global health crisis, followed by soaring inflation and the pressure that put on consumers. However, Disney has actually navigated that fairly well. The company’s theme parks were a popular destination for revenge travel, and as the company’s report shows, they continue to be.

But as it turns out, investors seem to believe that even magic has a value. Look, it can be hard to hold two competing thoughts in your head. But Disney is a popular destination. And it’s also a really expensive vacation that may be out of reach for millions of Americans.

Plus, a canary in the coal mine may be a decline in international visitors to its U.S. theme parks. To put that in context, this isn’t a situation that’s unique to Disney; many other theme parks are reporting the same problem. Nevertheless, it supports the idea that even the magic of Disney has a value.

A “Good” Quarter the Market Didn’t Like

To understand why DIS stock sold off, it helps to look at what Disney actually reported. Revenue grew 5% year-over-year to $26 billion, but total segment operating income fell 9% to $4.6 billion, and diluted EPS declined to $1.34 from $1.40 a year earlier, with adjusted EPS down 7% to $1.63. On the surface, that’s not a disaster, but it’s not the kind of earnings progression investors want to see this far into a turnaround.

The Experiences segment, which includes Parks & Experiences and Consumer Products, delivered another record quarter with $10 billion in revenue and $3.3 billion in segment operating income, up 6% year-over-year. Domestic Parks & Experiences operating income grew 8%, supported by a 1% increase in attendance and 4% higher per-capita spending. That confirms the narrative that the parks are still doing the heavy lifting for the company.

By contrast, the Entertainment segment showed the tension in the model. Revenue was up 7% to $11.6 billion, but operating income fell 35% to $1.1 billion as higher programming, production, and marketing costs more than offset higher subscription and affiliate fees and better theatrical revenue. That kind of margin compression is exactly what the market worries about when it looks at the future of Disney’s content engine.

Streaming Is Progressing – But Still Under Scrutiny

One area where Disney can credibly point to progress is streaming. Subscription video-on-demand (Disney+, Hulu, and Disney+ Hotstar, where applicable) grew revenue 11% year-over-year to $5.35 billion, with subscription fees up 13% and advertising and other revenue up 4%. Importantly, Entertainment SVOD operating income jumped 72% to $450 million, implying an 8.4% operating margin for the quarter.

Management is guiding to SVOD operating income of about $500 million in the second quarter of fiscal 2026 and a 10% SVOD operating margin for the full year, with Entertainment segment operating income expected to grow at a double-digit rate for fiscal 2026, weighted to the back half. That suggests the streaming business is moving from a capital sink to a real profit center, which was a key pillar of the broader turnaround.

The problem is that investors have grown more demanding. Streaming was a gold mine in 2020 and 2021 when the market rewarded subscriber growth at any cost, but it hasn’t been the same since. Now the bar is higher: streaming needs to be sustainably profitable and support the broader ecosystem rather than just being an expensive growth story. Entertainment segment operating income expected to grow at a double-digit rate for fiscal 2026, weighted to the back half. That suggests the streaming business is moving from a capital sink to a real profit center, which was a key pillar of the broader turnaround.

Theme Parks: Strength Today, Questions Tomorrow

Disney’s Experiences segment is the part of the business that looks closest to “classic Disney.” Domestic parks and experiences benefited from increased cruise capacity, higher room nights, and incremental attendance, including a favorable comparison against prior-year storm impacts. Per-capita spending growth shows that guests are still willing to pay up once they’re on property.

At the same time, Disney is leaning heavily into Experiences as a growth driver. Capital expenditures jumped to $3 billion in the quarter from $2.5 billion a year earlier, driven largely by cruise ship expansion and new theme park attractions. Management expects high-single-digit operating income growth in Experiences for fiscal 2026, again weighted to the second half of the year.

The underlying concern is that there are natural limits to how far pricing and spending can go, especially when a Disney trip is already a stretch for many families. Management also flagged “international visitation headwinds at our domestic parks” as a factor that will temper near-term Experiences operating income growth. That lines up with the idea that even for a beloved brand like Disney, the willingness to pay has boundaries.

Balance Sheet, Cash Flow, and Capital Returns

From a balance sheet and cash flow standpoint, Disney’s story is mixed but improving in some areas. The company generated $735 million of cash from operations in the quarter, down sharply from $3.2 billion a year earlier, primarily due to higher tax payments and increased content spending. Free cash flow was negative $2.3 billion after heavy capital expenditures.

However, management still expects $19 billion of cash provided by operations for fiscal 2026 and is on track to repurchase $7 billion of stock this year. Net interest expense declined from the prior year as average debt balances fell and capitalized interest increased, suggesting the balance sheet is slowly becoming less of a drag.

Those numbers help explain why analysts can look past a weak cash-flow quarter and still model an improving trajectory. They also give Disney some flexibility to keep investing in parks and content while returning capital to shareholders, which underpins the “value” argument for the stock.

Where This Bearish Outlook for DIS Stock Could Be Wrong

Analysts remain bullish on DIS stock, with a consensus Buy rating and a price target of $133.42, which would be a 27% increase from the stock’s price as of this writing. Supporting that outlook, at around 16x earnings, DIS stock is a value compared to the S&P 500 and its own historic value.

Maybe all investors need is clarification on a new CEO. But that seems too easy. The company ventured into the streaming arena. That was a gold mine in 2020 and 2021 but hasn’t been the same since.

Still, there are several ways the current bearish tone could prove too pessimistic. First, if the board names a credible successor quickly and outlines a clear handoff from Bob Iger, that could remove a major overhang and refocus attention on the fundamentals rather than the leadership soap opera. Second, if Disney executes on its guidance of double-digit Entertainment operating income growth, a 10% SVOD margin, and high-single-digit Experiences operating income growth, investors may have to revisit their assumptions about the durability of the business.

Leave a Reply