Airbnb Inc. (NASDAQ: ABNB) is up about 1.5% after it delivered its quarterly earnings report on Feb. 12. In the company’s fourth-quarter report, the company reported revenue of $2.78 billion, which surpassed expectations for $2.71 billion. The number was also an impressive 42% year-over-year (YOY) gain.

Table of Contents

However, earnings were a different story. Airbnb posted adjusted earnings per share (EPS) of 56 cents. That was 15% below the 66 cents that analysts had forecasted. The number was also 23% lower than the company’s adjusted EPS of 73 cents in the prior-year quarter.

Still, there was more good than bad, it seemed from a report that provides investors with a “state of the consumer” for 2026. Airbnb guided for low single-digit revenue growth for 2026 and showed improvement in margins and free cash flow, which led to growth in the company’s free cash flow and a total of $3.8 billion in stock repurchases for the full year 2025.

Will that be enough to offset a valuation that will require nearly flawless execution? That’s the question that investors have to answer and one we’ll try to unpack here.

Reducing Friction with Consumers

Combing through Airbnb’s report, there was a lot of talk about how artificial intelligence (AI) is transforming the business. The company reported that a custom AI agent already resolves about one-third of North American support issues. Furthermore, the company expects AI to boost support efficiency and the host/guest experience without large capital expenditures (capex).

However, the more significant revenue driver continued to be the company’s “Project Y” product improvements, including the continued rollout of Reserve Now, Pay Later, upfront total pricing, and simple fees. Airbnb plans to expand the availability of this feature to more consumers in 2026.

It Could Be a Good Year to Be a Hospitality Company

As I write this article, the Winter Olympics are just past the halfway point. That’s one of the growth drivers that Airbnb is excited about. But that’s not the only major sporting event in 2026. The United States hosts the FIFA World Cup this summer, a 39-day event that will attract visitors from around the world. Plus, the United States is celebrating a milestone birthday that will be marked with celebrations from coast to coast.

The takeaway for investors is that this could be a great year to own ABNB stock, particularly if consumers see the kind of tax returns being promised and potentially the benefit of lowering borrowing costs in the form of lower interest rates.

Risks to the Bull Case for Airbnb

While the optimistic narrative around Airbnb’s AI investments and 2026 event calendar sounds compelling, several material headwinds could derail the bull case.

First, the earnings miss should give investors pause. A 23% year-over-year decline in adjusted EPS despite 42% revenue growth signals margin compression that AI efficiencies haven’t yet offset. The company is essentially growing the top line while watching profitability erode, a pattern that typically doesn’t reward shareholders in the long run.

Second, the “low single-digit revenue growth” guidance for 2026 represents a dramatic deceleration from the 42% growth just reported. Even accounting for tougher comparisons, this suggests management sees a significant slowdown ahead. For a stock trading at a premium valuation, single-digit growth is rarely enough to justify the multiple.

Third, regulatory risks continue to mount globally. Cities from New York to Paris have implemented or are considering stricter short-term rental regulations. These restrictions can quickly remove inventory from Airbnb’s platform and dampen host enthusiasm, particularly in high-value urban markets that drive disproportionate revenue.

Fourth, the Reserve Now, Pay Later feature, while boosting conversion rates, introduces a new risk: payment defaults and last-minute cancellations. If guests overextend themselves financially or can’t secure financing, hosts face empty properties with little time to rebook. This friction could sour host relationships, the very foundation of Airbnb’s marketplace.

Finally, competition from traditional hotels has intensified. Major chains have responded to Airbnb’s threat by improving booking flexibility, loyalty programs, and even offering apartment-style accommodations. As the novelty of home-sharing wears off and hotels adapt, Airbnb’s competitive moat narrows.

ABNB Stock: A Cautionary Tale

Investors are getting excited about some potential initial public offerings (IPOs) set to debut in 2026. But investing in IPOs can be tricky. And Airbnb is an example of why it’s important not to buy into the initial hype.

Airbnb was one of the most anticipated IPOs of 2021. You’ll remember at the time that the world was sheltering in place; remote work was commonplace, and bleisure (the combining of business and leisure activities) was in full swing. Airbnb filled that space in a way that had investors fired up.

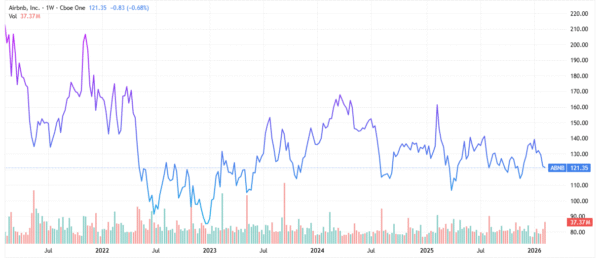

For much of 2021, it looked like the bull case was right, but as the five-year chart for ABNB stock shows, the stock has been a difficult hold for the last five years. The stock began trading publicly in February 2021. So, this marks its five-year anniversary, and the stock is down over 42% in that time.

This is despite the company routinely reporting YoY beats in revenue. And consumers, particularly high-income consumers, have continued to show a willingness to travel.

ABNB Stock Presents a Range of Options

Analyzing the ABNB stock chart along with analyst forecasts shows that sentiment is more bullish than bearish, but still mixed. The consensus price target of $143.97 would represent a gain of 18.6% from its closing price on Feb. 13. And of the 44 analysts offering ratings on the stock, 21 give the stock either a Buy or Strong Buy rating. However, just as many, 20, give the stock a Hold.

Of course, now is the time when ratings could change, and that will be something that investors want to watch. However, on the day after earnings, several analysts posted revised price targets, which confirmed that there’s a lack of conviction about the upside in ABNB stock.

For traders, it’s important to note that the stock has formed a golden cross pattern. That is, the 50-day simple moving average (SMA) crossed above the 200-day SMA. But that pattern has appeared on other occasions in the last 12 months without amounting to much, which offers further support for a neutral approach to the stock.

Is This Goldilocks Report Enough for You?

Airbnb’s fourth-quarter report had something for everyone, which is precisely what makes it a “Goldilocks” scenario. Revenue beat? Check. Free cash flow improvement? Check. Stock buybacks? Check. But alongside these positives came an earnings miss, slowing growth guidance, and persistent questions about valuation.

The real question is whether “not too hot, not too cold” is sufficient when the stock requires exceptional execution to justify its current price. For growth investors, the deceleration to low single-digit revenue growth in 2026 is concerning. For value investors, even after the five-year decline, the valuation isn’t particularly compelling given the growth profile.

What Airbnb does have working in its favor is timing. The 2026 event calendar is genuinely favorable, and if macroeconomic conditions improve with tax cuts and lower rates, discretionary travel spending could surprise to the upside. The company’s AI investments, while not yet showing up in margin expansion, could eventually deliver meaningful cost savings.

But investors need to be realistic about what they’re buying. This isn’t the high-flying growth story of 2021. It’s a maturing platform business navigating regulatory headwinds, intensifying competition, and a consumer base that’s becoming more price sensitive. The Reserve Now, Pay Later feature is a double-edged sword: it drives bookings today but potentially at the cost of host satisfaction and platform stability tomorrow.

For investors with a neutral-to-bullish outlook and a long time horizon, the current setup might offer reasonable risk-reward. The consensus price target implies nearly 19% upside, and if Airbnb can execute on its 2026 initiatives, there’s a path to outperformance. But for those seeking the next big tech winner or a safe haven, ABNB stock fits neither profile.

Leave a Reply