Gold is slipping, and the setup for a short gold trade is starting to gain traction

Table of Contents

One of the biggest catalysts is the growing expectation that President Trump’s top Federal Reserve choice, Kevin Warsh, could usher in a more hawkish monetary policy stance. Markets have reacted quickly to that possibility, strengthening the U.S. dollar and weighing on assets like gold that typically thrive in lower-rate environments.

Warsh has publicly acknowledged the need for rate flexibility, but investors largely view him as less supportive of aggressive, immediate rate cuts compared to other potential Fed leaders. That perception matters. Even modest expectations of tighter monetary policy tend to push Treasury yields higher and boost the U.S. dollar. Both of those metrics are historically negative for gold prices.

In fact, speculation surrounding a “Warsh Fed” recently pushed the U.S. Dollar Index up by roughly 0.5%. A stronger dollar makes gold more expensive for foreign buyers, dampens global demand, and often pressures prices lower in the near term. For traders, that combination creates an environment where a short gold trade can make sense, especially after an extended rally.

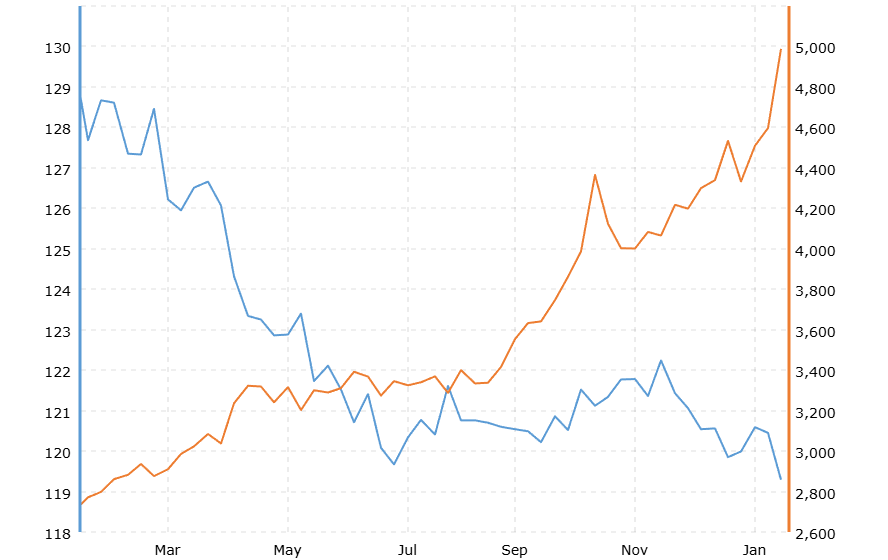

This chart compares the daily LBMA fix gold price (gold) with the daily closing price for the broad trade-weighted U.S. dollar index (blue).

That doesn’t mean gold’s long-term thesis is broken. But even strong secular uptrends experience pullbacks, consolidations, and sentiment resets. For investors looking to capitalize on a potential short-term decline, inverse gold ETFs offer a straightforward way to make a short gold trade without using options or margin-heavy strategies.

Direxion Daily Gold Miners Index Bear 2x Shares ETF

With an expense ratio of 0.93%, the Direxion Daily Gold Miners Index Bear 2x Shares ETF (NYSEARCA: DUST) seeks to deliver 200% of the inverse of the daily performance of the NYSE ARCA Gold Miners Index. The fund also pays a quarterly dividend, which is unusual for a leveraged inverse ETF.

DUST has been in a prolonged downtrend, but that’s largely a function of gold’s extended rally. If gold pulls back, miners often fall faster than the underlying metal due to operating leverage, rising costs, and sentiment shifts. That dynamic can amplify returns during a short gold trade, albeit with higher risk.

Direxion Daily Junior Gold Miners Index Bear 2x Shares ETF

The Direxion Daily Junior Gold Miners Index Bear 2x Shares ETF (NYSEARCA: JDST) works similarly to the DUST ETF but focuses on junior gold miners, which tend to be even more volatile. With an expense ratio of 0.89%, the ETF targets 200% of the inverse of the MVIS Global Junior Gold Miners Index.

Junior miners typically have weaker balance sheets and higher sensitivity to gold prices. As a result, JDST can move aggressively during gold sell-offs. Like DUST, it has trended lower during gold’s rise, but a reversal in gold could spark a sharp, short-term rally.

ProShares UltraShort Gold ETF

For investors who want direct exposure to gold prices rather than miners, the ProShares UltraShort Gold ETF (NYSEARCA: GLL) offers another approach.

With an expense ratio of 0.95%, GLL aims to deliver 200% of the inverse of the Bloomberg Gold Subindex. While it has also struggled during gold’s uptrend, it may appeal to traders looking for a cleaner expression of a short gold trade without company-specific risks tied to mining stocks.

Final Thoughts: Timing Matters in a Short Gold Trade

A short gold trade isn’t about calling the end of gold’s long-term bull market. Instead, it’s about recognizing when macro forces — such as a strengthening dollar, shifting Fed expectations, and crowded positioning — create conditions for a pullback. Inverse ETFs like DUST, JDST, and GLL can provide tactical opportunities during these periods, but they require discipline and short time horizons. Leveraged products magnify both gains and losses, making risk management essential. For investors willing to stay nimble, the current environment may offer a compelling — if temporary — opportunity to bet against gold.

Leave a Reply