Pay close attention to oversold gambling stocks, such as DraftKings (NASDAQ: DKNG) and Flutter Entertainment (NYSE: FLUT), with Super Bowl Sunday nearing. Historically, the weeks leading up to the Super Bowl have proven to be strong for the sports betting industry, driven by a surge in wagering activity.

Table of Contents

This time, that didn’t happen.

However, the gambling stocks in question are starting to rebound from excessively oversold conditions just days ahead of the big game.

According to data from the American Gaming Association (AGA), Super Bowl betting has grown significantly over the last several years:

- In 2021, an estimated $7.61 billion was wagered on the game.

- In 2022, that number climbed to more than $8 billion.

- In 2023, it exploded to $16 billion.

- In 2024, Super Bowl wagering reached approximately $23 billion.

- In 2025, that number came in at a whopping $30 billion.

With the 2026 Super Bowl set for early February, expectations are high for another record-setting year, particularly as legal sports betting continues to expand.

Also, as CBS Sports once noted, “The NFL remains king, and more money is wagered on the NFL than any other league. The NFL also attracts six-figure wagers (and sometimes seven-figure wagers) on a regular basis throughout the season.”

For investors looking to trade the 2026 Super Bowl, oversold conditions have created an opportunity in gambling stocks.

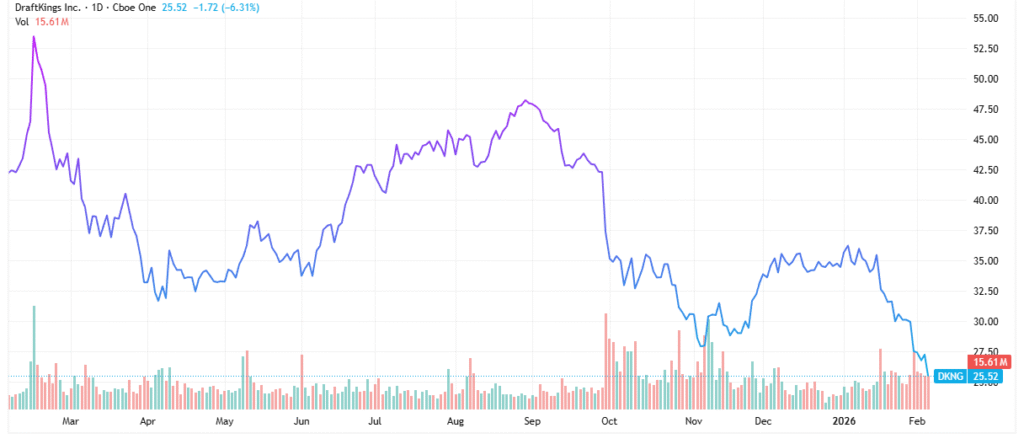

Gambling Stocks to Buy: DraftKings

DraftKings, one of the most recognizable names in U.S. online sports betting, has seen notable pre-Super Bowl price action in recent years. In 2024, DKNG climbed from a January low near $32 to a post–Super Bowl high of $45.62. In early January 2025, the stock rallied from roughly $17.60 to $20.88 as betting volumes increased and optimism returned to the sector.

Today, DraftKings trades at about $27.24, where it appears to have found double-bottom support dating back to November.

While the stock recently sold off on news of increased competition and cut price targets, that negative sentiment now appears largely priced in. From a technical perspective, DKNG is oversold and stabilizing at a key support level, suggesting downside risk may be limited in the near term.

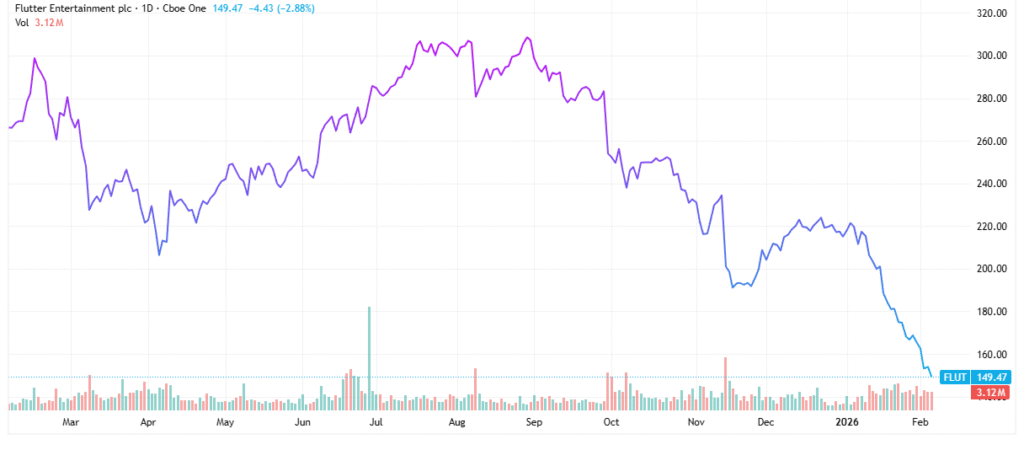

Gambling Stocks to Buy: Flutter Entertainment

Flutter Entertainment has also been a consistent Super Bowl winner. In early 2024, FLUT rose from a January low of around $160 to a high of $220.78. In January 2025, the stock rallied again, moving from approximately $260 to $300 as betting volumes increased and investors rotated back into the sector.

Nowadays, Flutter is excessively oversold and is beginning to pivot higher from around $153.90 per share. As a global sports betting powerhouse with a market capitalization near $27 billion, Flutter owns leading brands such as FanDuel and Paddy Power.

Like DraftKings, Flutter has already absorbed a significant amount of negative news related to competition and margin pressures, potentially setting the stage for a relief rally as Super Bowl betting momentum builds.

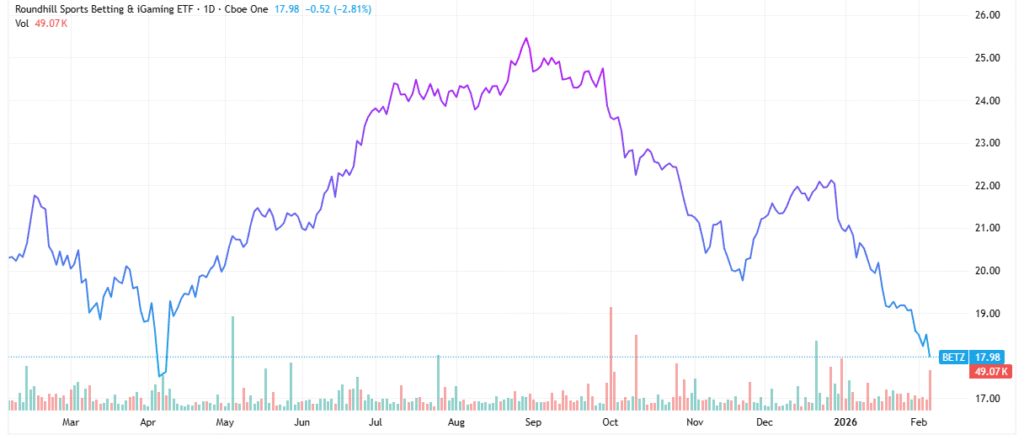

Gambling Stocks to Buy: Roundhill Sports Betting & Gambling ETF

Investors seeking broader exposure may also want to consider the Roundhill Sports Betting & Gambling ETF (NYSEARCA: BETZ). The ETF provides diversified access to the sports betting and online gambling industry.

From an August 2024 low of approximately $15.56, BETZ rallied to a December 2024 high of $20.28. More recently, after climbing from a 2025 low of $16.73 to $24.35, the ETF pulled back to around $18.50 as some holdings sold off amid rising competition concerns.

With an expense ratio of 0.75%, BETZ offers exposure to industry leaders such as DraftKings, Flutter Entertainment, Entain PLC, Genius Sports, and Rush Street Interactive, among its 31 holdings. For investors bullish on continued growth in legalized sports betting, weakness in the ETF could be viewed as a chance to accumulate ahead of a historically strong seasonal catalyst.

The Bottom Line on Gambling Stocks

With Super Bowl wagering volumes hitting record highs year after year, oversold gambling stocks and ETFs may offer attractive trading opportunities heading into the 2026 Super Bowl. While competition remains intense, much of the bad news appears priced into the sector.

Leave a Reply