Figma (NYSE: FIG) may have just shown Wall Street what successful AI monetization looks like for a software company. The design platform reported Q4 2025 results that beat its own guidance, sending shares higher in after-hours trading and reigniting a debate about which software companies are actually built for the AI era and which are just along for the ride.

Table of Contents

The numbers were hard to argue with. Figma posted Q4 revenue of $303.8 million, up 40% year-over-year and ahead of its own guidance range. More striking was what was driving that growth: not just more seats, but deeper platform adoption fueled by AI products that customers are clearly paying for.

Net Dollar Retention Rate climbed to 136%, a meaningful uptick that signals existing customers are spending more, not just renewing at the same rate. Full-year revenue crossed $1 billion for the first time, coming in at $1.056 billion, up 41%.

For investors who have spent the past month asking whether AI is a tailwind or a threat to software businesses, Figma’s quarter offered a compelling data point. When AI is woven into the core workflow — not bolted on as a chatbot — users adopt it, expand their usage, and pay more for it. The after-hours move in FIG stock suggests the market is starting to reward that distinction.

Figma Make Is Becoming a Real Growth Engine

The most important number in Figma’s report may be the Figma Make engagement data. Weekly active users of Figma Make grew more than 70% quarter-over-quarter, and over half of paid customers spending more than $100,000 in ARR were building in Figma Make on a weekly basis during Q4.

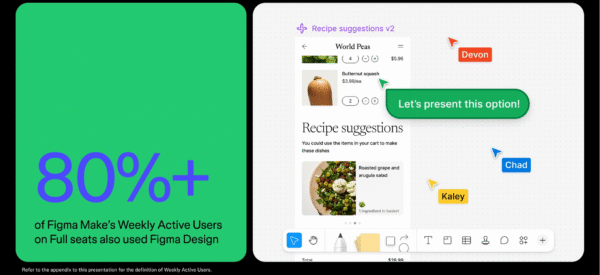

Perhaps carrying more weight, more than 80% of Figma Make’s weekly active users on Full seats also used Figma Design in the same period. This means AI adoption is deepening engagement with the core product rather than cannibalizing it.

That cross-product stickiness is exactly what investors have been hoping to see from AI-era software companies. Figma also reported that nearly 60% of Figma Make files created in 2025 were made by non-designers (i.e., product managers, developers, and CEOs), which dramatically expands the addressable user base beyond the design team. Customer counts reflect this momentum: paid customers with more than $100,000 in ARR grew 46% year-over-year to 1,405, and the company now counts 67 customers spending more than $1 million annually.

The Setup for 2026 Looks Constructive

Figma’s guidance for fiscal year 2026 calls for revenue between $1.366 billion and $1.374 billion, implying roughly 30% growth at the midpoint. While that represents a deceleration from 2025’s 41% pace, it comes on a significantly larger revenue base and against a backdrop where the company is still early in monetizing its expanded platform.

Q1 2026 guidance of $315–317 million implies 38% year-over-year growth, suggesting the business isn’t decelerating as sharply as the full-year figure implies. Management also guided for full-year non-GAAP operating income of $100–110 million, signaling continued progress toward sustainable profitability.

With $1.7 billion in cash and marketable securities on the balance sheet, Figma has the flexibility to invest in AI and international expansion – particularly in India, now its second-largest market by monthly active users – without sacrificing financial discipline.

What Could Go Wrong?

The bull case is not without risk. Gross margins compressed to 86% on a non-GAAP basis in Q4, down from 92% earlier in 2024, as the cost of supporting AI infrastructure scales. If AI compute costs continue to rise faster than revenue, margin pressure could intensify.

The 2026 full-year growth guidance of approximately 30% also represents a notable step-down that may concern investors accustomed to Figma’s recent acceleration. Competition is another wildcard. Despite the failed acquisition attempt, Adobe remains a formidable rival, and a wave of AI-native design tools is emerging.

Finally, Figma is still a newly public company. Navigating the scrutiny that comes with quarterly earnings cycles, and execution risk is real as the company expands into enterprise and international markets simultaneously.

Will This Report Reverse Analyst Sentiment?

Heading into its earnings report, analyst sentiment has been aggressively bearish on FIG stock. The consensus price target of $47.75 suggests 97% upside for investors. But that could be deceiving. The 13 analysts who cover FIG stock give the stock a consensus Hold rating, and there is one Sell rating on the stock.

Even Piper Sandler, which maintains an Overweight rating on FIG stock, cut its price target in half to $35 from $70. Supporting the bearish sentiment is institutional buying. In the second quarter since the company debuted, buyers still outpace sellers, but it’s clear that bearish sentiment has entered the picture.

Is FIG Stock a Buy?

The stock chart reflects the analyst’s sentiment. Stocks tend to be volatile after an initial public offering (IPO). That’s been the case with FIG stock, which has tumbled approximately 78% from its closing IPO price on July 31, 2025.

The good news is that FIG stock may have found a bottom. Buyers responded to momentum indicators, such as the relative strength indicator (RSI) that flashed oversold in early February. However, the RSI shows the stock trading in a narrow range, which suggests that upside may be limited.

If you’re thinking of getting involved, it’s a good idea to wait until you see how FIG stock opens on Feb. 19. That’s when the high-speed trading programs will weigh in. It could be a wild start, and you don’t want to be offside. It may also be a good idea to see if analyst sentiment becomes more bullish after the report.

Figma Rewrites the Narrative

Figma’s Q4 report is one of the cleaner examples the market has seen of AI driving genuine business expansion rather than just narrative. With accelerating revenue, rising retention, and an AI product that’s pulling non-designers into the platform, the company is building the kind of compounding usage dynamic that can sustain growth at scale. For investors searching for software companies that have earned their AI premium, Figma is making a strong case.

Leave a Reply