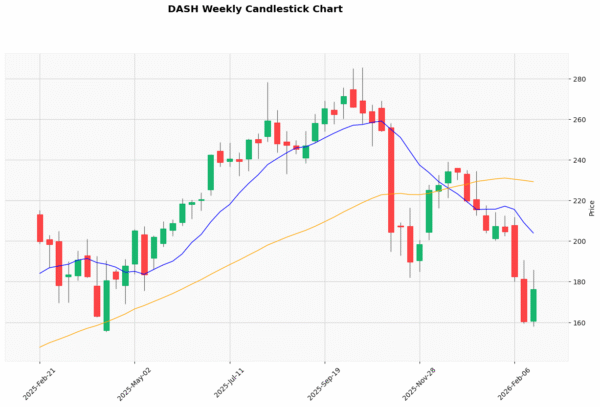

DoorDash (NASDAQ: DASH) hasn’t enjoyed a good start to the new year and the online food ordering and delivery company didn’t help matters with a poor earnings report. On Wednesday’s extended hours session, DASH stock encountered volatility, with investors responding to the delivery specialist’s fourth-quarter earnings miss.

Table of Contents

DoorDash posted earnings per share of 48 cents, missing Wall Street’s consensus estimate of 60 cents. Circumstances failed to improve on the top line, with revenue of $3.96 billion also falling short of the target of $3.99 billion. Still, a major positive was that the company saw sizable growth from the year-ago quarter’s print of $2.87 billion. That’s noteworthy given the sensitivity of DASH stock to the consumer discretionary market.

Unfortunately, that wasn’t enough to prevent early bird monitors from trimming their exposure. Fundamentally, the main issue appeared to be the Q1 outlook. While management adjusted EBITEDA guidance for Q1 2026 to a range between $675 million to $775 million, some analysts had expectations pegged at $800 million and above.

Despite the overall poor Q4 performance, there are two main things to consider. First, marketplace gross order volume (GOV) increased 39% year-over-year to $29.7 billion. Further, for Q1, management expects marketplace GOV to land between $31 billion and $31.8 billion. This improvement shouldn’t be overlooked, and with DASH stock rising about 2% on Thursday, it seems some in the equities arena understand the bigger picture.

Second, pre-earnings stocks can be absolute chaos — and generally, I don’t like it for that reason. There are too many variables, too many psychological factors that compound with each other, that have the tendency of creating carnage. One likely has to develop a bespoke model just for earnings season, which is incredibly challenging.

However, post-earnings is a different story because so much of the uncertainty has been baked in. Moving forward, we can focus more on statistical tendencies rather than the exogenous shocks that an earnings report may impose.

Volatility Skew Tells the Tale for DASH Stock

One of the most important tools for retail traders to consider when analyzing optionable securities is the volatility skew. Definitionally, the skew is a screener that identifies implied volatility (IV) across the strike price spectrum of a given options chain.

Primarily, the reason why IV is so instructive is that it’s a statistic that estimates a stock’s potential kinetic output, which is also derived from actual order flows. So, when traders use risk models based on Black-Scholes to estimate price range, the underlying forecast isn’t just a hand-waved number; it has empirical meaning.

Going a step further, the skew takes these IV readings to visually identify how the surface area for risk premium is being distorted through order flows in the system. Since the smart money tends to be the most dominant participants in the derivatives market, the shifting skew can reasonably be attributed to these sophisticated market participants.

In the case of the March 20 expiration date, we note a fascinating development. Essentially, the skew for the strikes near the current spot price is flat and calm, indicating no urgency in downside risk mitigation. On the left boundaries (toward the lower strikes), the skew rises to an IV level of over 100%. However, the rise is controlled, again indicating a lack of urgency to protect against downside tail risk.

That’s an unusually lackadaisical skew, especially for a security that’s down double-digit percentage points to start the new year.

On the right boundaries (toward the upper strikes), the skew rises to about an IV level of 150%. Therefore, we may empirically conclude that, in the case of the March 20 expiration date, the smart money’s most pressing priority does not appear to be corrective mitigation.

To be clear, this skew doesn’t automatically mean DASH stock is a buy. However, there may be some resistance that has faded away.

Establishing the Trading Parameters of DoorDash Stock

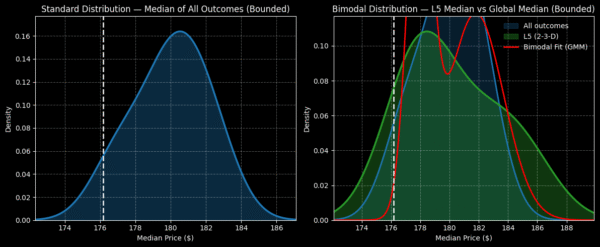

While we now have a basic understanding of smart money sentiments, we’re still at a loss as to how this translates into actual price outcomes. For that, we may turn to the Black-Scholes-derived expected move calculator. Wall Street’s standard mechanism for pricing options projects that for the March 20 expiration date, DoorDash stock may land between $158.98 and $194.88.

Where does this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this framework, the above range represents where DoorDash stock may symmetrically land one standard deviation away from spot (while accounting for volatility and days to expiration).

Mathematically, the model asserts that in 68% of cases, we would expect DASH stock to trade somewhere within the prescribed range when March 20 rolls around. That’s a reasonable assumption as it would really take an extraordinary catalyst to drive a security beyond one standard deviation from spot.

Still, the main challenge is that we merely know how the market is pricing uncertainty. We have not yet determined if that pricing is justified. To uncover this element requires second-order analyses, which take observational data and condition it relative to an empirical anchor.

Basically, we have a classic case of the search-and-rescue (SAR) conundrum. If DASH stock symbolizes a lone shipwrecked survivor, then Black-Scholes is a satellite system that identified a distress signal that pinged somewhere in the Pacific Ocean. Through theoretical drift patterns, we can establish a reasonable search radius.

However, under an environment of limited resources, we can’t afford to search the entire area. To get around this dilemma, we need to use probabilistic math to best estimate where DASH might be found.

That’s where the Markov property comes into view.

Narrowing the Probability Space

Under Markov, the future state of a system depends entirely on the present state. Colloquially, forward probabilities should not be calculated independently but be assessed in context. Using the SAR analogy above, different ocean currents — such as choppy waves versus calm waters — will likely influence where a shipwrecked survivor may drift.

Here’s how the Markov property is relevant to DoorDash stock. In the past five weeks, DASH printed only two up weeks, leading to an overall downward slope. There’s nothing special about this 2-3-D sequence, per se. However, this quantitative signal represents a unique ocean current, and survivors caught in these waters would be expected to drift in a particular manner.

From here, we can use enumerative induction and Bayesian-inspired inference to best estimate where DASH may drift. Essentially, we would take the median pathway associated with the 2-3-D sequence and apply it to the current spot price, thus mapping out a projected forward distribution.

It’s here that we must talk about David Hume’s famous critique of inductive methodologies. Hume stated that the future is not necessarily compelled by the past, making inductive arguments philosophically circular. Still, this critique also applies to every inductive process, including gravity. My counterargument is that relative to second-order analyses, the Markov approach utilizes the fewest assumptions.

If you accept the above premise, DASH stock would be expected to land between $172 and $190 under 2-3-D conditions, with probability density being most prominent between $175 and $184. Aggressive speculators may be interested in the 180/190 bull call spread expiring March 20.

At $190, DoorDash stock must rise through at expiration the maximum realistic range identified by Markov (though inside Black-Scholes’ maximal dispersion). Doing so will generate a payout of almost 160%. Breakeven lands at $183.85, improving the trade’s probabilistic credibility.

Leave a Reply