Consumer staples stocks are making a comeback. Since December 2025, there’s been a sector rotation underway. Initially, investors were advised to proceed with caution. The concern was that the interest in these blue-chip value names was just window dressing for portfolio managers making numbers.

Table of Contents

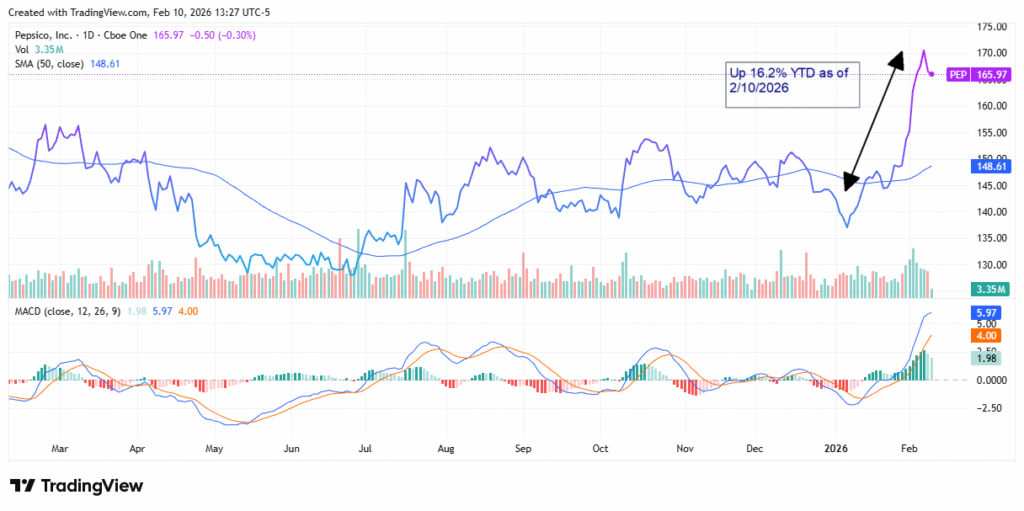

But look at this chart, and you’ll understand why a bigger move may be underway.

Why Consumer Staples Stocks Are Back in Play

Money has rotated back into defensive earnings compounders as investors reassessed stretched valuations in AI, semis, and high‑beta growth. Macro data have stayed “good but not great,” keeping recession odds on the table while also reducing the probability of aggressive rate cuts, which supports a bid for steady free‑cash‑flow names that can grind higher even in a slower nominal growth world.

That backdrop favors consumer staples with three characteristics: visible pricing power, globally diversified demand, and an ability to translate incremental revenue into outsized EPS and dividend growth. Beverage majors like PepsiCo (NASDAQ: PEP) and Coca‑Cola (NYSE: KO) screen well across all three dimensions, which is why they have led recent consumer staples sector performance rather than food manufacturers or household‑product names that still face heavier mix and cost headwinds.

From a portfolio‑construction standpoint, investors are less interested in the old “bond proxy” narrative and more focused on staples as a source of upside convexity if growth disappoints and the market broadens out beyond the megacap tech complex. That creates an opening for high‑quality staples to re‑rate back toward their historical premiums as earnings revision momentum stabilizes.

PepsiCo: Quietly Re‑Accelerating

PepsiCo comes into this consumer staples rebound with an underappreciated earnings inflection story. Management has already pivoted from pure price‑led growth toward a more balanced algorithm of modest volumes plus disciplined pricing, which better matches a consumer that remains value‑conscious but hasn’t rolled over. That balance is important because it signals that the company is not just “harvesting” the pandemic‑era pricing reset but still investing behind brands and distribution to defend share.

The core North America snacks and beverages franchises give PepsiCo a structurally advantaged platform: it can flex pack sizes, channel mix (especially convenience and food‑service), and promotional intensity to protect volumes without fully reversing prior price increases. International remains a second engine, with emerging markets still driving unit growth as middle‑class consumers trade up into global brands.

On the P&L side, PepsiCo has visible levers for margin resilience—procurement, mix shift toward higher‑margin categories, and ongoing productivity programs. That has allowed EPS to grow faster than revenue and should continue to support mid‑single‑digit to high‑single‑digit EPS growth even if top‑line decelerates. For income‑oriented investors, the combination of a competitive dividend yield, a long history of annual increases, and steady buybacks makes the total‑return profile attractive once the valuation risk premium compresses.

Coca‑Cola: Pricing Power on Display

Coca‑Cola’s latest quarter underscores why global beverage systems tend to outperform later in the cycle. Net revenues grew roughly low‑single‑digits year over year in Q4 2025, with organic revenue up about 5% as a 4% increase in concentrate sales and a positive price/mix contribution offset only modest unit volume gains. While reported revenue came in below consensus, EPS grew faster than sales thanks to expanded comparable operating margins and disciplined cost control.

Reported earnings per share for the quarter increased to about 0.53 dollars, with comparable EPS of roughly 0.58 dollars exceeding analyst expectations by a couple of cents. For the full year 2025, net revenues rose around 2% to just under 48 billion dollars, but net income grew more than 20%, reflecting meaningful operating leverage and the benefit of prior years’ restructuring. That spread between revenue and profit growth is precisely what investors want to see from a mature staples bellwether.

Importantly, the quarter also demonstrated Coca‑Cola’s ability to absorb noise. A large non‑cash impairment tied to a secondary brand weighed on reported operating margin, but comparable operating margin still ticked higher year over year into the mid‑20s, supported by productivity and mix. Management’s 2026 outlook calls for low‑single‑digit net revenue growth and mid‑single‑digit comparable EPS growth, which looks conservative enough to be beatable if volumes hold and FX headwinds ease. In a market that has punished “just okay” numbers from cyclicals, that level of visibility has renewed investor interest in KO as a core defensive compounder.

What Makes This Consumer Staples Move Different

That setup supports a thesis where investors can own these names for a baseline of mid‑single‑digit top‑line growth, a couple of points of margin expansion over time, and high‑single‑digit EPS growth, with dividends layered on top. If risk sentiment deteriorates and the market rotates further toward quality and stability, that earnings profile could command a higher multiple, providing an additional source of upside.

That setup supports a thesis where investors can own these names for a baseline of mid‑single‑digit top‑line growth, a couple of points of margin expansion over time, and high‑single‑digit EPS growth, with dividends layered on top. If risk sentiment deteriorates and the market rotates further toward quality and stability, that earnings profile could command a higher multiple, providing an additional source of upside.

The current rotation into staples is not just a reach for yield; it is a search for resilience that doesn’t require a full‑blown recession to work. In prior cycles, staples outperformance often came alongside significant multiple expansion as investors treated the group almost like a duration trade against falling rates. This time, the setup is more nuanced: rates remain elevated in real terms, but inflation has cooled, and the market is rewarding companies that can sustain real pricing power without destroying volumes.

PepsiCo and Coca‑Cola benefit from structural advantages that are hard to replicate: vast distribution networks, entrenched brands, and decades of category management data. Their categories are also relatively insulated from private‑label encroachment compared with center‑store grocery, which means the consumer “trade down” dynamic is less threatening than for many food peers. Meanwhile, both companies have leaned into smaller, higher‑margin formats and better‑for‑you adjacencies, allowing them to participate in health‑conscious trends rather than be disrupted by them.

That setup supports a thesis where investors can own these names for a baseline of mid‑single‑digit top‑line growth, a couple of points of margin expansion over time, and high‑single‑digit EPS growth, with dividends layered on top. If risk sentiment deteriorates and the market rotates further toward quality and stability, that earnings profile could command a higher multiple, providing an additional source of upside.

Risks to the Consumer Staples Comeback

The biggest risk to the consumer staples comeback is that the soft‑landing narrative proves too pessimistic and the economy actually re‑accelerates, pulling capital back into cyclicals and high‑growth tech at the expense of defensives. A renewed “risk‑on” chase could compress multiples for staples even if fundamentals remain intact, creating a period where investors get paid primarily through dividends and EPS growth rather than price appreciation.

Input‑cost volatility is another swing factor. While commodity pressures have eased from the peaks of 2022–2023, packaging, sweeteners, and logistics remain structurally higher than pre‑pandemic, limiting how much incremental margin expansion management teams can deliver without additional pricing. Regulatory and political risk—including sugar taxes, packaging mandates, and restrictions on marketing to younger consumers—also represent medium‑term overhangs for global beverage companies.

Finally, both PepsiCo and Coca‑Cola now face a higher bar for execution simply because expectations have reset upward following their latest prints. Coca‑Cola, in particular, is guiding to a more moderate growth cadence after a strong profit recovery in 2025, which leaves less room for operational missteps or macro downside before investors revisit the multiple they are willing to pay. For long‑term investors, however, these risks look manageable relative to the quality of the underlying franchises.

Conclusion

For an investor audience, the key takeaway is that the “boring” part of the market is starting to look interesting again. Consumer staples, led by beverage majors like PepsiCo and Coca‑Cola, offer a blend of durable demand, demonstrated pricing power, and improving capital‑return profiles that fit well in portfolios seeking ballast against an increasingly narrow, growth‑heavy tape.

The recent earnings trajectory at Coca‑Cola—modest revenue growth, stronger EPS gains, and conservative guidance—illustrates the kind of steady, all‑weather performance that can compound quietly in the background while the market debates the next macro scare.

Leave a Reply