Cinemark (NYSE:CNK) is oddly one of the more surprisingly positive names in the market in the new year, with CNK stock having gained just over 7%. Amid a difficult environment for names within the broader discretionary retail space, Cinemark also suffers from having to fight a credibility battle. After all, it’s not like the box office is thriving as it once did before streaming platforms took command of the entertainment landscape.

Table of Contents

For the upcoming fourth-quarter earnings report — scheduled for release on Feb. 18 before the market open — Wall Street analysts are expecting earnings per share of 28 cents on revenue of $778.15 million. In the year-ago quarter, Cinemark posted EPS of 33 cents on revenue of $814.3 million. These results represented a mixed performance, with the company missing on the bottom line but exceeding in the top.

Still, the overall framework for Cinemark stock is largely pessimistic. That’s because growth is clearly eroding, suggesting that there is an increasingly limited window of success for the cineplex business model. It also doesn’t help matters that the company consistently fails to impress regarding per-share profitability. Investors will need some other compelling reason to stay engaged in Cinemark.

Such engagement might not be a stretch, as the headline numbers would imply. Sure, CNK stock isn’t exactly lighting up the Street, with the security losing about 25% of its value over the past 52 weeks. However, the smart money doesn’t seem to be prioritizing downside insurance, which goes against conventional wisdom. As such, the contrarian position might not be wholly irrational.

Volatility Skew Provides an Important Clue Regarding CNK Stock

Among first-order (observational) analyses, volatility skew represents one of the most significant indicators because it provides sentiment clues of the smart money. Definitionally, volatility skew identifies implied volatility (IV) — or a stock’s potential kinetic output — across the strike price spectrum of a given options chain.

For the March 20 expiration date, options traders are refusing the opportunity to overtly prioritize downside insurance. For one thing, the skew for strikes near the at-the-money (ATM) price is flat for both puts and calls. This setup indicates that there’s no heightened demand for protecting against southbound volatility.

Of course, this statement doesn’t mean that hedging doesn’t exist. In the far-left wing of the skew, put IV swings higher and stands above call IV. However, the relative discrepancy or spread between the put and call IV is generally modest for most strikes. Again, the structure suggests that no real urgency exists to protect against tail risk.

On the other end, call IV stands above put IV for the upper strikes beyond the ATM strike. Here, these out-the-money (OTM) calls reflect prioritization for modest upside convexity. It’s not that the smart money outright believes a bullish wave is coming for CNK stock. But because such positivity would be unexpected, the subsequent magnitude of reward should be large. Therefore, traders are prioritizing exposure to this bullish tail.

Ultimately, the biggest takeaway comes from information by omission. With such a poor performance in CNK stock over the past year, you would expect the smart money’s priority to be to watch its back. We don’t really find that pensive posture, which may hint at a contrarian opportunity.

Establishing the Trading Parameters of Cinemark Stock

While we now have a basic read on smart money sentiment, we’re still at a loss as to how this translates into actual price outcomes. For that, we may turn to the Black-Scholes-derived expected move calculator. Wall Street’s standard mechanism for pricing options projects that for the March 20 expiration date, Cinemark stock may land between $21.97 and 27.80.

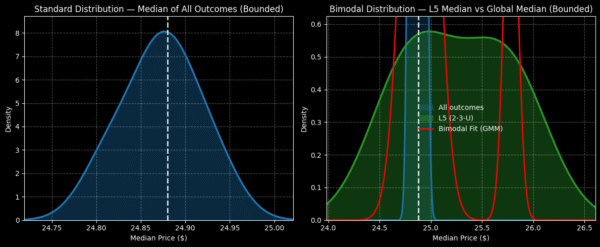

Where does this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this framework, the above range represents where CNK stock may symmetrically land one standard deviation away from spot (while accounting for volatility and days to expiration).

From a mathematical perspective, the model claims that in 68% of cases, we would expect CNK stock to trade somewhere within the prescribed range in 34 days. That’s a reasonable assumption, if only because it would take an extraordinary catalyst to drive a security beyond one standard deviation from spot. Still, we’re left with a rather hefty peak-to-trough range of roughly 27%.

At this point, we have reached the maximum utility of first-order analyses. To derive any more insights will require a second-order analysis, which would condition the data at hand against an empirical anchor.

Perhaps the best way to think about this conundrum is in terms of search-and-rescue (SAR) missions. Imagine if CNK stock represented a lone shipwrecked survivor. Black-Sholes has identified that a distress signal went out somewhere in the Pacific Ocean, while the expected move calculator has laid out a realistic search radius.

Given our constrained environment, we must maximize our resource expenditure wisely, as there are other emergencies that our team must address. Therefore, we have an incentive to search for the survivor the smart way through probabilistic math — and that’s where the Markov property comes into view.

Using Science to Narrow Down the Probability Space

Under Markov, the future state of a system depends entirely on the present state. Colloquially, forward probabilities should not be calculated independently but be assessed in context. Using the SAR analogy above, different ocean currents — such as choppy waves versus calm waters — can easily influence where a shipwrecked survivor is likely to be found.

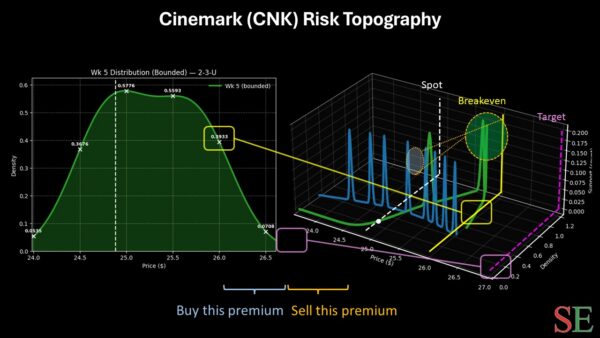

Here’s how the Markov property specifically relates to Cinemark stock. In the past five weeks, CNK printed only two up weeks, but with an overall upward slope. There’s nothing special about this 2-3-U sequence, per se. However, this quantitative signal represents a unique type of ocean current. As such, survivors caught in these waters would be expected to drift in a particular manner.

From here, we can use enumerative induction and Bayesian-inspired inference to better estimate where CNK stock is likely to drift over the next five weeks. Basically, the idea is that we take the median drift pattern historically associated with the 2-3-U sequence and apply it to the current spot price.

Philosophically, all inductive processes face the criticism famously forwarded by David Hume, which colloquially states that the future is not necessarily compelled by the past. However, my counterargument is that within second-order analyses, the Markov framework arguably utilizes the fewest assumptions.

If you accept the premise above, CNK stock would be expected to range between $23.50 and $27 over the next five weeks, with probability density peaking between $24.50 and $26. Aggressive speculators may consider the 25/27 bull call spread expiring March 20.

For this trade to be fully profitable, CNK stock would need to rise through the $27 strike at expiration, which is a lofty target. However, doing so would generate a maximum payout of 100%. Breakeven lands at $26, which helps improve the wager’s probabilistic credibility.

Leave a Reply