Bristol-Myers Squibb (NYSE:BMY) is set to release its earnings disclosure amid a shaky environment in the capital markets. Both equities and cryptocurrencies stumbled amid rising geopolitical tensions. However, BMY stock managed to keep its head above water, albeit barely. Though the performance was very modest, it’s an encouraging sign relative to the volatility we witnessed.

Table of Contents

For the fourth quarter — with results scheduled for release on Thursday before the opening bell — Wall Street is anticipating earnings per share of $1.23 on revenue of $12.27 billion. In the year-ago quarter, the pharmaceutical giant posted EPS of $1.67 on revenue of $12.34 billion. These figures beat the consensus target of $1.47 and $11.56 billion, respectively.

Since February 2024, Bristol-Myers has delivered top-and-bottom-line beats consecutively. During this period, BMY stock has gained nearly 15%, which isn’t the most awe-inspiring performance. For context, the benchmark S&P 500 moved up about 40% during the same period.

Nevertheless, with so many popular enterprises suffering volatility amid a rotation away from growth-oriented names, Bristol-Myers looks intriguing. Fundamentally, healthcare represents one of the core necessities, making it a durable sector amid challenging economic circumstances. Even better, the smart money has positioned itself for upside convexity.

Volatility Skew Reveals a Clear Bias for BMY Stock

Before exploring complex analyses, it’s important to exhaust the important first-order frameworks. One of the most insightful is volatility skew, which identifies implied volatility or a stock’s potential kinetic output across the strike price spectrum of a given options chain. For various expiration dates, the smart money appears to be leaning bullishly.

For example, the Feb. 6 weekly chain — which is the expiration date after Bristol-Myers’ Q4 earnings — reveals heightened IV pricing for calls, especially at strike prices below the spot price. This indicates that the priority among sophisticated market participants is upside optionality. Further, many of these calls appear to be deep in-the-money (ITM) calls, which suggests that traders are willing to pay a premium for potential upside convexity.

Just as significantly, the premium for downside insurance is limited relative to demand for calls. That’s not to say that the smart money doesn’t fear volatility because downside is treated as a non-trivial risk. However, the bias clearly leans to the bullish side of the spectrum.

It’s also worth pointing out that call IV to the right (or above) of the spot price is gradual. Effectively, the market is pricing continuation risk, not breakout certainty. So, while we’re probably not talking about a moonshot, the general sentiment is that BMY stock is not expected to collapse.

Looking a little bit further ahead for the March 20 expiration date, we see a similar dynamic. Deep ITM calls have seen higher IV pricing, reflecting a bullish lean. On the upper boundaries, both put and call IV are modestly elevated, with puts carrying a slight edge. As such, there appears to be some hedging involved, though the general setup is again to position for upside convexity.

Defining the Search Parameters

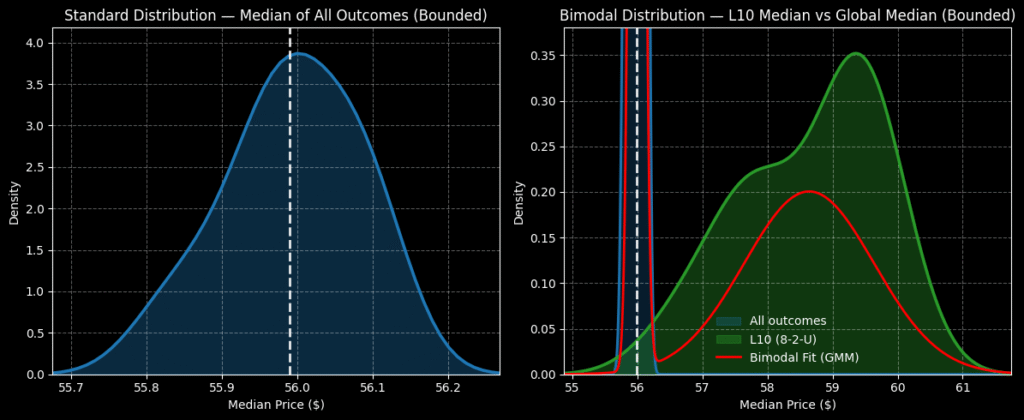

While we may have a basic understanding of the bias of the smart money, we’re still at a loss as to how this may translate into actual outcomes. To find out, we can turn to the Black-Scholes-derived expected move calculator. For the March 20 expiration date, the model anticipates that BMY stock will land between $52.54 and $59.60. This range represents a 6.3% high-low spread relative to the current spot price.

Where did this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this framework, the above range represents where BMY stock would fall symmetrically one standard deviation away from spot (while accounting for volatility and days to expiration).

If you look at the math, the model basically states that in 68% of cases, BMY should land between roughly $53 and $60 when March 20 rolls around. And while this lays out the parameters of the battlefield, it’s not the most instructive piece of data for debit-side options traders.

Let’s imagine that you are a member of a search-and-rescue team and you need to look for shipwrecked survivors. Black-Scholes is important because it declares that the stricken ship went down somewhere in the Pacific Ocean (as opposed to, say, the Atlantic).

However, the model makes its calculations independent of market structure. Stated differently, it’s probably accurate in setting the search parameters, but it doesn’t offer a probabilistic view because it doesn’t incorporate contextual factors that could influence forward probabilities.

Well, that’s a major problem. It’s akin to assuming that the Pacific has no current and that environmental factors are negligible. The model is also assuming that the survivors are simply floating and not swimming or behaving in ways that could compound the distance from where they made their distress call.

As an officer charged with search efforts, what would you do? Frankly, you know that not every incident merits a full-scale search. In other words, you can’t just buy a long iron condor and play both the bullish and bearish sides.

At some point, you have to use probabilistic math to improve the odds of finding the survivors — and that’s where the Markov property comes into view.

Markov to the Rescue

Under Markov, the future state of a system depends solely on the current state. That’s a fancy way of saying that forward probabilities should not be independently calculated but rather assessed under an ecosystem context. To use a simple football analogy, a 20-yard field goal is an easy chip shot. Add snow, wind and playoff pressure, and these odds may change dramatically.

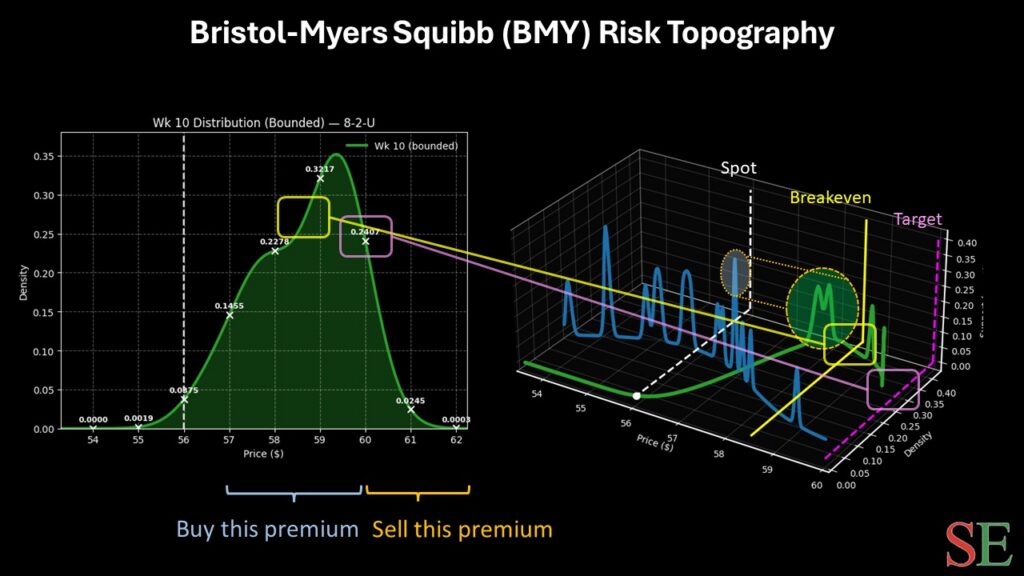

When it comes to our search-and-rescue analogy, Markov isn’t just useful — it’s necessary. For example, let’s consider the current context of BMY stock. In the last 10 weeks, it printed eight up weeks, leading to an overall upward slope. This 8-2-U sequence represents a specific type of ocean current. Put another way, survivors caught in these waters will likely drift in a certain way compared to if a different type of current were involved.

Subsequently, we can use enumerative induction to see how the market typically responds under 8-2-U conditions, as well as incorporate a Bayesian-lite inference to reach an estimated range. Over the next 10 weeks, we would expect BMY stock to land between $55 and $62, with probability density peaking between $58.50 and $60.

Does that mean BMY is guaranteed to coalesce at this peak range? No. The market is a dynamic and cruel place, much like the Pacific Ocean. If you get lost at sea, you can bet that the U.S. Coast Guard will use Markovian models to pinpoint where you might be. But you can also be eaten by a shark — and there’s no way to predict that.

Still, the theory is that over time, market behaviors statistically conditioned on specific quantitative structures should yield similar results. That’s where inductive Bayesian inference comes into the frame. In a world of uncertainties, this is probably the best approach available to retail traders.

Let’s move away from theory and go into practical applications. Given the above market intel, I like the 57.50/60.00 bull call spread expiring March 20. If BMY stock rises through the $60 strike at expiration, the spread will trigger the maximum payout, which stands at 150%. Breakeven lands at $58.50, bolstering the trade’s probabilistic credibility.

Leave a Reply