Forgive me for being coy, but the play on words is needed for investors considering getting involved with Cameco Corp. (NYSE: CCJ) stock. Cameco is the leading pure play on uranium mining and delivery. Headquartered in Canada, the company has several Tier One and Tier Two assets along with additional assets in development.

Table of Contents

CCJ stock is up more than 137% in the last 12 months and over 617% in the last five years as the world, and notably the United States, embraces nuclear energy. At the core of this interest is the energy demands being created by artificial intelligence (AI).

The data centers being built require power 24/7, 365 days a year. That demand is colliding with two realities in the United States. First, there isn’t enough cheap, clean energy to go around. And second, our nation’s aging electrical infrastructure has to be addressed.

That’s a high-level view of the need for nuclear power, which is powered by uranium. That brings me back to Cameco. This is a multi-year and, more likely, a multi-decade buildout. It’s a neighborhood that many companies (i.e., customers) are trying to buy into, but in many cases, the foundations for the houses haven’t been poured yet.

That may explain why CCJ stock fell 3% despite a solid earnings report. And it’s also why, if you believe that nuclear energy will rise to meet the moment, Cameco stock deserves a place on your radar.

The Supply Gap Keeping Cameco Under Construction

Understanding Cameco’s supply gap requires looking beyond simple geology. There’s technically enough uranium in the ground to meet global demand for centuries. The challenge isn’t scarcity—it’s accessibility.

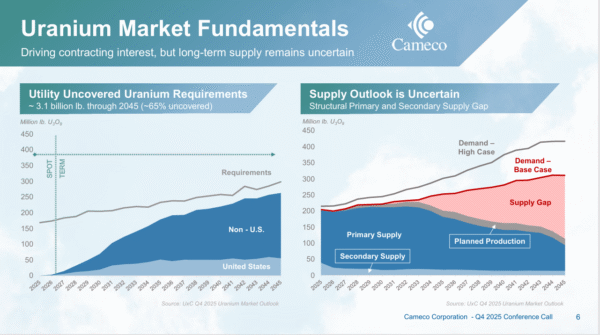

The supply deficit exists because of industry-wide underinvestment following the 2011 Fukushima disaster. During Cameco’s recent Q4 2025 conference call, management emphasized their intentional discipline, stating they are “simply not prepared to satisfy that demand at today’s economics, which do not support sustainable supply.”

This creates an interesting dynamic. Cameco and other producers have some production capacity they could expand, but they’re choosing not to commit at current price levels. The company is preserving “significant uncommitted volumes to be priced when more demand comes to the market.” They’re betting that utilities will eventually be forced to accept substantially higher prices rather than abandon nuclear power.

The company’s presentation shows projected demand through 2045 with roughly 65% of utility requirements still uncovered. Even with planned production increases across the industry, a substantial supply gap remains. This gap exists not because uranium is rare, but because Tier 1 deposits (low-cost, high-grade) are limited, permitting can take 10-15 years in developed countries, and new mines require billions in capital investment.

Compounding the challenge, secondary supply sources—stockpiles from decommissioned weapons and utility inventories—are being depleted. This cushion that masked supply deficits for decades is disappearing, forcing utilities back to the primary market at a time when production capacity is constrained.

CCJ Stock: A Bullish Uptrend Remains in Place

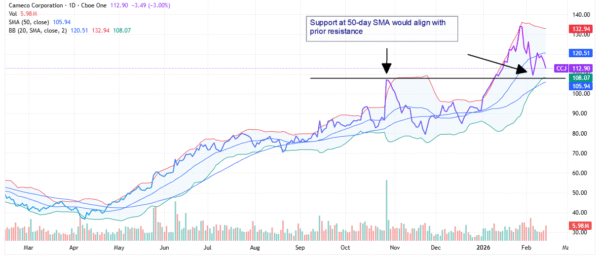

Despite the 3% pullback after the earnings report, CCJ stock remains in an uptrend. This began about five years ago but has become more pronounced in the three years beginning in March 2023.

In the last year, that upward move has become more pronounced, with Cameco stock hitting a record high of over $133 per share in late January. That’s a lot of growth priced into a stock that’s trading at around 89x forward earnings as of this writing. At that level, CCJ stock is expensive to itself, to the Materials sector, as well as to many gold mining stocks.

A bullish case can be made that Cameco will grow into that valuation. However, in the short term, it seems more likely with the current market volatility that CCJ stock may have further to drop.

A good place to watch would be the current 50-day simple moving average of around $105. That would align with a level of resistance the stock reached in October 2025. That would also align with the lower Bollinger Band.

At that level, you’d be getting about 15% upside from the current consensus price from 20 analysts of around $123.79. But keep in mind that Cameco just reported on Feb. 12. There will likely be new ratings and price targets coming in over the next one to two weeks, which could change investor sentiment in a positive or negative way.

Risks to the Bull Case for Cameco

It’s tempting to lump all mining stocks into a single bucket. And there’s one reason why that holds. Whether it’s oil, precious metals, or copper, companies like Cameco need higher prices to cost-effectively get it out of the ground.

However, the uranium story is quite different than that of gold and silver. In those cases, the bull case is anchored by a lack of supply. There simply isn’t enough known supply of either metal to fill the demand coming from central banks, government agencies (i.e., the U.S. Department of Defense) and private sector companies.

With uranium, there’s plenty of supply, but there’s not enough economically developed, permitted, and financed production capacity to meet the projected demand at prices below approximately $80 to $100 per pound.

The risk to the bull case is twofold. First, even at higher prices, it will take years for the new supply to come online. But data centers and other projects need to have power right now.

Another risk is that, if uranium prices spike too high (e.g., above $200 per pound), it could trigger demand destruction as potential customers look for other technologies for their power.

CCJ Stock: A Long-Term Play with Short-Term Volatility

Cameco represents a compelling but complex investment thesis. The fundamentals—growing nuclear demand driven by AI data centers, depleting secondary supply, and structural production deficits—support a multi-year bull case. However, the premium valuation and inherent timing risks mean this isn’t a stock for the impatient investor. If you believe nuclear energy is essential to meeting modern power demands, Cameco deserves serious consideration. But approach it with realistic expectations about volatility and a time horizon measured in years, not quarters. This neighborhood is being built—just slower than some might hope.

Leave a Reply