Investing in the aging population is becoming one of the most compelling long-term themes in the market. Americans aged 65 and older accounted for 17% of the U.S. population in 2020, or about 55.8 million people, according to the U.S. Census Bureau. That figure continues to rise steadily each year, creating powerful and durable tailwinds for investors who know where to look.

Table of Contents

Some will turn 80 this year, and that milestone alone is expected to create significantly higher demand for senior housing and care facilities. In fact, as quoted by CNBC, “The 80+ population is set to increase meaningfully over the next few years, which will drive a material increase in demand for senior housing,” wrote Jefferies analyst Joe Dickstein.

We also have to consider that people are living longer, which only increases demand further. Longer lifespans mean more years requiring assisted living, skilled nursing, memory care, and outpatient medical services. At the same time, there’s a growing shortage of caregivers to meet this explosive demand, creating a supply imbalance that strongly favors owners of healthcare real estate.

As noted by Medsien.com, “The growing aging population is driving demand for more medical care, as we face provider shortages. Patients 65 and older account for 34% of the demand for physicians. And by 2034, patients over 65 will account for 42% of the demand. An aging population means higher use of health care services and a greater need for family and professional caregivers.”

For investors, this combination of demographic certainty and constrained supply creates a rare opportunity. The question becomes not if demand will grow, but how to gain exposure in a way that balances growth with income and risk management.

So, what’s the best way to invest?

We suggest care facility real estate investment trusts (REITs), not only for their exposure to a rapidly growing market but also for their ability to generate reliable income. Healthcare REITs benefit from long-term leases, relatively stable occupancy rates, and the essential nature of the services provided. That makes them particularly attractive for investors seeking yield while still participating in secular growth tied to investing in the aging population.

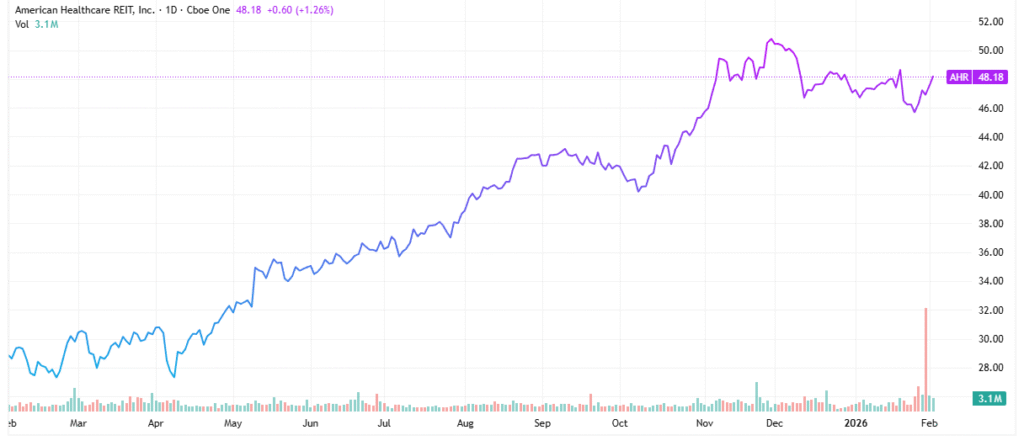

Stocks for an Aging Population: American Healthcare REIT (AHR)

With a yield of 2.12%, American Healthcare REIT (NYSE: AHR) is a real estate investment trust that acquires, owns, and operates a diversified portfolio of clinical healthcare real estate. The company focuses primarily on senior housing communities, skilled nursing facilities, and outpatient medical buildings across the United States, the United Kingdom, and the Isle of Man.

American Healthcare REIT is expected to release its fourth-quarter and full-year 2025 earnings report on Thursday, Feb. 26, after market close. While investors wait for that update, the most recent quarterly results provide a useful snapshot of execution. In Q3, the company’s earnings per share of 33 cents beat expectations by 19 cents. Revenue of $572.93 million, up 9.4% year over year, also exceeded estimates by $20.97 million—evidence of steady operating momentum.

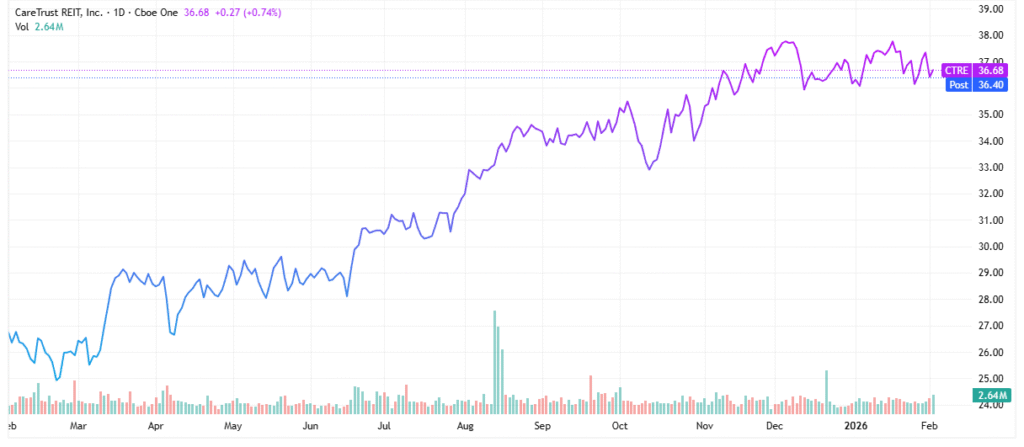

Stocks for an Aging Population: CareTrust REIT (CTRE)

We can also look at CareTrust REIT (NYSE: CTRE), a “real estate investment trust engaged in the ownership, acquisition, development, and leasing of skilled nursing, seniors housing, and other healthcare-related properties.” CareTrust currently offers a more generous yield of 3.61%, making it appealing for income-focused investors.

In its most recent quarter, Q3 funds from operations came in at 45 cents, missing estimates by two cents. However, revenue of $132.44 million beat expectations by $10.09 million, suggesting continued portfolio expansion and tenant demand despite short-term earnings variability.

Investing in the Aging Population for Income and Stability

Investing in the aging population isn’t just a long-term growth story—it’s also an opportunity to generate income in a market driven by demographic certainty rather than economic cycles. The steady rise in Americans over age 65, combined with a sharp increase in the 80+ population, creates sustained demand for senior housing, skilled nursing, and outpatient care facilities for decades to come.

Care facility REITs offer investors a practical way to participate in this trend. These companies benefit from essential services, long-term leases, and predictable cash flows, which support dividends even during periods of broader market volatility. As caregiver shortages persist and healthcare utilization increases, owners of well-located, high-quality healthcare real estate are likely to see continued demand and pricing power.

For investors looking to balance growth with yield, investing in the aging population through healthcare REITs such as American Healthcare REIT and CareTrust REIT offers a compelling combination of income potential and demographic-driven tailwinds. As the population continues to age, this theme should remain one of the most reliable and resilient opportunities in the market.

Leave a Reply