Apple Inc. (NASDAQ: AAPL) stock took investors on quite a ride but finished 0.46% higher the day after its quarterly earnings. The Apple earnings report was one of many significant reports investors received in the last week. And, like many of those reports (I’m looking at you, Microsoft), investors were left with more questions than answers.

Table of Contents

In the case of Apple earnings, questions continue about the company’s artificial intelligence strategy (AI). Investors are also pondering how much of a bite will be taken out of Apple’s earnings as they buy ever more expensive memory chips to power their iPhones.

Those questions, which came on a day when the market was generally in a selling mood, weighed on the stock price. But the positive move late in the day may provide confirmation that the worst is over.

However, in this volatile market environment, emotion can take precedent over fundamentals. That’s why it’s important for investors to look at the Apple earnings report with a balanced perspective that accounts for both the hope and the hysteria.

Hope from Apple Earnings: iPhone Sales

Many companies like to underpromise and overdeliver. That’s why it was curious for Apple to put a large target on its back by forecasting that the quarter just ended would be the best quarter for the company and for iPhone sales.

But as the idiom goes, it’s not bragging if you can back it up. Apple reported record revenue of $143.8 billion. That was 16% higher than the prior year. A key reason for that was due to sales of its iPhone 17, which the company referred to as “staggering.” Sales came in at $85.3 billion, which was up 23% from the prior year.

And, as with its overall topline, this was also the highest-ever iPhone revenue. The company also posted its fastest iPhone sales growth rate since fiscal Q4 2021.

However, that may not even be the most impressive part. Of that $85.3 billion, $25.5 billion came from China. That number was up 38% and helped soothe concerns that Apple was losing market share in the country.

Apple Earnings Hysteria: Margin Pressure

Of course, as every investor should know, the headline numbers get the immediate attention, but it’s what the company says regarding future guidance that’s critical. Management said on the call that it’s concerned about the rising cost of certain components (specifically, memory hardware and chips used in the iPhone.

Apple said it left money on the table because it didn’t have enough supply from Taiwan Semiconductor Manufacturing Corp. (NYSE: TSM) to meet demand. That’s because Taiwan Semi has seen accelerating demand from other companies building out their AI stack.

However, there are two things for investors to remember. First, having demand outpacing supply is not necessarily a bad thing for Apple. Keep in mind, the company has a loyal (some would say cult-like) user base. The diehard Apple consumers aren’t going to switch loyalties because they have to wait a few months for a new device.

Second, while this does create concerns about margin pressure, it also potentially extends the iPhone 17 sales window. That means that this quarter’s number may not be as much of a one-off as it may appear.

Apple Earnings Hysteria: What is the AI Strategy

The larger concern for Apple may come from its lack of an AI strategy. At this point, it’s an issue that the company doesn’t really even pretend to address.

It has partnered with Alphabet Inc. (NASDAQ: GOOGL) to allow Gemini, Alphabet’s large language model (LLM) to “plug into” Apple Intelligence.

This is part of Apple’s larger strategy of owning the user experience, but outsourcing some of the intelligence. In this case, Gemini will be used to handle more complex queries that Siri can’t handle.

For investors, the appeal is mutual. Apple keeps control of the user experience and data while instantly making the iPhone smarter, without betting the farm on a single AI model. Alphabet, meanwhile, gains potential access to more than a billion iPhone users at a time when AI assistants are becoming a new front door to search and information.

This also brings up another key point. Apple’s iPhone sales are surging even though they don’t possess the AI features that other models have. Therefore, when analysts are wondering if consumers will demand more AI features on future iPhones, they may be framing the issue incorrectly. Consumers are voting with their wallets, and they’re fine with the iPhone in its current state.

Investors are Telling You That AAPL Stock Looks Oversold

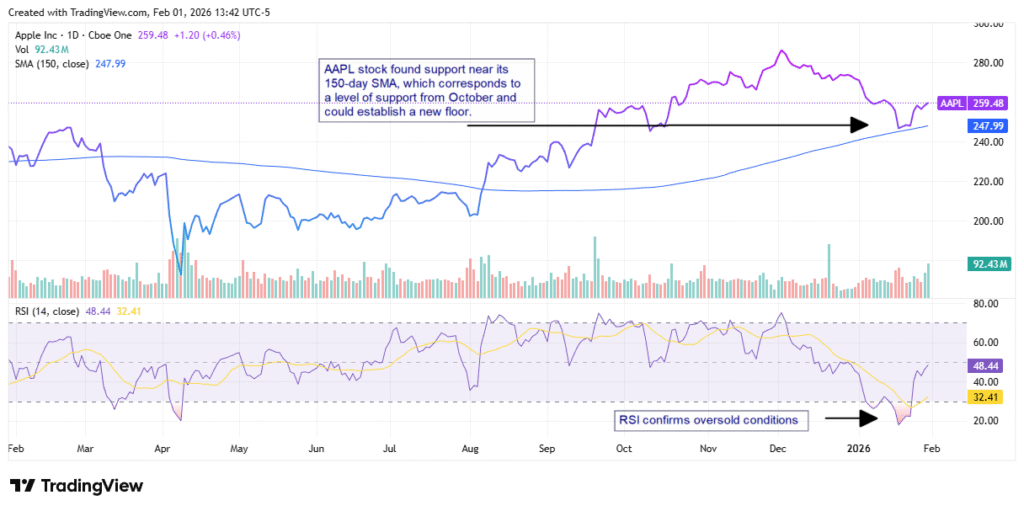

On Jan. 20, about a week before Apple earnings, the AAPL stock price dropped below $250. It appeared that the stock would drop past a support level it hit in early October. However, the relative strength indicator was flashing oversold and sure enough, that’s when a pre-earnings reversal began.

What’s important to note is that even as AAPL stock came under pressure after the earnings report, the stock never approached that support level, which is now looking like a new floor for Apple stock.

If that’s the case, investors will want to pay attention to analyst sentiment. The consensus price target for AAPL stock as of this writing is $295.79. Apple is one of the most covered stocks, with 50 analysts offering a rating. Of those analysts, 30 give the stock either a Strong Buy or a Buy, with 17 other analysts giving the stock a Hold.

For further context, most of these price targets are 12-month targets. That means investors may have to be patient before AAPL stock makes a bullish move. However, investors who did that in 2025 were rewarded with a nice gain in the back half of the year.

Is AAPL Stock Overvalued?

Valuation is a key concern among investors this earnings season. This applies to stocks in general, but particularly to technology stocks. Many of the common metrics present a mixed picture, but one that leans towards Apple stock being at worst, fairly valued. And by some metrics, AAPL stock trades at a discount to its historic values.

Leave a Reply