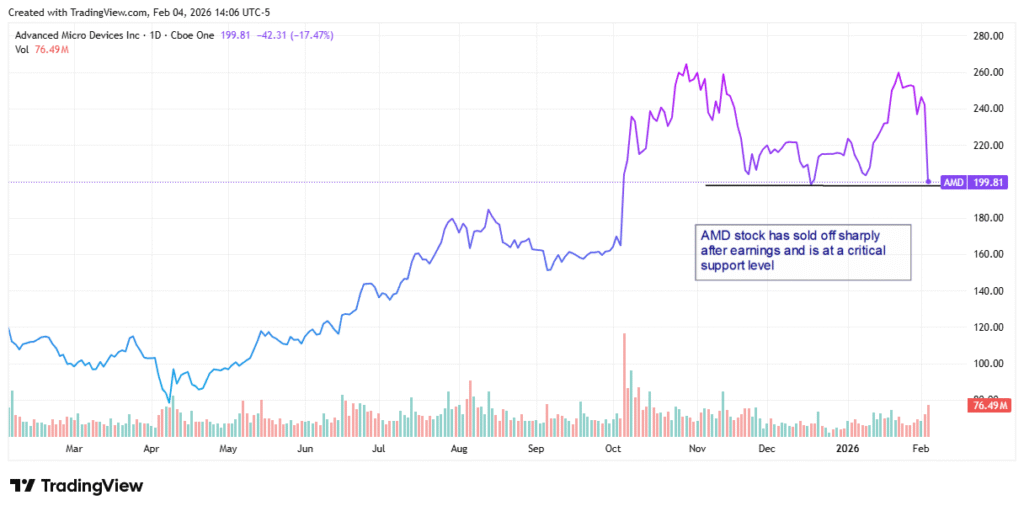

Advanced Micro Devices (NASDAQ: AMD) stock is down over 17% in mid-day trading the day after the company posted strong fourth-quarter earnings. However, as investors have seen from many big tech companies this earnings season, sometimes good isn’t good enough.

Table of Contents

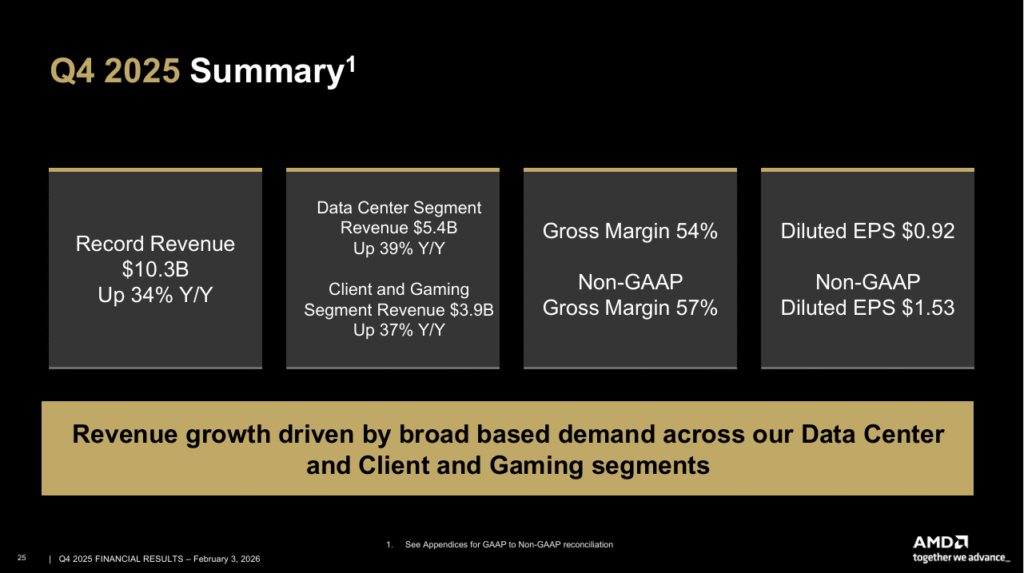

Let’s reiterate that the report was good. AMD posted record revenue of $10.3 billion, which was up 34% year-over-year (YoY). For the full year, the company also reported record revenue of $34.6 billion. For both the current quarter and the full year, Advanced Micro Devices cited broad-based demand across its Data Center and Client and Gaming segments.

Adjusted earnings per share (EPS) of $1.53 smashed estimates for EPS of $1.32 and were 42% higher YoY. Adding to the bullish report, the company saw an expansion in its gross margin and operating income. That signals long-term pricing power with the company forecasting a compound annual growth rate (CAGR) of over 35% between 2028 and 2030. This isn’t hype. It’s a company that’s executing amid expectations for a tight supply chain for GPUs and CPUs.

Once again, you’d have to look hard to find a blemish in the report.

However, the market and investors are forward-looking. And AMD’s guidance was less than expected. The revenue forecast of $9.8 billion for Q1 2026 would be an impressive 32% YoY gain. However, it would be down about 5% from the current quarter.

Investors were also hoping for more information on the company’s MI450 GPUs and its Helios’ rack-scale solutions. Advanced Micro Devices didn’t have much to say about those products, which won’t have an impact until the second half of the year.

That was enough to take shares lower.

Data Center Demand is Real

Punctuating the strength of the company’s data center business, full-year revenue came in at $16.6 billion, which was up 32% YoY. The growth was fueled by the company’s EPYC CPUs powering cloud hyperscalers and its Instinct MI300X GPUs that are capturing AI accelerator share.

In the fourth quarter alone, data center revenue came in at $5.4 billion, up 39% YoY, with China being a significant catalyst, delivering approximately $390 million of that number.

Looking forward, chief executive officer (CEO) Lisa Su remarked that the data center business could grow to tens of billions annually. Given AMD’s history of issuing conservative guidance and the recent results from NVIDIA (NASDAQ: NVDA), that’s probably a low estimate.

But even at that level, it would signal the potential for triple-digit revenue growth. That’s well beyond the company’s forecasts for high-double-digit growth.

Su is the latest CEO to issue guidance that should throw cold water on the hot take that data center spending is a bubble that’s about to burst. That isn’t stopping investors from buying into the fear trade that’s befalling many stocks related to the AI trade.

The Bearish Rebuttal

You could make an argument that AMD stock was up over 60% in the 12 months heading into the earnings report. Therefore, the argument would go; there was already significant growth priced into the stock.

However, that doesn’t account for the last several quarters when the company has been delivering revenue that is higher both sequentially and year-over-year. You could just as easily make the case that AMD earned its premium price, and this report confirmed why.

AMD Stock is a Gift for Growth-Hungry Investors

With AMD stock pulling below $200, the buying case becomes very simple. The consensus price target is $289.43, and that comes from 48 analysts covering the stock. That gives investors over 40% upside at the consensus mark. Notably, that price target is about 10% above the all-time high AMD stock reached twice in the last six months.

That percentage goes even higher when you factor in some of the price targets coming in after earnings. Analysts liked what they heard and believe in the long-term outlook for the stock.

This is an important observation for investors. You should always pay more attention to where long-term analyst sentiment is more than short-term trading moves. In a world dominated by high-speed trading platforms, traders key in a number. If they don’t get it, a round of selling is triggered.

It’s painful if you’re holding AMD stock. But when the dust settles, this is going to be a buying opportunity.

The Market is Repricing AMD Stock, Use That to Your Advantage

With shares below $200 versus a $289 consensus target (40%+ upside), this dip ignores AMD’s fortress balance sheet ($10.6B cash), client/gaming surge (Ryzen share gains), and AI pipeline.

High-speed trading triggered the selloff, but fundamentals scream opportunity. Growth investors: Accumulate now—history shows post-earnings pullbacks in leaders like AMD yield outsized returns when execution persists.

Leave a Reply