Alphabet Inc. (NASDAQ: GOOGL) delivered its Q4 2025 earnings after the market closed on Feb. 5. The report shows a company leaning hard into AI, cloud, and subscriptions—and getting paid for it. Revenue grew 18% year-over-year in the quarter to roughly $114 billion, pushing full-year sales above $400 billion for the first time, while EPS climbed more than 30% as operating leverage and higher-margin businesses did the heavy lifting.

Table of Contents

Search remains the profit engine with 17% ad growth, but the nature of the story is shifting: Google Cloud is scaling into a real profit center, YouTube is a $60+ billion annual business, and paid consumer subscriptions are now well into the hundreds of millions.

At the same time, Alphabet is aggressively investing in its AI opportunity. Gemini already has more than 750 million monthly active users, Google Cloud is running at a more than $70 billion annualized revenue pace with 48% year-over-year growth in Q4, and the company is processing over 10 billion tokens per minute across first-party models.

Those metrics matter because they point to durable monetization vectors in ads, cloud, and productivity, even as capex climbs sharply to support AI infrastructure. For investors, the setup is a classic “pay now, monetize later” AI buildout—except Alphabet is already monetizing at scale.

AI and Cloud Drive the Main Bullish Takeaway

The central takeaway from Alphabet’s Q4 earnings report is that Alphabet’s AI and cloud bets are no longer speculative; they’re showing up in both the top and bottom line. Google Cloud delivered 48% year-over-year revenue growth in Q4 to about $17.7 billion and expanded operating margin from 17.5% to 30.1%, a rare combination of hypergrowth and margin expansion at scale.

With that pace, Cloud is now on a revenue run-rate north of $70 billion, positioning Alphabet as one of the most important AI infrastructure and platform providers globally.

On the consumer side, the AI story is just as important. Gemini has already reached 750 million monthly active users, and Alphabet is processing more than 10 billion tokens per minute across its first-party models, including direct API usage. That usage underpins monetization across ads, cloud, and enterprise tools.

Meanwhile, YouTube generated more than $60 billion in ads and subscriptions in 2025, and paid consumer subscriptions surpassed 325 million across Google One, YouTube, and other offerings—adding a sticky, recurring layer to what was once a mostly advertising-driven business.

Further Bullish Support for the Alphabet Thesis

Beyond AI and cloud, the rest of the P&L offers further support for a constructive long-term view. Total company revenue increased 15% in 2025 to just over $402 billion, while operating income grew 15% to roughly $129 billion, keeping operating margins around 32% despite a significant ramp in R&D and capex. Net income rose 32% to about $132 billion, and diluted EPS climbed 34% to $10.81, signaling that earnings growth is outpacing revenue as mix improves and efficiency efforts flow through.

Core Google Services remains a cash engine. Search and Other grew 17% year-over-year in Q4, YouTube ads were up high single digits, and subscriptions, platforms, and devices revenue increased 17%, with segment operating margin expanding from 39.0% to 41.9%.

On the cash side, Alphabet generated trailing twelve months free cash flow of roughly $73.3 billion, essentially flat year-over-year despite nearly doubling capital expenditures, which underscores the strength of the underlying cash generation. Taken together, investors are getting a business that is funding an enormous AI buildout out of internal cash, while still growing earnings at a mid-30% clip.

Where the Alphabet Thesis Could Go Wrong

The bullish AI and cloud narrative carries real execution and macro risk. First, Alphabet is dramatically ramping capital expenditures—Q4 2025 capex was nearly $27.9 billion, up 95% year-over-year — and every quarter of 2025 has shown accelerating growth in infrastructure spend. If AI-driven demand, pricing, or competitive dynamics fail to support adequate returns on that investment, investors could face a period of margin compression and lower free cash flow conversion. Even with strong TTM free cash flow today, the bar for returns on tens of billions in incremental capex is high.

Second, the competitive landscape in AI and cloud is fierce. Hyperscaler peers are investing aggressively, and enterprises have choices for both model providers and cloud platforms. Alphabet must continue to differentiate Gemini, maintain developer mindshare, and prove that its integrated stack—from tokens processed to API usage to end-user applications—translates to superior business outcomes. Regulatory and antitrust overhangs remain another wildcard, particularly around Search and YouTube, which still fund a large portion of Alphabet’s AI and cloud ambitions. Any material regulatory remedy, shift in traffic acquisition costs, or disruption in ad targeting could weigh on growth and profitability.

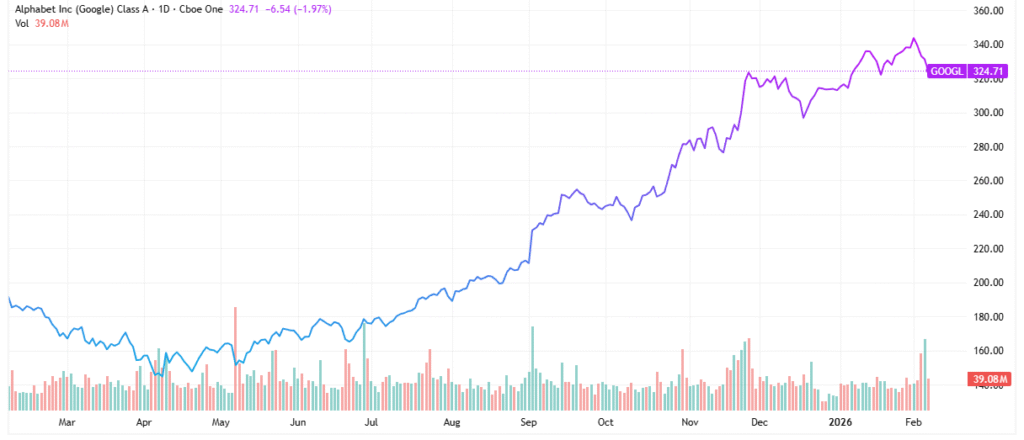

Technical Analysis: Trend Still Favors the Bulls

From a technical perspective, Alphabet’s setup aligns with the fundamental story. The stock remains in a primary uptrend, underpinned by a series of higher highs and higher lows that have tracked the company’s accelerating earnings and expanding AI narrative over the past year. The latest earnings beat—anchored by double-digit revenue growth, mid-teens operating income growth, and strong EPS leverage—should help reinforce recent support levels as buyers step in on dips.

With Cloud growth re-accelerating and margins improving, investors are likely to continue rewarding Alphabet with a premium to its historical earnings multiple so long as the AI and free cash flow story remains intact. A break below recent support would warrant caution, but as long as price action holds above prior consolidation zones and earnings revisions remain positive, the path of least resistance appears skewed to the upside.

An AI Compounder Still in the Early Innings

Alphabet’s Q4 2025 report reinforces the idea that this is an AI-led compounder, not just an ad business with a cloud side hustle. Revenue growth remains healthy in the mid-teens, EPS is growing even faster, and Cloud, YouTube, and subscriptions are adding diversification and resilience to the model.

Yes, capex is surging, and the AI arms race is real, but Alphabet is playing it from a position of scale, profitability, and free cash flow strength. For long-term investors comfortable with the regulatory and execution risks, Q4 looks less like a peak and more like another step in a multi-year AI and cloud monetization runway.

Leave a Reply