Uranium stocks are quietly lining up for what could be a powerful multi-year breakout. While the sector has already rallied off its 2023–2024 lows, several new catalysts suggest the move may be far from over. Washington policy shifts and exploding energy demand driven by artificial intelligence have put nuclear power back into the mainstream. And uranium is at the center of that story.

Table of Contents

For investors, this isn’t just a political headline trade. It’s a structural supply-and-demand setup that could support higher uranium prices and stronger equity performance across the mining and nuclear fuel value chain.

Three Major Catalysts Are Aligning for Uranium Stocks

Uranium stocks could benefit from three key catalysts, all of which are gaining momentum in early 2026.

First, the Trump Administration has expanded its critical minerals list to include uranium. This move is designed to strengthen domestic supply chains and reduce reliance on foreign, and often geopolitically unstable, sources of nuclear fuel. The United States currently imports the majority of the uranium it consumes, with meaningful exposure to countries such as Russia, Kazakhstan, and Uzbekistan.

By designating uranium as a critical mineral, the administration is signaling that domestic mining, processing, and enrichment capacity is now a national priority. That opens the door to faster permitting, government incentives, long-term purchasing agreements, and increased investment across the sector. Historically, when Washington designates a resource as “critical,” capital tends to follow.

Second, President Trump has publicly embraced nuclear power as a cornerstone of U.S. energy policy. During his recent speech at the World Economic Forum in Davos, Trump delivered some of his strongest remarks yet in favor of nuclear energy.

“I’ve signed an order directing and approval of many new nuclear reactors. We’re going heavy into nuclear,” Trump said. ” I was not a big fan, because I didn’t like the risk, the danger, but…the progress they’ve made with nuclear is unbelievable, and the safety progress they’ve made is incredible. We’re very much into the world of nuclear energy…”

That shift matters. Nuclear power had long been politically controversial, but sentiment has changed dramatically as energy security, grid reliability, and decarbonization have moved to the forefront. A pro-nuclear White House increases the odds of reactor approvals, life-extension programs for existing plants, and investment in next-generation reactor designs such as small modular reactors (SMRs).

Third, artificial intelligence is driving a surge in energy demand that renewables alone cannot meet. AI-driven data centers require massive, always-on power. Solar and wind are intermittent by nature, while natural gas faces emissions pressure and infrastructure constraints. Nuclear, by contrast, offers reliable baseload power with zero carbon emissions.

Major tech companies are increasingly turning to nuclear energy to fuel their AI ambitions. Meta Platforms (NASDAQ: META) recently announced plans to use nuclear power to run its AI data centers, partnering with Vistra (NYSE: VST), TerraPower, and Oklo Inc. (NYSE: OKLO). Those projects are expected to add roughly 6.6 gigawatts of power by 2035. Meta also signed a 20-year agreement last year with Constellation Energy (NASDAQ: CEG) to purchase nuclear power, underscoring the long-term commitment.

This trend isn’t limited to Meta. Across the tech sector, nuclear power is emerging as one of the few scalable solutions capable of supporting the next wave of AI infrastructure.

A Tight Uranium Market Adds Fuel to the Fire

These demand-side catalysts are arriving at a time when the uranium market is already structurally tight. Years of underinvestment following the Fukushima disaster left global supply constrained just as reactor restarts, new builds, and life extensions picked up pace. Bringing new uranium mines online is capital-intensive, heavily regulated, and time-consuming, which limits how quickly supply can respond to rising demand.

As a result, uranium prices tend to move in sharp cycles when demand accelerates. That dynamic can create outsized gains for well-positioned miners and uranium-focused investment vehicles.

ETFs Offer Diversified Exposure to the Theme

While investors can buy individual uranium stocks such as Cameco Corp. (NYSE: CCJ), one of the most efficient ways to gain exposure is through exchange-traded funds (ETFs). ETFs help diversify single-asset and geopolitical risk while still capturing upside from higher uranium prices.

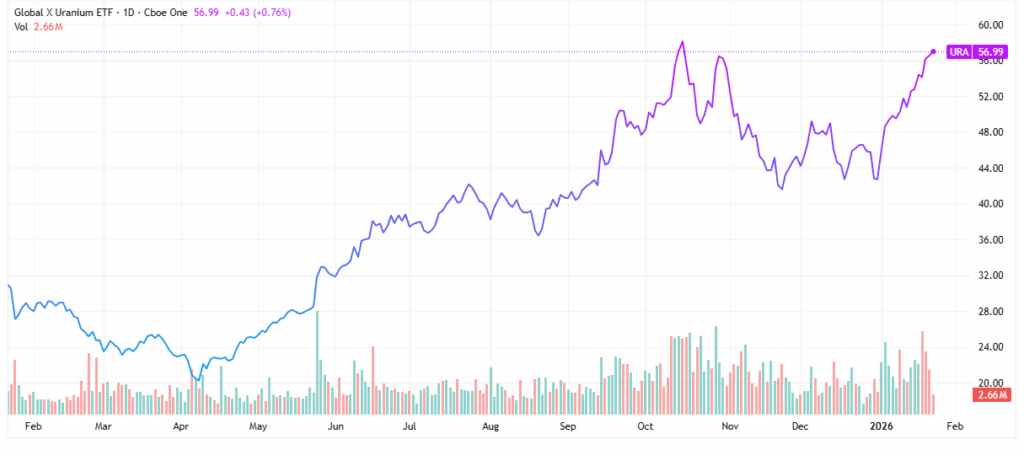

Global X Uranium ETF (URA)

With an expense ratio of 0.69%, the Global X Uranium ETF (NYSEARCA: URA) provides broad exposure to companies involved in uranium mining, exploration, refining, and nuclear component manufacturing. The fund holds roughly 50 uranium-related stocks, offering diversification across geographies and business models.

Top holdings include Cameco Corp., NexGen Energy (NYSE: NXE), Uranium Energy Corp. (NYSEAMERICAN: UEC), Paladin Energy (OTCMKTS: PALAF), Denison Mine (NYSEAMERICAN: DNN), and NuScale Power (NYSE: SMR). After a period of consolidation, URA appears oversold relative to the improving fundamentals, which could make it attractive to investors looking to position ahead of renewed momentum.

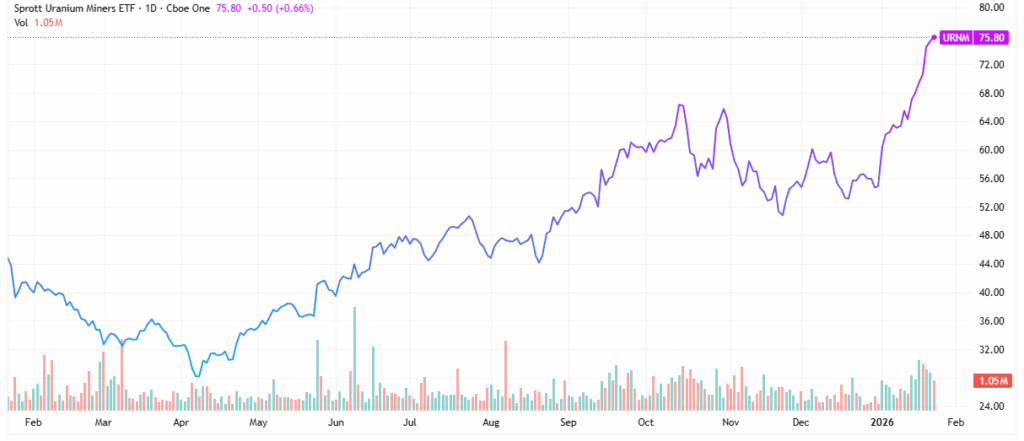

Sprott Uranium Miners (URNM)

With an expense ratio of 0.75%, the Sprott Uranium Miners ETF (NYSEARCA: URNM) offers a more concentrated and leveraged play on uranium prices. The fund invests primarily in uranium miners but also holds physical uranium, giving investors direct exposure to the commodity itself.

Top holdings include Cameco Corp., Paladin Energy, Denison Mines, Uranium Energy Corp., Deep Yellow Ltd., Yellow Cake PLC, and Ur-Energy. For investors who are bullish on uranium prices and comfortable with higher volatility, URNM provides a more aggressive way to express that view.

Bottom Line for Investors

Between policy support, rising AI-driven energy demand, and a structurally tight supply market, uranium is re-emerging as one of the most compelling long-term energy investment themes. President Trump’s renewed push for nuclear power could act as an accelerant, drawing fresh capital into the space and reshaping how the market values uranium stocks.

For investors willing to tolerate volatility, uranium ETFs like URA and URNM offer diversified exposure to a sector that may be entering the early stages of its next major upcycle.

Leave a Reply