Alphabet (NASDAQ:GOOGL) may be many things but undervalued isn’t one of them. Right now, GOOGL stock changes hands for over 32 times trailing year earnings, more than 29 times forward earnings and over 10 times sales. These metrics stand well above their respective ratios from one year ago, raising concerns about a pullback.

Table of Contents

So far, the market has responded positively to the tech juggernaut that owns the massive Google ecosystem. Since the beginning of January, GOOGL stock moved up over 5%. In the trailing 52 weeks, the security shot up over 65%. Of course, with so much positive news likely baked in, the natural tendency is for investors to trim exposure.

The upcoming fourth-quarter earnings report may be the spark that sets everything in motion. Wall Street analysts are looking for earnings per share to hit $2.62 on revenue of $104.67 billion. In the year-ago quarter, Alphabet posted EPS of $2.15 on revenue of $96.47 billion. This performance beat the earnings estimate of $2.13 but slightly missed the sales target of $96.67 billion.

Coincidentally, the Q4 print of 12 months ago represented the last time Alphabet failed to deliver a clean report. While it’s impossible to say with absolute certainty what may transpire, it does appear that analysts are generally optimistic about GOOGL stock, particularly as the underlying company shifts its artificial-intelligence protocols into higher gear.

Now, truth be told, I’m not the biggest fan of earnings season because of the highly kinetic disruption that can materialize. That said, a careful interpretation of the options market and the structural data of GOOGL stock may be pointing to a surprisingly bullish outlook.

How the Volatility Skew for GOOGL Stock Signals Opportunity

Before placing a trade, market participants should consider the volatility skew of optionable securities. This screener shows the implied volatility (IV) — which is basically the level of expected kinesis — for various strike prices on the same expiration date. For GOOGL stock, puts feature much higher IV relative to calls on strike prices south of the current spot price for the Feb. 20 options chain.

What’s going on here? Traders are likely buying downside insurance, which is why the premiums for put options — which provide holders the right to sell the underlying security at the listed strike price — have soared. Fundamentally, the protective posture makes sense because of the impressive performance of GOOGL stock. At any moment, it’s possible that a sharp devaluation may occur, perhaps due to a shock catalyst.

Adding to this narrative, puts also carry a premium on strike prices above the spot price. Again, this dynamic underscores the primary motif: the smart money is prioritizing downside protection over upside speculation.

At first glance, the strong presence of puts from the volatility skew implies fear — and fear doesn’t exactly seem like a great emotion for bullish investors. Ironically, though, it could be the supporting structure that helps GOOGL stock march higher.

First, while the volatility skew indicates fear, it does not indicate panic; otherwise, you would see actual selling. The fact that the negativity is concentrated in put activity rather than a rush for the exits tells you that the smart money is, well, being smart about their optimism. It’s quite clear that they see value in the AI story — the story that the Q4 earnings report could further illuminate. It’s just that they also want protection.

Second, fear may be a positive for GOOGL stock because it allows the bulls to sustainably nibble on capital appreciation rather than to gobble it. It’s the latter action that typically sparks the reflexive move to panic out of a hot position. That’s not to say that GOOGL stock can’t fall from here because it can. However, we have some confidence that the upside is controlled and disciplined.

Narrowing Down the Search for Efficiency

Based on the current volatility metrics and accounting for days to expiration, the Black-Scholes model for the Feb. 20 options chain is signaling a forward dispersion between $305.26 and $357.08. Essentially, this range represents where prices may fall if they landed symmetrically within one standard deviation from the spot price. Stated differently, 68% of the time, GOOGL stock by Feb. 20 should land between $305 and $357.

On paper, that’s great information because we now have a solid understanding of where the battlefield’s parameters are. However, most retail traders are on the debit side, which means that they pay a premium for the right to speculate on events that have yet to materialize. Therefore, the problem of the above dispersion is that it’s incredibly wide — nearly 8% in either direction from spot and a gap of just under 17% between the two prices.

You can see the problem. If you buy a long straddle type of investment (such as an iron condor), you would pay a debit to “attack” both a bullish and bearish target. That’s a double premium, and if you’re wrong on the trade, you’ll end up with a massive principal loss. So, we need to find a way to narrow the above dispersion, and that’s where the Markov property comes into play.

Markov claims that the future state of a system depends solely on the current state. Simply, this means that forward probabilities will change based on the context of the present environment.

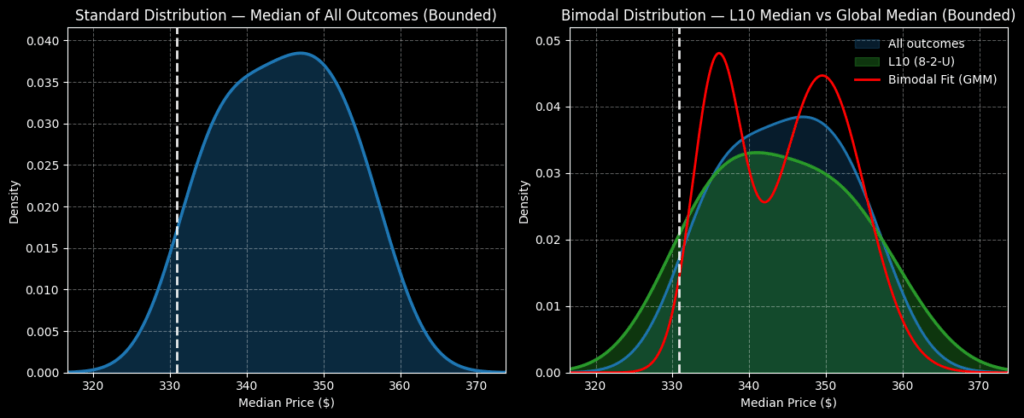

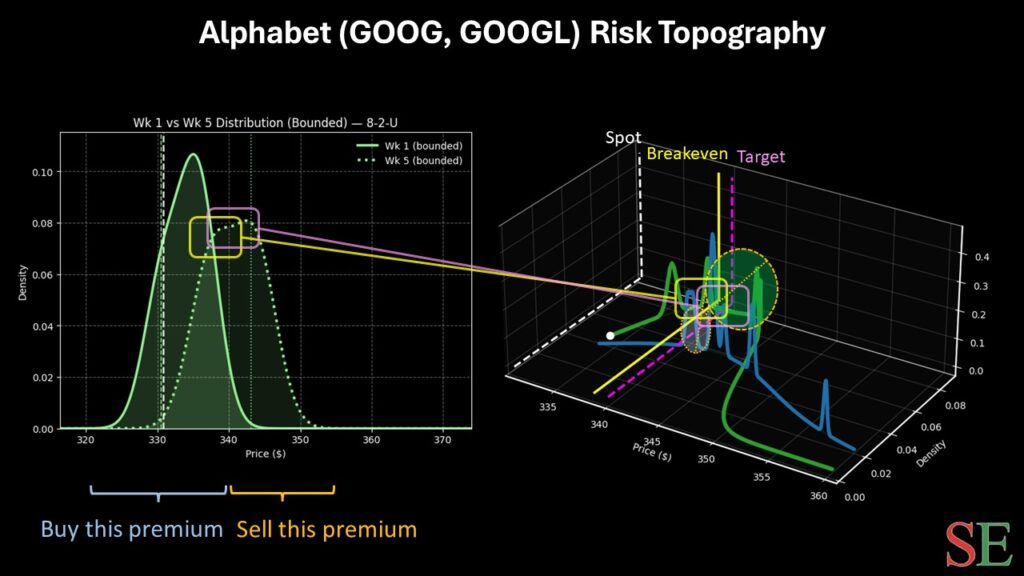

For GOOGL stock, it’s entering the field of battle having printed eight up weeks in the last 10 weeks, creating an upward slope. Under this 8-2-U sequence, GOOGL will be expected to range between $310 and $380 over the next 10 weeks, with probability density peaking between $335 and $350. That brings the addressable gap down to 4.5% between the two prices.

Over the next five weeks, GOOGL stock would likely trade between $330 and $350, with probability density peaking at around $343. Now, we have a clear target to zero in on.

Letting the Data Do the Heavy Lifting

One little gift that volatility skew has provided is that, on a relative scale, GOOGL stock is actually underpriced. That’s because with so many traders buying downside protection, the IV for GOOGL calls is comparatively low. We may take advantage of that.

Right now, traders can buy the 337.50/340 bull call spread expiring Feb. 20, 2026, which requires a net debit of $120 (the most that can be lost). Should GOOGL stock rise through the second-leg strike ($340) at expiration, the maximum profit would be $130, a payout of over 108%. Breakeven lands at $338.70.

For this trade to be fully profitable, GOOGL would only need to rise less than 3% from Thursday’s close. That’s a realistic target based on both technical and fundamental momentum. It’s just that the payout is unusually generous because of the fear premium. However, this opens the door to a compelling contrarian trade.

Leave a Reply