Waste Management (NYSE:WM) might not be the most exciting name in the market but it could be one of the most consequential. When the self-explanatory services specialist discloses its fourth-quarter earnings report on Jan. 28 after the ringing of the closing bell, all eyes will be on WM stock. In an indirect manner, Waste Management, more than most other entities, can provide real-time insights into the wider economy.

Table of Contents

Fundamentally, the company sits at the intersection of consumer and industrial activity, pricing power and cost pass-through. That’s because the underlying business tracks physical economic throughput, as waste volumes correlate with commercial activity, construction, manufacturing and consumer spending. So long as businesses are producing, building and selling, waste gets generated. If activity slows down, these volumes flatten or decline.

In addition, Waste Management offers a critical clue regarding inflation reality. To be sure, the company commands strong contractual pricing and escalation clauses. Nevertheless, it still faces costs related to labor, fuel and regulations. Therefore, if the services giant can raise prices and maintain profit margins, such a dynamic implies that inflationary pressures are being absorbed by the economy.

On the other hand, if margins compress or pricing stalls, this circumstance may signal that demand elasticity is finally biting. Therefore, the specific details of the financial print, along with the market’s response to the WM stock, offer a much more substantive gauge of inflation.

For Waste Management specifically, Wall Street analysts will be looking for earnings per share to hit $1.95 on revenue of $6.39 billion. In the year-ago quarter, the company posted EPS of $1.70 on revenue of $5.89 billion. Both figures missed the consensus targets of $1.80 and $5.91 billion, respectively, thereby raising the stakes for WM stock moving forward.

Still, it should be noted that Waste Management is off to a solid start to the new year. Since the January opener, WM stock has gained more than 4%. Interestingly, the options market may be pointing to additional upside ahead.

How the Smart Money is Positioned Optimistically in WM Stock

Before you start jumping into a trade, it’s important to consider the parameters of the battlefield. This broad market intel is provided by the Black-Scholes model, which is Wall Street’s standard mechanism for pricing options. There’s a lot of mysticism involved with this system, so I’ll break it down for you.

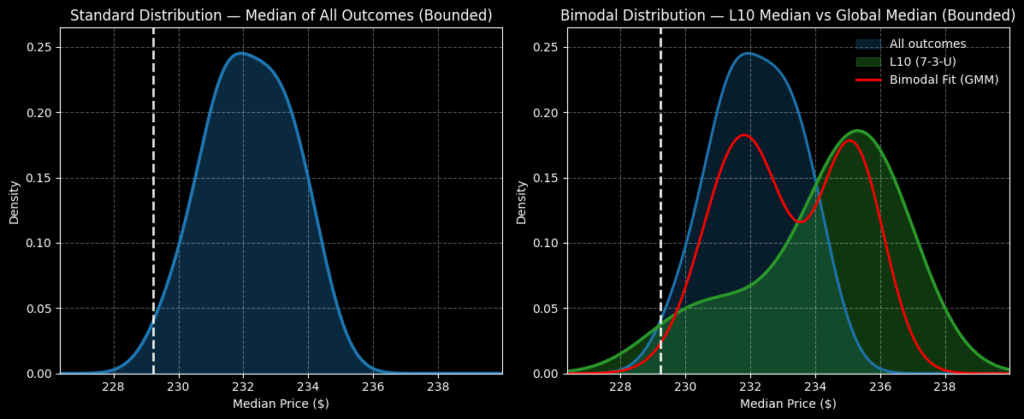

Essentially, Black-Scholes is a formula that assumes stock prices form a lognormal distribution. By this logic, an analyst can integrate volatility and days to expiration of a select options chain to extract a likely range of forward outcomes that symmetrically fall within one standard deviation of the spot price.

For example, the above formula states that for the Feb. 20 options chain, WM stock will likely land between $219.33 and $236.71. This dispersion represents a 3.81% high-low spread relative to the spot price of $229.23 (Friday’s close).

Without getting bogged down by the math, the Black-Scholes model is saying that 68% of the time, we would expect WM stock to fall between roughly $219 and $237 on Feb. 20. While it’s possible that WM stock could fall outside this range, that would mean that the move would be greater than one standard deviation — and such a bold forecast would require hefty evidence.

Although the above insights are meaningful, we’re still left clueless as to any bias implemented by smart money traders. That’s where volatility skew becomes an important screener. This dataset identifies implied volatility (or the expected kinesis of a security) across various strike prices for the same expiration date. With WM stock, call IV stands above puts throughout the pricing spectrum for the Feb. 20 options chain.

What’s the significance of this volatility skew? First, the deep in-the-money (ITM) calls suggest synthetic long ownership of WM stock among institutional investors. It’s possible that these participants prefer the flexibility or leverage of options rather than outright ownership. Second, and perhaps more significantly, derivative market traders are exposed to the possibility of an outsized performance.

Quantitatively, this exposure may be quite prudent.

Sifting Through the Noise with a Second-Order Analysis

To recap, the options battlefield for the Feb. 20 expiration date suggests an approximate dispersion of WM stock of between $219 and $237. Further, we know from volatility skew that the smart money is net bullish. However, being smart doesn’t necessarily translate to being prescient. To get a better understanding of where WM is likely to end up, we need to conduct a second-order analysis using the Markov property.

Under Markov, the future state of a system depends solely on the current state. That’s a fancy way of saying that forward probabilities shouldn’t be calculated independently but that influencing context should be taken into account. To use a simple sports analogy, a 20-yard field goal attempt in football is considered a guaranteed three points. Add the context of snow, wind and playoff pressure and the odds will likely change — and quite dramatically.

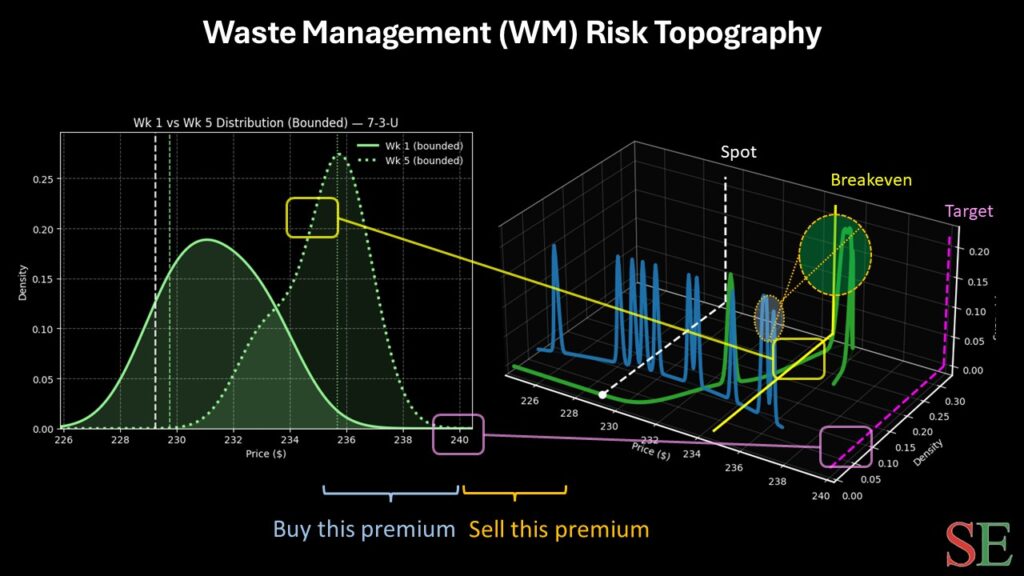

For WM stock, the current context is that, in the last 10 weeks, the security printed seven up weeks, leading to an overall upward slope. Under this quant signal, the forward 10-week returns would likely range between $226 and $240, with probability density likely peaking around $235. Over the next five weeks, WM would probably range between $230 and $240, with density peaking around $236.

In effect, we now have a much narrower range to target, allowing us a more reasonable speculative profile. Based on the market intelligence above, the most reasonable trade may likely be the 230/240 bull call spread expiring Feb. 20. This trade would require WM stock to rise through the second-leg strike ($240) at expiration. If it does, the payout would stand at 115%. Breakeven would land at $234.65.

Closing Notes About Waste Management Stock

Primarily, we would be targeting the 230/240 bull spread using the principle of statistical induction. By observing how WM stock responds to the 7-3-U sequence, we are anticipating that a similar dynamic will materialize. If so, the most realistic outcome would likely make the aforementioned spread a compelling speculative proposition.

That said, please be aware that induction has its limits — there’s really no law that states that WM stock must act in accordance with established conditional behaviors. Also, because IV is heightened for calls through the Feb. 20 strike price spectrum, bullish exposure will not be cheap.

In other words, being optimistic about Waste Management isn’t a contrarian position; it’s actually the expected posture among the pros. So, while WM stock might not be the most exciting trade, it is arguably a smart one.

Leave a Reply