Procter & Gamble (NYSE:PG) may soon be in the crosshairs of anxious investors for cynically favorable reasons. A consumer goods investment, PG stock typically offers market participants a safe but boring entity for portfolio management. However, this banal thesis has become a critical one amid a volatile combination of broader economic pressure and a brewing geopolitical conflict over U.S. control of Greenland.

Table of Contents

Understandably, the global equity markets stumbled badly amid the Trump administration’s aggressive tactics, particularly the threat of tariffs on key European partners. While the pugnaciousness should not be ignored, it’s worth reminding ourselves of the so-called TACO trade, a meme that stands for “Trump Always Chickens Out.” As unorthodox and imprudent as this approach may be, it appears to be part of the president’s strongman aura that he has carefully cultivated.

Of course, because the lack of diplomatic nuance harkens back to an anachronistic paradigm, President Trump’s rhetoric has effectively sparked robust demand for safe havens. One such expression could come in the form of PG stock. While its overall performance was disappointing last year, P&G generally offers stable returns, along with a solid 2.88% dividend yield.

For the upcoming Jan. 22 disclosure for the fiscal second quarter, Wall Street analysts will be looking for earnings per share of $1.86 on revenue of $22.29 billion. In the year-ago quarter, P&G posted EPS of $1.88 on revenue of $21.88 billion. These figures modestly beat expectations calling for EPS of $1.86 and a top-line print of $21.59 billion.

Overall, while analysts lean bullishly on PG stock, the assessment is quite mixed. Some experts don’t anticipate much movement in the security in either direction following the results, while others believe a decent print — stemming from demand for everyday goods following the holiday shopping surge — could see PG march higher.

Here’s the technical reality. With PG stock down 9% in the past 52 weeks, in addition to increased safe-haven demand, the chances of upside seem plausible. In addition, the options market could also be signaling optimism.

Laying Out the First-Order Battlefield for PG Stock

To get an idea of how much kinetic potential PG stock may generate, it’s useful to consider implied volatility (IV), which is a residual metric derived from actual order flows. As expected, IV for the Jan. 23 options chain is relatively elevated at 45.73%. By contrast, for the next monthly options chain expiring Feb. 20, IV sits at only 21.5%.

Using the Black-Scholes model — Wall Street’s standard mechanism for pricing options — the expected high-low spread for the Jan. 23 options chain is 3.06% relative to the current spot price of $147. Generally, though, I prefer analyzing a longer time period.

For the Feb. 20 options chain, the expected high-low spread stands at 4.66%, which translates to a lower price target of $139.67 and an upper target of $153.33. Now that we have a dispersion based on anticipated volatility, we need to clarify whether this forecasted distribution is optimal or not.

At first glance, these expected move calculators appear insightful, and they are to an extent. They provide the parameters of the battlefield. That said, it may not be the most efficient use of capital to chase after the underlying outcomes.

From a debit-side trader’s perspective, you are paying a premium for the right to speculate on events yet to materialize. So, if you have a wide dispersion, your costs will also be wide if you attempt to trade the entire distribution. However, if you have good reason to believe that certain outcomes will be more probable than others, you have an incentive to only focus on likely scenarios.

Stated differently, most options-related financial content leads up to Black-Scholes as the answer. As a matter of fact, Black-Scholes is the question. If you want the answer, you must turn to the Markov property.

Graduating to a Second-Order Analysis

In football, a 20-yard field goal attempt — especially in the professional iteration — is practically a guaranteed three points. However, this high success ratio could quickly fall down the order when other factors, such as cold weather, harsh winds and playoff pressure are thrown into the mix. At that point, nothing is guaranteed.

What is the point of mentioning this? As any sports fan inherently recognizes, context changes everything. Under the Markov property, the future (behavioral) state of a system depends only on the current state. Basically, if you want to know what may happen tomorrow in the market, you can’t just have a one-size-fits-all formula like Black-Scholes. Instead, you need to consider today’s market context.

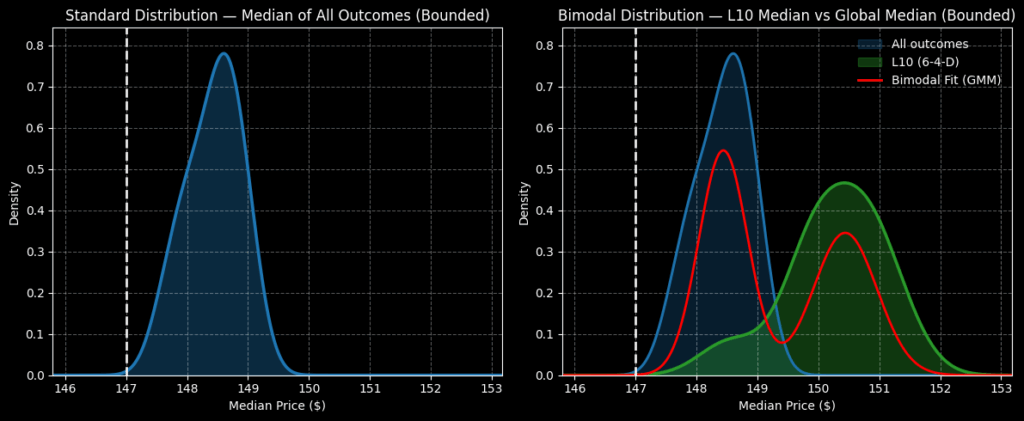

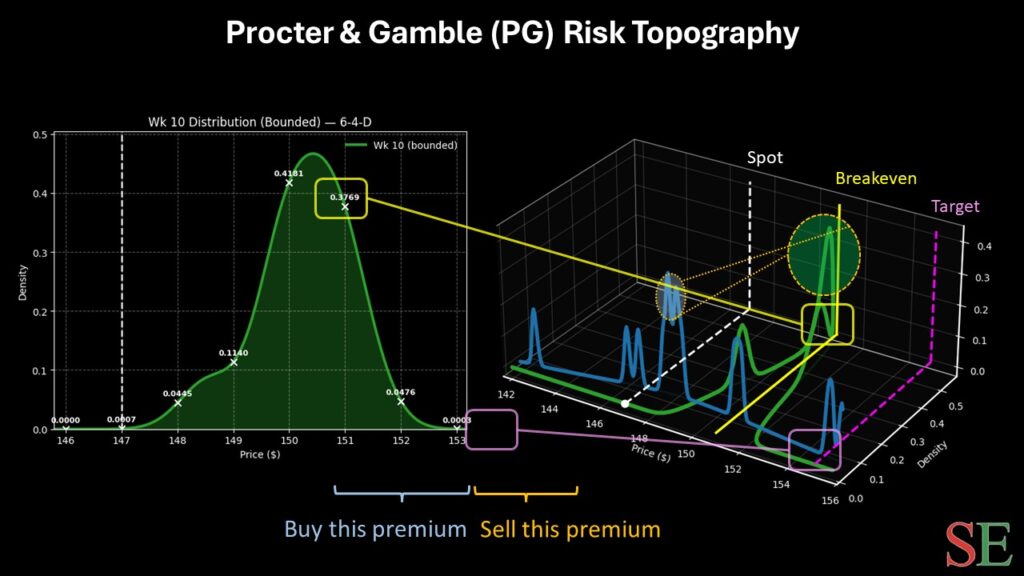

Let’s look at PG stock. In the trailing 10 weeks, PG stock printed six up weeks, but with an overall downward slope. This unusual contrast — which I have abbreviated as the 6-4-D sequence — will likely spark a different forward outcome than had any other sequence flashed.

Using past analogs going back to January 2019, when the 6-4-D sequence flashes, the forward 10-week outcomes would typically range between $147 and $153 (assuming a spot price of $147, Tuesday’s close). Probability density would likely peak between $150 and $151.

Looking out five weeks ahead (which approximately coincides with the Feb. 20 options chain), forward outcomes would likely cluster in a slightly tighter range between $148 and $153, with probability density peaking at $151.

You can clearly see the beauty of the Markov property. With just Black-Scholes, we had a range for PG stock between about $140 and $153. That’s the equivalent of saying the stock could go up or it could go down — brilliant insight, right? With Markov, which is effectively an analysis of an analysis, we’re targeting a much tighter spectrum.

Trading Ideas to Consider

With the way that market makers are currently structuring risk, there are two trading ideas that potentially stand out. First, the 148/150 bull call spread expiring Feb. 20 appears enticing. This wager requires a net debit of $110 for the chance to earn a profit of $90 should PG stock rise through the second-leg strike ($150). Breakeven lands at $149.10, making this a contextually credible call spread.

However, the payout of just under 82% might not be to everyone’s liking. For an enhanced opportunity, bold contrarians may opt for the 149/155 bull call spread. This trade requires PG stock to rise through the $155 strike at expiration. If so, the maximum payout would clock in at 212.5%.

Of course, hitting such a lofty target over the next five weeks is awfully ambitious. What does add to the overall credibility is the breakeven price, which comes in at $150.92. Basically, this aligns with peak probability density under 6-4-D conditions.

With any luck, a stronger-than-expected earnings report could see PG stock reach for the higher prices of the forward distribution. Ultimately, it’s going to come down to personal risk tolerance.

Leave a Reply