Some enterprises may be too relevant to brush aside indefinitely, and cybersecurity specialist Palo Alto Networks (NASDAQ:PANW) may represent one of the clearest examples of such accolades. True, providing digital security infrastructure isn’t exactly the sexiest business model, not with artificial intelligence dominating the business ecosystem. However, it’s the rise of the machines themselves that makes PANW stock so compelling.

Table of Contents

Fundamentally, cybersecurity represents a line item on the corporate expense sheet that cannot be underserved. All it really takes is one bad data breach to nuke a hard-earned reputation — not to mention the loss of customer trust and heightened regulatory scrutiny. Even worse, cybercriminals are becoming increasingly adept at breaching defenses. And for all its benefits, gen AI would expand the scale and scope of critical vulnerabilities.

It’s also fair to point out that Palo Alto Networks isn’t the only name in cybersecurity. With competition heating up, the company finds itself in challenging waters. With broader economic headwinds weighing on sentiment, PANW stock hasn’t been the strongest performer, gaining less than 13% in the past 52 weeks. For context, the S&P 500 gained more than 19% during the same period.

Nevertheless, the rising sophistication of cybercrime cynically necessitates digital security. Therefore, while Palo Alto may not be the most riveting business, it happens to be one of the most important enterprises. For investors, there’s a long-term case to be made. At the same time, options traders may have an enticing opportunity with PANW stock.

Pushing Upstream into the Informational Space

As a rule of thumb, anytime you place a wager in the market — especially in the options arena — you should assume that you’re operating from a disadvantage. No matter how smart you are, so long as you are classified as a retail market participant, you will always be downstream of pretty much everything.

By the time actionable information gets to your screen, the intelligence has already been filtered down through multiple institutional layers. Even expert opinion — which by nature is a downstream construct — has likely been first disseminated to privileged investors. Unless you are an institutional entity, you are always last to know.

To be blunt, when it comes to access, there is really no way to go upstream. However, this doesn’t mean that you’re forever doomed to be trading with one hand tied behind your back. The fact of the matter is, nobody knows what tomorrow will bring. Therefore, any assertions about tomorrow are never neutral.

Of course, Wall Street can’t just throw its hands up in the air and plead ignorance. Subsequently, market makers will use formulations derived from the Black-Scholes model as a first-order approximation of forward risk pricing. It’s from this model that options-related probabilities come from. However, what’s important to keep in mind is that these probabilities are presuppositional.

Essentially, they’re probabilities relative to a normally distributed world that the Black-Scholes model has created. In this paradigm, risk is calculated monotonically; that is, risk rises in proportion to the target price’s distance away from the spot price. To use a football analogy, a 50-yard field goal represents a much more difficult proposition than a 30-yard attempt.

However, in certain game situations, it’s possible that a 30-yard kick may be more difficult than a 50-yarder. For example, a kicker may have extreme difficulty in a massive crosswind and would prefer a longer attempt in a clean environment.

The problem for market makers is that they can’t just price risk in an unorthodox way for some securities and not for others. Fortunately, the retail trader has no such restrictions and is free to price risk however they want.

My hypothesis, ultimately, is that PANW stock options are incorrectly priced — and bullish speculators may potentially take advantage of this dynamic by going upstream the information space.

Exploiting a Pricing Mismatch for PANW Stock

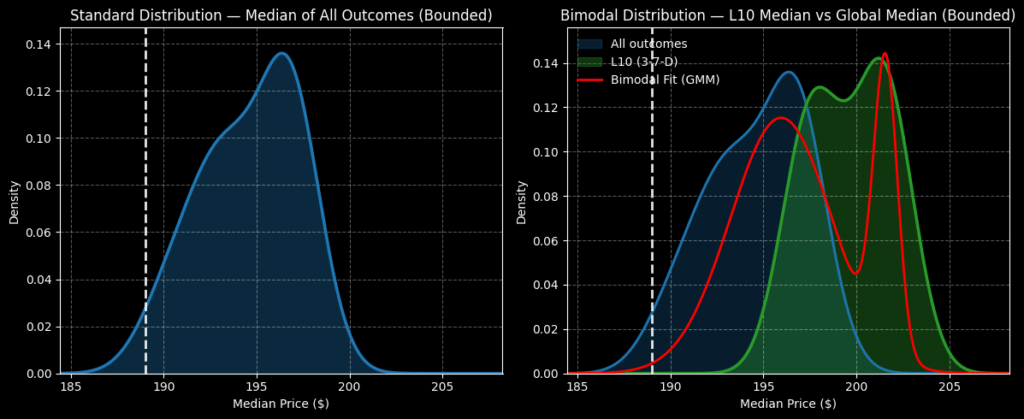

As one of the most relevant players in the broader tech ecosystem, it shouldn’t come as a surprise that PANW stock enjoys an upward bias. Looking at the security from a hierarchical perspective, past historical data going back to January 2019 reveals that a random 10-week position held in PANW would land between $185 and $202 (assuming a spot price of $189.02).

However, we’re not interested in trading Palo Alto stock for its aggregate behavior but rather the statistical response to its current quantitative structure. In the last 10 weeks, PANW printed only three up weeks, leading to an overall downward slope. Typically, investors may consider this setup to be unusually risky as it implies that the bears have control. Still, under this framework, PANW tends to resolve upward over the next 10 weeks.

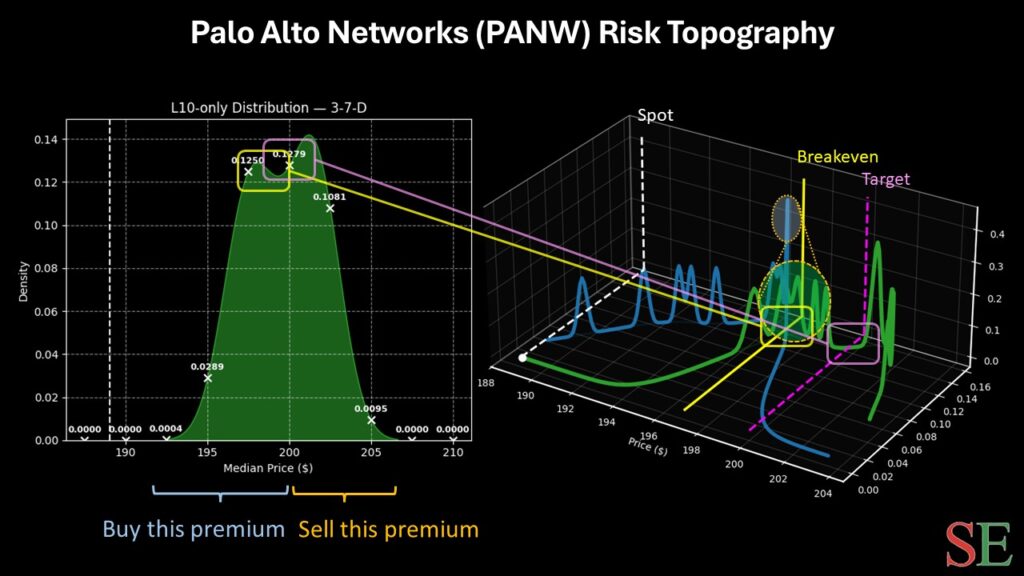

Specifically, after the 3-7-D (three up, seven down, downward trend) sequence flashes, Palo Alto stock would be expected to land between $193 and $207. Moreover, probability density would likely peak around $200. What’s even more fascinating, probability decay between $200 and $205 would sharply accelerate. As such, it would make sense to cap off debit-based exposure around the $200 mark.

Looking at Black-Scholes-derived options calculators, the chance that PANW stock will reach $200 by the Feb. 20, 2026, monthly expiration date would be 31.42%. However, a hierarchical model isolating for the response to the 3-7-D sequence shows that a landing spot of $200 is contextually realistic. It’s not a moonshot bit of speculation as the Black-Scholes model implies.

Basically, Wall Street prices risk as a function of distance to the current spot price. However, it has not been proven that PANW stock’s behavioral patterns can be best described by a lognormal, parametric calculation. In my best estimation, the 31.42% figure that Wall Street is calculating is overly pessimistic.

As such, I would be a buyer of PANW stock — but only up to a certain point.

Targeting a Sensible Trade for Palo Alto Stock

Given the market intelligence above, the trade that comes off as the most appealing (in my opinion) is the 195/200 bull call spread expiring Feb. 20. This trade requires PANW stock to rise through the second-leg strike ($200) at expiration. If it does, the maximum payout would clock in at 150%. Breakeven sits at $197, adding to the trade’s probabilistic credibility.

To be sure, there are higher-strike spreads that offer much bigger payouts. However, the expected distribution of PANW stock outcomes reveals a sharp drop in probability density beyond the $202 price point. Therefore, cutting off upside exposure at $200 makes plenty of sense.

Leave a Reply