McCormick & Co. (NYSE: MKC) failed to impress investors when it reported earnings on Jan. 22. At the market close on Jan. 23, MKC stock was down 9.3% in the last five trading sessions. The stock is now trading at 2019 levels and may be oversold. Still, with consumers still facing the pinch of higher prices, 2026 may be a year when MKC stock marks time.

Table of Contents

The report wasn’t awful, with a slight miss on earnings offset by a slight beat on the top line. And both numbers were higher on a year-over-year (YoY) basis. It makes sense. Consumers continue to find value by eating at home. That favors the company’s core spice business.

However, it comes down to the guidance, particularly the guidance having to do with earnings. The company said its gross margin in the quarter took a hit from higher-than-expected commodity inflation and additional tariff recognitions. The company expects both conditions to continue in 2026.

Earnings will also be under pressure from a higher effective tax rate, increased interest expense, ERP implementation costs that shifted into 2026, rebuilt incentive compensation, and elevated brand/digital investments.

Will Consumers Bear Higher Prices

McCormick announced plans to raise prices in 2026 as a way of offsetting some of these cost pressures. This will be a test of the narratives surrounding the U.S. economy.

Most economic indicators suggest that the U.S. economy is stronger than expected. The final read on third-quarter GDP came in at 4.4%. Consumer confidence is up, and the rate of inflation is holding steady below 3%, which is in line with the idea that the U.S. government is comfortable with an inflation target of 3% as opposed to 2%. Plus, the latest jobs numbers, while still showing softness, also hint at improvement.

On the other hand, the spike in gold and silver prices, geopolitical concerns, and an activist executive branch in Washington create an uncertain environment for consumers. It’s not a data-driven metric, but for many consumers and investors, the economy just feels off.

That’s important to McCormick because it falls into the consumer staples category, but it faces competition, including house brands that may be more attractively priced.

All this is to say that it doesn’t feel like McCormick management is low-balling investors when it calls for earnings per share (EPS) growth between 1% and 4% in 2026.

MKC Stock May be Tasty for Income investors

The current consensus price target implies 21% upside for MKC stock. But as of this writing, analysts had weighed in on the low single-digit earnings growth forecast. Needless to say, MKC stock may be a tough buy for growth investors.

But it’s a different story for income investors. McCormick is a dividend aristocrat having increased its dividend payout for 38 consecutive years. The company extended that streak in its latest earnings report, increasing the dividend to 48 cents per share to 45 cents per share. That 6.6% increase was slightly below its three-year average but is more than double the current rate of inflation.

Dividends are never the only reason to buy a stock. But if you have an optimistic view of the economy in 2026, then it’s not hard to make a bull case for MKC stock. This is particularly true when the stock looks reasonably priced.

McCormick Stock Isn’t Overvalued

As of the market close on Jan. 23, MKC stock had a price-to-earnings (P/E) ratio of 20.7x and a forward P/E ratio of 19.7x. That’s a discount to the S&P 500 average of 27.6X.

But the S&P includes many of the top technology stocks. A better barometer is to compare MKC stock to its historic average. In that regard, the stock is trading at a discount of about 14.6%. The stock is also attractively priced compared to the average of consumer staples stocks of 22x by Yardeni Research.

Is MKC Stock a Hold or a Buy?

Analysts have been lowering their price targets for MKC stock since the earnings report. However, the new targets are above the stock’s closing price on Jan. 23, and, in many cases, are above the consensus price target of $73.64.

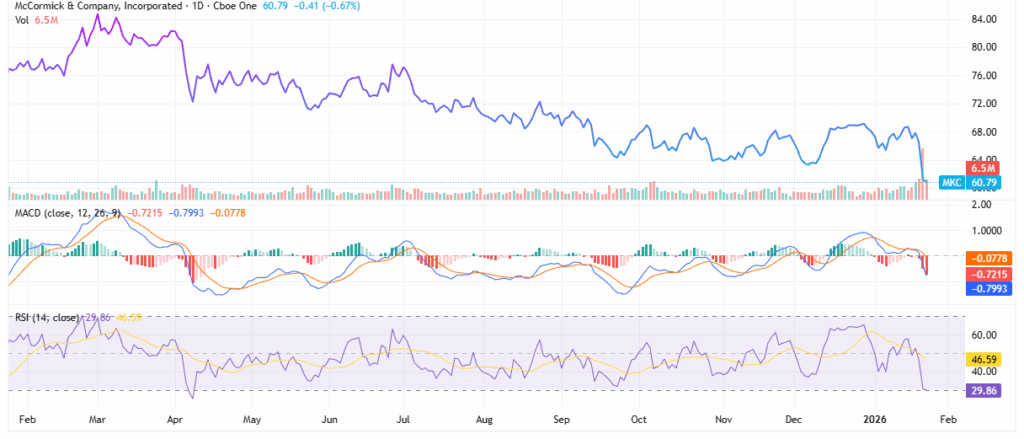

But that doesn’t change the fact that the MKC chart is ugly. The stock has been in a downtrend since 2022. And this latest move down is a setback to a stock that was trading in a defined range that may have been signaling a break to the upside.

From a technical standpoint, the MKC stock price has sliced below its 20- and 50-day simple moving average (SMA). However, the stock is now flashing oversold signals in both the MACD and the relative strength indicator (RSI), which sits at 29.

Adding to the oversold pattern, the stock has now dropped below its lower Bollinger band.

That said, the March 20, 2026, options chain for McCormick stock shows a lack of conviction. Put and call volumes are relatively low, and open interest is scattered, all of which argue against strongly bullish or bearish sentiment.

Good Story, But Many Headwinds

McCormick remains a high-quality consumer staples company, but 2026 looks like a transition year. Rising costs, cautious guidance, and an uncertain consumer backdrop limit near-term upside, even as the stock looks closer to fair value.

For income-focused investors, MKC’s dividend growth and defensive profile may justify patience. Growth investors, however, may want to wait for clearer signs that margins and earnings momentum are turning higher before stepping in.

Leave a Reply