Kimberly-Clark (NASDAQ:KMB) may not have the pizzazz of the latest innovator in the artificial intelligence ecosystem, yet its upcoming fourth-quarter earnings report will likely be incredibly consequential. As a consumer goods giant, Kimberly-Clark sits at the intersection of shopper demand, pricing power and cost inflation — and these factors are vital to policymakers and not just stakeholders of KMB stock.

Table of Contents

Fundamentally, the consumer goods manufacturer focuses on non-discretionary items. We’re talking about toilet paper, diapers, and cleaning products. People typically don’t trade down these products because they can’t. Instead, they adjust quantity and brand as a reflection of shifts in price tolerance. So, if Kimberly-Clark reports stable volumes and pricing, it implies that consumer demand is holding up, even under inflation and historically elevated interest rates.

Therefore, both the actual print and underlying management commentary will likely be meaningful for KMB stock, perhaps more so than any other economic cycle. For Q4, which is scheduled for release on Jan. 27, analysts are anticipating earnings per share of $1.64 on revenue of $4.1 billion.

In the year-ago quarter, Kimberly-Clark posted EPS of $1.50 on revenue of $4.93 billion. This was a mixed performance, with the company beating the sales estimate of $.86 billion but falling a bit short of the $1.51 EPS target.

Overall, Kimberly-Clark’s fiscal performance has been spotty, having been unable to deliver two consecutive earnings and growth beats since 2023. If there was any time to start a new trend, it would be now. Over the past five years, KMB stock is down roughly 23%, presenting a very disappointing case.

Still, as risky of a proposition as it is, the smart money seems to believe in the brand’s comeback potential.

How the Smart Money Laid Out the Battlefield for Kimberly-Clark Stock

Before engaging in any trade for KMB stock, you need to understand the parameters of the battlefield. That comes in the form of the Black-Scholes formula, which is Wall Street’s standard mechanism for pricing options. It’s far from perfect, and it may not even be particularly accurate. However, it offers a starting point for investigation.

Looking at the Feb. 20 options chain, the Black-Scholes-derived expected move calculator is projecting a wide dispersion between $95.59 and $108.39. This projected range represents a 6.28% high-low spread from the current spot price of $102.23 (Friday’s close).

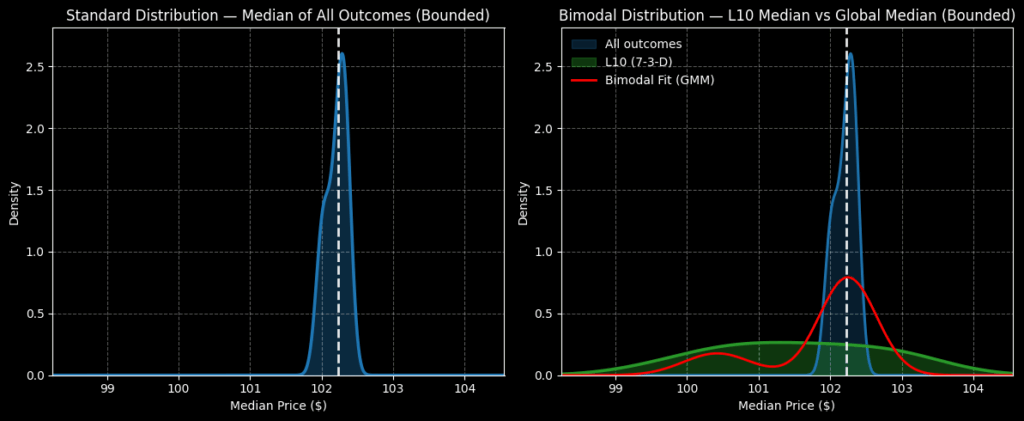

Without getting too bogged down with the math, Black-Scholes states that given the expected volatility and days to expiration of the selected options chain, a symmetrical split of prices one standard deviation away from the spot price should see the KMB stock price fall between roughly $96 and $102. In other words, 68% of the time, you would expect on Feb. 20 that KMB would be somewhere between the aforementioned range.

While that is important information, we’re still left clueless as to any other bias or context that could color the results. After all, the “probability of profit” that’s derived from Black-Scholes only makes sense if we assume that the model is the most accurate reflection of reality.

I contend that it is not. And this disagreement is the whole reason for analyzing the options market. Otherwise, if you believe everything that Black-Scholes says, then there is simply no point in attempting to find an edge (as there would be no inefficiency to exploit).

Now, to get a better understanding of how the smart money is positioned, we should consider volatility skew, which identifies implied volatility (expectations of kinesis based on actual order flows) at various strike prices for the same expiration date. In the case of KMB stock, for the Feb. 20 options chain, call IV is higher across most strike prices in the spectrum.

Essentially, this dynamic clues us into two behavioral elements. First, higher call IV at the low end of the pricing spectrum indicates potential synthetic long exposure to KMB stock rather than direct ownership. Second, and perhaps more significantly, call IV at the upper range stands well above put IV. This transactional framing suggests the smart money is prioritizing upside exposure, thereby adding a wrinkle to the upcoming earnings report.

A Second-Order Framework Requires Cautious Optimism

From the data that we have on hand, it appears that Wall Street’s pros anticipate that Kimberly-Clark may deliver a sizable earnings beat. If so, exposure to KMB stock would seem to make sense. However, there are two concerns to keep in mind.

First, because demand for out-the-money (OTM) calls is heightened (per the volatility skew that we just mentioned), the premiums for bullish trades are quite expensive. So, even though KMB stock is down over 19% in the past six months, that doesn’t necessarily make the security a discount in the options market.

As an aside, this is one reason why you need to conduct real analysis. While it’s tempting to label a sinking stock as a discount, the two descriptors — volatility and value — are not necessarily the same thing.

Notably, the premium tied to KMB stock call options becomes apparent when we apply a second-order analysis using the Markov property. Under Markov, the future state of a system depends solely on the current state. That’s a fancy way of saying that forward probabilities should not be independently calculated because context can easily influence the outcome.

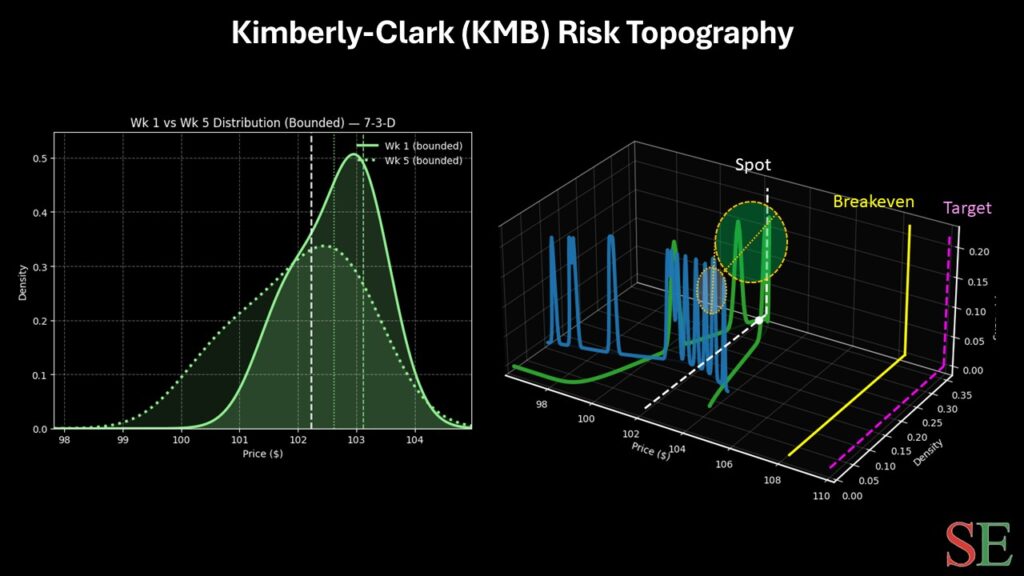

And what is the current context for KMB stock? In the past 10 weeks, the security printed seven up weeks, but with an overall downward slope. This is an extremely rare sequence, which would likely result in KMB ranging between $98 and $105 over the next 10 weeks. Over the next five weeks, the range would likely be modestly tightened to between $99 and $105.

What’s problematic, though, is that probability density would likely peak near the spot price before gravitating toward $101 over the next 10 weeks. In other words, the gravitational pull toward a higher resolution is statistically weak. Therefore, serious caution needs to be applied before betting on KMB stock.

Chasing Higher Expected Value Over Outright Probability

I’m going to be upfront: upside convexity for KMB stock is wildly expensive, even though most financial experts might claim that the security is on a discount because of its poor technical performance. Basically, what this means is that good money is chasing a bad bet.

I don’t want to pay too much for probability comfort. That’s why, if you are going to bet on KMB stock, I’d prioritize a higher expected value over outright probability. For the Feb. 20 options chain, you’d probably be looking at the 107/110 bull call spread.

In this case, the net debit is only $135, and you’ll be hoping that KMB stock rises through the second-leg strike at expiration. If so, that would translate to a profit of $165. Breakeven comes in at $108.35. However, you will be making this trade knowing that the upside stems from the Q4 earnings report.

Otherwise, both Black-Scholes and Markov suggest that the upside potential for KMB stock is limited.

Leave a Reply