Johnson & Johnson’s latest earnings report shows a mature healthcare giant acting more like a growth stock again, and investors are taking notice. In Q4 2025, Johnson & Johnson (NYSE: JNJ) delivered 9.1% reported sales growth to 24.6 billion, with operational growth of 7.1% and adjusted operational growth of 6.1%. Numbers like that should be your signal that the post-Kenvue transition phase is firmly behind the company.

Table of Contents

Quarterly GAAP EPS climbed to 2.10, while adjusted EPS rose 20.6% year over year to 2.46, matching consensus and underscoring the quality of the beat on revenue rather than accounting noise. For the full year, sales grew 6.0% to 94.2 billion and adjusted EPS increased 8.1% to 10.79, even after investment-heavy business development and a drag from Stelara biosimilar erosion.

J&J management described 2025 as a “catapult year,” powered by double‑digit growth from key oncology and neuroscience brands and accelerating MedTech momentum. At the same time, Johnson & Johnson issued 2026 guidance that points to another year of mid‑single‑digit operational sales growth and mid‑to‑high single‑digit EPS growth, outpacing many large‑cap peers while maintaining its dividend discipline.

For investors scanning big pharma for durable earnings and defensive growth, Johnson & Johnson’s earnings, guidance and stock price trend collectively argue that the long‑term bull case is intact – though not without risks.

Johnson & Johnson Earnings Show Broad-Based Growth and Resilience

The biggest takeaway from the earnings report is how broad‑based the growth has become across both Innovative Medicine and MedTech, even as legacy headwinds like Stelara intensify.

- Innovative Medicine delivered full‑year 2025 sales of about 60.4 billion, up 6% reported and 5.3% operationally, with 13 brands growing double digits and oncology and neuroscience leading the way.

- MedTech’s performance adds a second engine to the growth story. Full‑year 2025 MedTech sales reached roughly 33.8 billion, up 6.1% reported and 5.4% operationally, while Q4 sales of 8.8 billion grew 7.5% reported and 5.8% operationally.

The Innovative Medicine segment generated 15.8 billion in worldwide sales, up 10% reported and 7.9% operationally, despite an estimated 1,110‑basis‑point drag from Stelara erosion. Flagship drugs such as Darzalex, Erleada, Carvykti, Tecvayli, Talvey, Tremfya and Spravato all posted strong share gains and market expansion, offsetting pressure from older agents like Imbruvica and Zytiga and demonstrating that the growth portfolio is doing the heavy lifting.

MedTech’s growth was driven by electrophysiology, Abiomed’s Impella platform, Shockwave intravascular lithotripsy and new products across orthopaedics, surgery and vision, partially offset by volume‑based procurement pressure in China and the final stages of an orthopaedics transformation.

On the bottom line, enterprise‑wide adjusted EPS for 2025 grew 8.1% to 10.79 on 6% sales growth, implying margin leverage despite higher R&D spending of 14.7 billion and continued capital deployment for pipeline and platform expansion. That combination of diversified top‑line growth, operating discipline and active pipeline investment is the core of the earnings‑power story investors took away from this report.

2026 Guidance Signals Continued Sales and EPS Growth

For 2026, Johnson & Johnson guided to operational sales growth of 5.7% to 6.7%, corresponding to 99.5 billion to 100.5 billion in revenue, with adjusted operational sales growth of 5.4% to 6.4%. Reported sales are expected to grow 6.2% to 7.2% after a modest positive foreign‑exchange contribution, translating to estimated reported sales of 100.0 billion to 101.0 billion.

Management projects adjusted EPS of 11.43 to 11.63, implying 4.5% to 6.5% operational EPS growth and 5.9% to 7.9% reported growth, slightly ahead of current Street expectations even after absorbing “hundreds of millions” in impact from a U.S. drug‑pricing agreement and potential tariff‑related pressures. The company also expects at least a 50‑basis‑point improvement in adjusted pre‑tax operating margin and a tax rate in the mid-to-high teens, suggesting further operating leverage as newer launches scale.

JNJ Stock Technical Analysis: Trend, Support Levels, and Price Targets

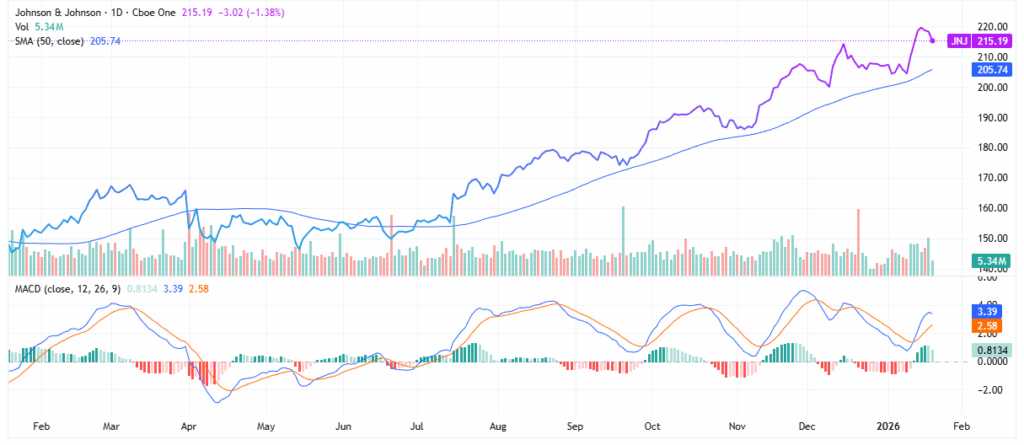

From a technical perspective, JNJ shares have quietly transitioned from a defensive laggard to a leadership‑quality healthcare name over the past year. The daily chart shows the stock advancing from the mid‑160s in early 2025 to the low‑220s in early January 2026 before a modest pullback to around 215, leaving JNJ still well above its rising 50‑day simple moving average near 206.

This rising intermediate trend line, combined with the series of higher highs and higher lows since mid‑2025, indicates that the primary trend remains bullish despite near‑term volatility around earnings. The MACD on the daily chart has recently turned up from the zero line after a brief negative crossover, and the histogram has shifted back into positive territory, hinting at renewed upside momentum after the post‑earnings dip.

For bullish investors, a common approach would be to treat the 50‑day moving average and the 205–208 zone as a potential buy‑the‑dip area, with an initial upside target near the recent high around 220 and an extended target in the 230s if sentiment around the 2026 guidance and pipeline milestones remains supportive.

A tighter, swing‑trading stance might place a stop just below 200, where the prior consolidation base from October–November 2025 sits, acknowledging the risk of a deeper retracement toward the 200‑day moving average if broader markets weaken. Bears, on the other hand, may look for a failed retest of the 220 level or a decisive close below the 50‑day moving average as a signal that the uptrend is tiring, particularly if accompanied by a MACD rollover and expanding volume on down days.

In that scenario, short‑term traders could target a move back into the high‑190s to low‑200s, where multiple prior price pivots cluster and valuation would reset closer to historical averages.

Possible Contradiction to the Bull Case

The most obvious challenge to the bullish narrative is that Johnson & Johnson’s growth remains partly at the mercy of external forces, just as its valuation has re‑rated higher. On the policy front, the company is absorbing “hundreds of millions” in annual impact from U.S. drug‑pricing agreements and faces continued scrutiny over pricing, reimbursement and potential tariff changes that could pressure both Innovative Medicine and MedTech margins.

The Stelara erosion curve—modeled on Humira’s path—remains a meaningful overhang in immunology, and additional patent cliffs plus looming generic competition for Opsumit and Simponi could weigh on segment growth if newer launches underperform expectations. Litigation, including the long‑running talc overhang, also represents a non‑trivial tail risk to cash deployment flexibility and investor sentiment.

Is Johnson & Johnson Stock a Buy After Strong Earnings and Guidance?

Johnson & Johnson’s latest earnings report reinforces the view that this is no longer just a defensive dividend name but a diversified healthcare compounder with credible mid‑single‑digit growth and a deep innovation pipeline. The combination of strong 2025 execution, above‑consensus 2026 guidance, double‑digit growth from key oncology, neuroscience and MedTech platforms, and a disciplined capital allocation framework supports a constructive long‑term stance for investors willing to ride through episodic policy and litigation headlines.

Technically, the stock’s uptrend and supportive momentum indicators provide a reasonable backdrop for buy‑on‑weakness strategies, while the valuation reset of the past year and ongoing macro and policy risks argue for position‑sizing discipline and clear risk management. For investors across experience levels, JNJ’s latest quarter tilts the risk‑reward balance toward patience and selective accumulation rather than aggressive trading or outright pessimism.

Leave a Reply