Tesla Inc. (NASDAQ: TSLA) remains one of the market’s most debated names, and its latest Q4 2025 results reaffirm why Tesla stock is a favorite of retail investors. In its quarterly update, the company continued to show that it’s more than a car company, emphasizing progress in areas such as autonomous driving, AI, and robotics. The report highlights measurable progress on Full Self‑Driving (FSD) and the Optimus humanoid robot platform. Both pillars reinforce CEO Elon Musk’s vision of Tesla as an AI‑driven manufacturing and technology leader rather than simply an EV maker.

Table of Contents

Yet despite this momentum, the market’s reaction has been subdued. Tesla’s Q4 figures show a business still navigating compressed automotive margins, cautious global demand, and execution challenges tied to scaling complex new initiatives. Analysts broadly view Tesla stock as fairly valued at current levels, given both its optionality in autonomy and robotics and the near‑term headwinds that could cap upside. The duality of visionary promise and operational strain will continue to define the investment case in 2026.

Autonomy Takes the Driver’s Seat

Tesla’s biggest near‑term technological milestone is its evolving Full Self‑Driving (FSD) platform. During the quarter, the company reported meaningful adoption growth for FSD subscriptions and expanded beta testing in international markets. Management cited more than 2 billion cumulative FSD miles, paving the way for what it calls “supervised autonomy.” The Q4 deck showcased progress in end‑to‑end neural network training. That’s further evidence that Tesla continues to invest heavily in AI infrastructure, labeling compute, and Dojo‑based model optimization.

However, the commercial payoff remains uncertain. While the company expects notable software margin leverage over time, regulatory limitations prevent true full autonomy in most markets. Nevertheless, Tesla’s shift toward subscription‑based software revenue could reshape its earnings profile, much as the iPhone’s app ecosystem redefined Apple’s. If FSD achieves broad adoption, it could transform Tesla stock’s valuation from cyclical auto manufacturing to high‑margin AI platform pricing.

Optimus: A Growing Bet on AI Robotics

Few developments in the Q4 update symbolized “more than a car company” better than Optimus, Tesla’s humanoid robot. The presentation included footage of Optimus prototypes performing real‑world factory tasks—folding fabrics, sorting components, and manipulating delicate materials without teleoperation. This progress suggests Tesla’s neural network training and vision systems are translating beyond the automotive domain.

Musk suggested limited internal deployment of Optimus within Tesla’s manufacturing network in 2026, potentially driving efficiency gains. While commercialization remains speculative, Optimus represents an entirely new product category leveraging Tesla’s AI stack, mechanical engineering, and battery expertise. The broader implication is a diversification narrative: if Optimus scales, Tesla could emerge as a leader in general‑purpose robotics—a market analysts estimate could exceed $100 billion globally within a decade.

Still, execution challenges mirror those of autonomy: software reliability, manufacturing complexity, and regulatory frameworks must all align before revenue impact materializes.

Phasing Out Two Models Signals Focus

Tesla’s update deck confirmed it will sunset two legacy models, the Model S and Model X, to streamline production and prioritize next‑generation architectures. Although these vehicles helped build Tesla’s early premium brand identity, their volume now accounts for less than 5% of total deliveries. Consolidating manufacturing capacity frees resources for newer platforms like the next‑gen compact vehicle and Cybertruck ramp‑up, and it allows Tesla to direct capital toward energy products and AI‑driven development.

This may disappoint purists, but the move aligns with Tesla’s shift from niche luxury toward mass‑scale technology integration. The long‑term margin impact depends on how efficiently these freed resources are redeployed.

Where Bulls May Still Be Right

Skeptics argue that the valuation of Tesla stock already discounts its core EV growth. Yet bulls highlight that Wall Street repeatedly undervalues transformational platforms until their economics become undeniable. If FSD or Optimus gain traction, Tesla could evolve into a royalty‑style software and robotics provider with far higher operating leverage than today’s hardware margins suggest. Furthermore, few competitors integrate AI, energy, and manufacturing ecosystems as cohesively.

For long‑term investors, excessive caution could mean missing early exposure to two potential trillion‑dollar markets—autonomous mobility and robotics. Tesla’s proven capacity to scale complex technologies argues for at least partial conviction, even amid volatility.

Technical View: Tesla Stock Consolidating Before the Next Move

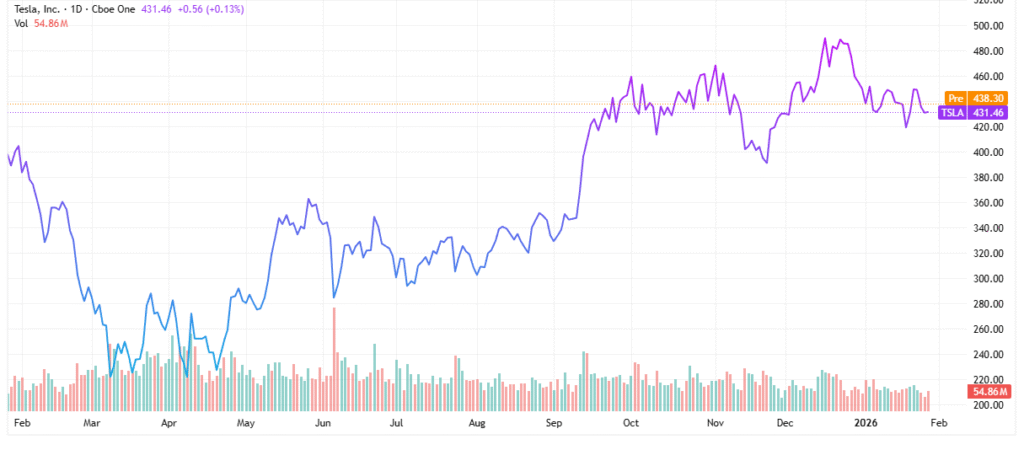

Tesla stock has been in a strong uptrend over the past year, with shares now consolidating just above the 430 level after briefly trading above 500 earlier in January 2026. The rising pattern of higher highs and higher lows from the spring 2025 bottom confirms persistent institutional demand, even through bouts of volatility.

The recent pullback from the 500 area looks more like a digestion phase than a reversal, as volume has cooled rather than spiked in a climactic selloff. From here, a sustained breakout above the prior high could open a path toward the 525–550 zone, while the area around 400 stands out as near‑term support that would need to hold to keep the bullish technical structure intact.

Some Final Thoughts on Tesla’s Outlook

Tesla’s Q4 2025 update reinforces that it’s no longer just an electric vehicle company but an emerging force in AI, autonomy, and robotics. Its progress in FSD and Optimus could eventually reshape its revenue profile and justify higher long‑term valuations. Yet execution risk remains high, from regulatory hurdles to the technical complexity of mass‑scaling autonomy and humanoid robots.

For now, Tesla stock appears fairly valued—balanced between visionary potential and near‑term uncertainty. Investors betting on Tesla today are effectively backing its AI future rather than its current automotive earnings power.

Leave a Reply