Mastercard (NYSE:MA) stock isn’t what you call a favorably mispriced options opportunity. If we’re being completely honest with each other, It’s structurally inefficient — and unfavorably so from the perspective of the debit-side retail trader. Because of the uncertainties clouding the card payment and financial services provider (at least in relation to the broader economy), exposure to Mastercard shares is hedged.

Table of Contents

I love sports analogies because they help simplify complex subjects. If we think of the options market in football terms, MA stock has extra blockers on the strong side of the formation. Subsequently, the defense recognizes this formation and also has defenders plugging potential holes in the strong side. Therefore, if a run does materialize in that direction, no one is going to be caught by surprise.

To be clear, the presence of extra defenders on the strong side does not mean the play won’t be successful; it’s just that it won’t be a free-flowing contrarian swing. Instead, the ball carrier is going to have to generate some “tough” yards. That’s the opportunity we have available in MA stock.

Specifically, the hedging makes Mastercard stock expensive in volatility terms. Probabilistically, I still believe there’s upside to be extracted and I’ll share the reasons why.

Earnings Could Provide a Nice Surprise

From a narrative perspective, Mastercard’s fourth-quarter earnings report could provide a positive surprise, helping to enliven sentiment. Since the start of the year, MA stock has been down nearly 9%. Investors have had to digest plenty of jitters regarding the broader economy, from elevated prices (inflation) to the higher-level concerns associated with the Trump administration’s tariffs.

Still, nothing can boot up the economic blue screen of death quite like a positive earnings report from an economic bellwether. Here, the track record should help in the confidence department.

For the Jan. 29 disclosure, Wall Street analysts are looking for earnings per share of $4.22 on revenue of $8.76 billion. In the year-ago quarter, the financial services giant posted EPS of 3.82 on revenue of $7.49 billion, beating out the consensus view of $3.69 and $7.38 billion, respectively. More importantly, going back to January 2021, Mastercard has never failed to beat on both the top and bottom lines.

That’s not to say that the trend can’t be broken. However, it’s important to keep in mind that, despite the poor technical performance, the fundamental print has been impressive.

Volatility Skew Tells the Tale for MA Stock

Where Mastercard gets a little tricky is in the volatility skew. This screener showcases implied volatility (IV) or the target security’s expected kinetic outlook across the strike price spectrum for a specific expiration date.

In the case of the Feb. 20 expiration date, IV for put options is mostly priced higher throughout the entire dispersion relative to call IV. This dynamic tells us two things. First, the far out-the-money (OTM) puts appear to imply downside insurance. Second, the deep in-the-money (ITM) puts suggest a mechanical synthetic short position, possibly to protect actual long exposure to MA stock.

However, call IV also curves upward toward the upper price boundaries, possibly inferring a dampened long exposure. Either way, what’s clear about Mastercard stock is that the smart money is directionally agnostic. They have the optionality to enjoy upside if it materializes but they’re also hedged to the hilt if the corrective cycle continues.

What does that mean for debit-side traders? Basically, both bullish and bearish convexity are expensive due to the elevated IV. In other words, traders are paying for insurance against downside and upside risk. Even so, the ultimate move in the near term may be to the positive end of the spectrum.

Diving into a Second-Order Analysis for Mastercard Stock

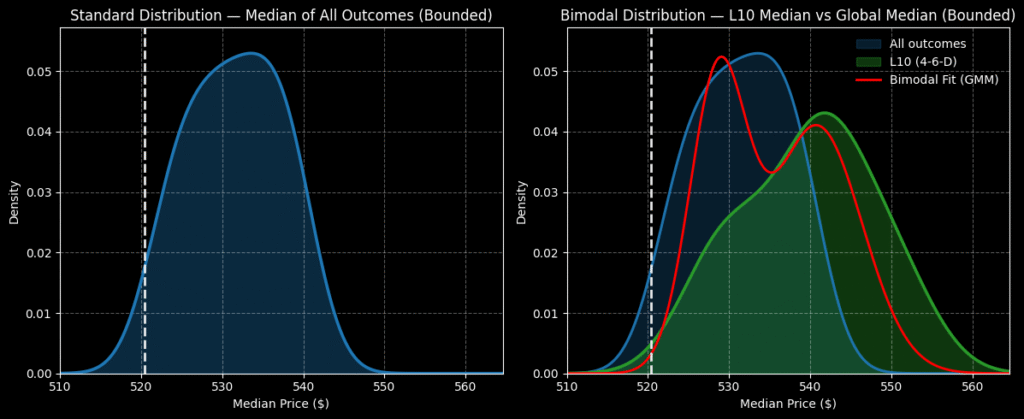

According to the Black-Scholes-derived expected move calculator, MA stock would be projected to land between $494.88 and $546.86 for the Feb. 20 options chain. This swing represents a 4.99% high-low spread from the current spot price.

Without getting bogged down by the math, Black-Scholes answers where a security may symmetrically land one standard deviation away from the spot price (when accounting for volatility and days to expiration). In other words, in 68% of cases, MA stock should range between approximately $495 and $547 at the end of Feb. 20.

While the above dispersion is insightful because it provides the parameters of the battlefield, it’s not very instructive in terms of likely outcomes. We have a list of possibilities rather than a list of probabilities. That distinction matters from a debit-side perspective because we must pay for the right to speculate on forward outcomes yet to materialize.

Therefore, if we covered every inch of a wide dispersion, we would risk running out of money. Instead, like a search-and-rescue team, we need to narrow our focus radius. We can do that through a second-order analysis via the Markov property.

Under Markov, the future state of a system depends solely on the current state. That’s a fancy way of saying that forward probabilities should not be independently calculated but rather assessed taking into account context. To use a simple football analogy, a 20-yard field goal is an easy chip shot. Add snow, wind and playoff pressure and these odds may change dramatically.

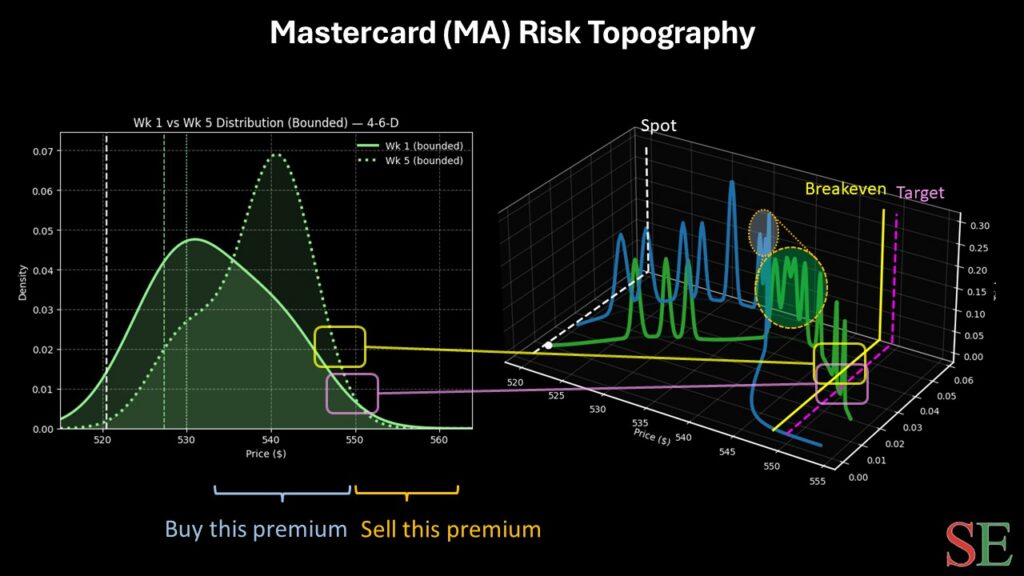

For MA stock, the current context is that in the trailing 10 weeks, the security printed only four up weeks, leading to an overall downward slope. Under this 4-6-D sequence, the forward 10-week returns should range between $510 and $565, with probability density peaking around $543.

What’s fascinating is that there’s not much material change expected in terms of median probability densities over the next five weeks. Therefore, the area around the $540 price point may be a statistical sweet spot for the bulls to take aim at.

The Trade to Consider

While there are several ways to express bullishness for MA stock, the one idea that stood out to me was the 547.50/550.00 bull call spread expiring Feb. 20. This wager is quite aggressive, requiring MA stock to rise through the second-leg strike ($550) at expiration to trigger the maximum payout of 138%. The breakeven price is also elevated at $548.55.

So, why bother with this trade? First, the $550 strike price is within the realistic range of the 4-6-D sequence’s forward distribution. I’m straight-up betting that a positive earnings print can help rejuvenate sentiment more robustly than usual. Second, it’s one of the nominally cheapest spreads available.

Sure, there are more probabilistically sensible call spreads that you can buy. However, because of the hedging dynamics that I shared earlier, you’ll notice that the net debits are typically very expensive, starting from around the $400 to $500 range.

With the aforementioned spread, you’re looking at a net debit of $105 for the chance to earn $145. In my opinion, that’s a much more sensible risk-reward profile.

Leave a Reply