Delta Air Lines (NYSE:DAL) recently released its earnings results for the fourth quarter, delivering a mixed read that ultimately sent DAL stock lower in the open market session on Tuesday. Investors will likely take some encouragement at the carrier’s overall financial performance, though near-term options traders may be tempted to consider a bearish position — albeit only temporarily.

Table of Contents

Regarding the print, Delta posted adjusted earnings per share of $1.55, beating out Wall Street’s consensus view of $1.53. However, on the top line, the airliner only managed to generate $14.61 billion, which missed expectations calling for $15.80 billion. Fortunately, management did have some good news to share, which may have mitigated some of the disappointment.

For the first three months of 2026, Delta has forecasted an increase in sales of as much as 7%. Further, adjusted earnings may land between 50 cents per share and 90 cents per share, well above the 72 cents per share anticipated by analysts.

Despite a mixture of data, investors took to the exits, leading to a 2.39% loss for DAL stock. As management admitted, Delta is sitting atop a so-called “K-shaped” economic recovery, meaning that top-line growth has been concentrated among higher-spending consumers. In theory, that should be a win for Delta, as travel isn’t exactly a pursuit of the underprivileged.

Unfortunately, K-shaped recoveries are also fundamentally problematic, especially in the aftermath of artificial intelligence. To make a long story short, the simultaneous productivity enhancement and the disruption of AI mean that while the K-shape’s upper arm is longer, it’s also thinner due to fewer participants.

Over time, that’s a sustainability concern — and it does seem that the market is responding to that risk. As such, there’s reason for both investors and traders to be cautious about DAL stock.

No Such Thing as Independent, Objective Truth in the Market

I’m going to share something that puts me at odds with 99% of the financial publication industry: there’s no such thing as independent, objective truth in the market. While this statement sounds nihilistic, it’s one of the most liberating concepts one can absorb. It’s also the point where, ironically enough, true knowledge of the market begins.

Invariably, if DAL stock continues on its descent, analysts will argue that the carrier is undervalued. However, you should be aware that this concept cannot be independently verified in the abstract. Undervaluation in this context only means a discount relative to an assumption, but nobody knows if that assumption will hold true or not.

Similarly, traders will turn to options-focused calculators to find Delta’s potential forward dispersion. In recent years, “expected move” calculators have grown popular in the finpub space as they supposedly provide statistical intelligence of potential kinesis. However, these calculators — and the “probability of profit” metrics that they spit out — are based on assumptions built from the Black-Scholes formula.

To be sure, the math undergirding Black-Scholes is elegantly brilliant and internally consistent. But just because a formula is elegant and consistent does not mean that it correctly describes reality. In fact, Black-Scholes is guaranteed not to be correct.

You don’t need to be a mathematical wizard to understand the key epistemological concern. Black-Scholes, of course, is Wall Street’s standard mechanism for pricing options, but it’s also a one-size-fits-all solution. So, whether you’re modeling risk for semiconductors, apparel manufacturers or airliners, the underlying derivatives are priced via this standardized formula.

When options-related content leads up to the Black-Scholes-derived probability of profit as the punchline, I can’t help but laugh. That’s where the analysis begins, not where it ends. When you embrace the non-existence of independent truth in the market, you free yourself from the presumptions of Black-Scholes or any other templated methodology.

Instead, we will let the data — the one that is specific to DAL stock — do the talking.

Finding ‘Truth’ in the Structure of DAL Stock

If a theist is ever to convincingly deliver objective evidence of a deity, it will almost certainly come in the form of a hierarchical framework. Mainly, that’s because there’s no one linear proposal — such as the fine-tuning argument — that neatly and logically concludes the existence of a higher power.

By the same logic, there’s no one financial metric that explains the behavior of a public security. That’s why fundamental, technical and even quantitative analysis should be taken with a grain of salt if the methodology is flat or single-layer. Instead, the only way that we can find “truth” — or at least as far as we can understand that concept in the market — is through hierarchical structure.

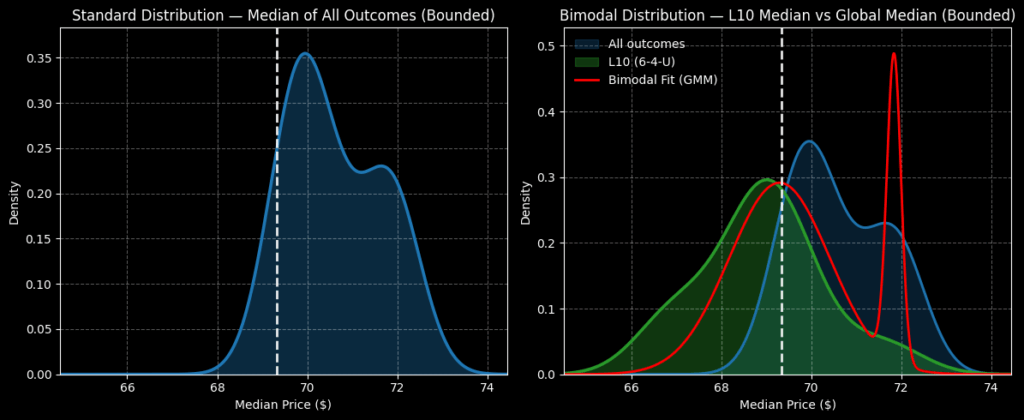

Using a dataset going back to January 2019, the forward 10-week returns of DAL stock would ordinarily land between $67 and $74 over the next 10 weeks (assuming a spot price of $69.33, Tuesday’s close). This demonstrates an upward bias as an aggregate behavior.

However, the market operates under a Markov property, meaning colloquially that the probability of tomorrow hinges on what happens today. Under a hierarchical framework, “today” can be defined as the current quantitative structure, where in the last 10 weeks, DAL stock printed six up weeks, leading to an overall upward slope.

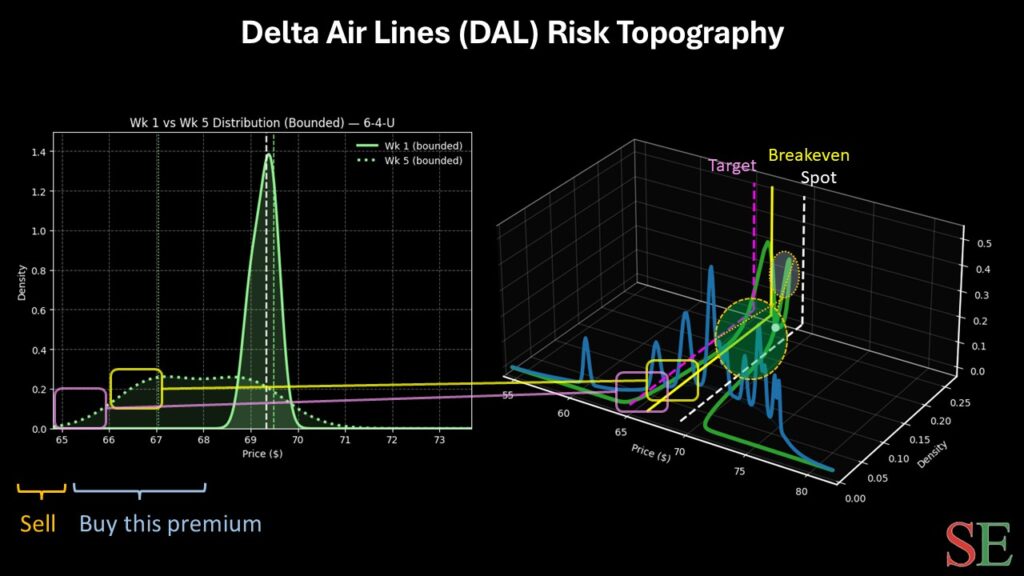

Under 6-4-U conditions, the forward 10-week returns of DAL stock could be expected to lean slightly bearish, with outcomes expected to land between $65 and $74. Further, probability density would likely peak at just below spot, thus presenting risks for bullish traders.

What’s really interesting is that on a fixed, five-week-forward framework, DAL stock risks landing between $65 and $72. Given the adverse response to Delta’s earnings, it wouldn’t surprise me at all for a bear put spread to be in play.

Taking a Potshot Against Delta Stock

To be clear, I’m not suggesting an extended negative position against DAL stock. I do believe that over the next several weeks, Delta can regain its mojo. However, in the immediate aftermath of less-than-stellar earnings results — combined with DAL gaining a strong 19.31% in the trailing six months — the security could face some turbulent weather.

With the hierarchical analysis pointing to a downward distribution before a reversion to the mean, a bearish position could be profitable.

It’s a highly ambitious trade, but the 67.50/65 bear put spread expiring Feb. 20, 2026, may be intriguing. This trade requires a net debit of $94, which is the most that can be lost. Should DAL stock fall through the $65 strike at expiration, the maximum profit would be $156 or a payout of nearly 166%.

Leave a Reply