FCX stock is back in the spotlight after Freeport-McMoRan (NYSE: FCX) reported its Q4 2025 earnings. The report highlighted the company’s leverage to two powerful themes: the electrification-driven copper supercycle and gold’s renewed role as a monetary hedge.

Table of Contents

The company reported solid fourth-quarter and full-year results, supported by healthy realized prices for copper and gold and continued progress on key growth and recovery initiatives, including the ongoing restoration of Grasberg mining and smelting operations. The report emphasized a wide 2026 Adjusted EBITDA range driven primarily by copper price assumptions, underscoring how incremental moves in the copper curve can quickly flow through to cash flow, capital returns, and balance sheet strength.

At the same time, Freeport’s portfolio retains meaningful gold exposure, largely as a byproduct of its large-scale copper operations, providing FCX stock with built-in diversification if industrial metals experience cyclical volatility. Copper is now formally designated as a U.S. “critical mineral,” and long-term demand is expected to rise meaningfully due to AI, data centers, energy transition, and defense modernization.

In short, Freeport-McMoRan is a central player in a tightening supply–demand backdrop. For investors, the latest update reaffirms FCX stock as a core vehicle for gaining exposure to both structural copper growth and the enduring appeal of gold.

The Debasement Trade is Alive and Well

Gold remains a strategic component of Freeport’s production mix, offering earnings diversification and downside protection during periods when copper prices or global growth disappoint. Many of Freeport’s long-lived copper districts, including its Indonesian operations, produce gold as a byproduct. This enhances project economics and helps smooth cash flows across commodity cycles. When gold prices are strong, byproduct credits help reduce unit net cash costs on copper, effectively boosting margins even if copper itself is range-bound.

From a macro standpoint, gold continues to benefit from persistent fiscal deficits, elevated sovereign debt levels, and geopolitical tension, all of which support investment demand from central banks and private investors. In that context, Freeport’s gold exposure functions as a built-in hedge within the broader copper-focused portfolio, giving FCX stock a degree of resilience that some pure-play copper producers lack. Over a full cycle, this combination can help stabilize free cash flow, supporting reinvestment in growth projects and potential capital returns to shareholders.

Why Copper May Be the Real Story

Even with a solid gold contribution, copper is clearly the centerpiece of Freeport’s strategy and valuation. The Q4 2025 earnings presentation highlights the company’s geographically diverse, long-lived copper assets and emphasizes that more than 65% of the world’s copper is used in applications that deliver electricity, positioning Freeport squarely at the heart of global electrification. Copper’s recent addition to the U.S. Geological Survey’s list of critical minerals reinforces the metal’s strategic importance and the potential for supportive policy and investment trends.

Demand-side projections draw on an independent S&P Global study led by Dan Yergin, which estimates that accelerating electrification could drive copper demand to roughly 42 million metric tons by 2040, about 50% above current levels. Four vectors—core economic growth, energy transition, the explosive expansion of AI and data centers, and defense modernization—are expected to underpin unprecedented copper demand, with copper acting as the essential conductor across each.

Against a backdrop of constrained new mine supply and challenging permitting regimes, Freeport’s existing production base, Grasberg recovery, and brownfield options at Bagdad, El Abra, and Safford/Lone Star provide meaningful leverage to any sustained uptrend in prices.

Risks to the Thesis

The bullish case for FCX stock is highly sensitive to copper and gold prices, and a reversal in either metal due to weaker global growth, China softness, or tighter monetary conditions would pressure earnings and cash flow. The 2026 Adjusted EBITDA range underscores this exposure, as relatively small shifts in realized copper prices can translate into multi-billion-dollar swings in EBITDA and free cash flow.

Operational risks are also present, including the complexity of safely restoring Grasberg mining and smelting operations, potential delays or cost inflation in growth projects, and ongoing challenges related to labor, energy, and logistics.

Regulatory, ESG, and community-relations risks add another layer of uncertainty, particularly in jurisdictions where permitting and environmental scrutiny are intense. Any material disruption—whether from technical issues, social license concerns, or policy changes—could impact volumes, costs, or timelines just as copper markets tighten, weakening the near-term investment case.

Technical Outlook

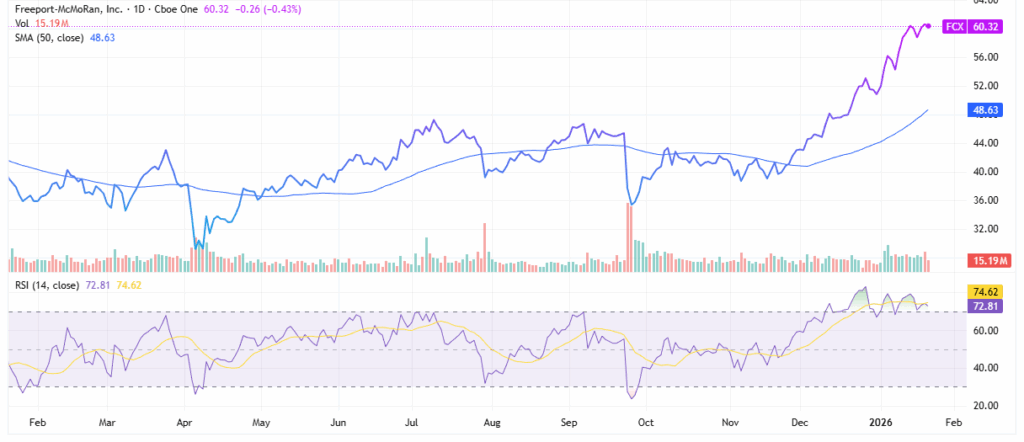

From a technical perspective, FCX stock is extended but still riding a strong uptrend, with price recently pushing into the low 60s and holding well above its rising 50-day simple moving average around the high 40s. The slope of that moving average has turned decisively higher since late November, confirming a transition from consolidation to a sustained advance rather than a short-lived spike. This suggests that dip buyers have been steadily supporting the stock on pullbacks, even as it probes fresh 52-week highs.

Momentum is elevated, with the 14-day RSI hovering in the low 70s after briefly pushing into overbought territory, a setup that often precedes either a sideways digestion phase or a modest retracement toward the rising 50-day line. Volume has been solid but not climactic during the recent run, implying accumulation rather than blow-off conditions, which may give bulls some confidence that the trend can resume after any near-term pause.

For investors with a longer time horizon, pullbacks toward the high 40s to low 50s—closer to the 50-day moving average and prior consolidation bands—may offer more attractive entry points, while shorter-term traders will likely watch for RSI to cool and price to hold those support zones before pressing new long positions.

The Final Word on FCX Stock

Freeport-McMoRan’s Q4 2025 earnings report presents a compelling blend of near-term execution and long-term optionality tied to electrification and monetary metals. The combination of large, long-lived copper assets, embedded gold exposure, Grasberg restoration, and a robust pipeline of brownfield growth projects positions the company to benefit if copper demand evolves as S&P Global and management anticipate.

For investors who can tolerate commodity and cycle risk, FCX stock remains a high-torque way to express a constructive view on copper, with gold and disciplined capital allocation providing an added degree of balance.

Leave a Reply