Rare earth stocks are moving from an obscure corner of the market to the center of a major geopolitical and industrial shift. For years, the U.S. has been overly dependent on China, which controls roughly 80% of the world’s rare earth supply. That reliance once seemed like a manageable trade-off. Today, that looks like a strategic vulnerability. As recent supply-chain shocks have shown, depending on a single country for critical materials is a risk the U.S. and its allies can no longer afford to take.

Table of Contents

Rare earths are not optional inputs. Without them, the global push toward electrification and advanced technology stalls out. Electric vehicles, millions of which governments want on the road, require rare earth magnets for motors and drivetrains. Smartphones, computers, flat-panel televisions, and digital cameras all rely on rare earth elements to function. Wind turbines use them for high-efficiency power generation, while semiconductors and computer chips need them to meet modern performance standards.

The implications go beyond consumer technology. Defense systems, guidance equipment, radar, and other advanced military hardware all depend on rare earth materials. Even the U.S. Department of Defense has warned that prolonged shortages could affect readiness and the production of critical warfighting systems. In other words, this isn’t just an economic issue; it’s a national security concern.

The good news is that the world is actively working to break its dependence on China. Governments are funding domestic mining, processing, and recycling efforts, while private companies race to build alternative supply chains. That shift is creating a powerful, long-term opportunity for investors willing to look closely at the rare earth stocks positioned to benefit from this global realignment.

Rare Earth Stocks #1: USA Rare Earth

USA Rare Earth (NASDAQ: USAR) is a development-stage critical minerals company focused on advancing a fully integrated rare earth element (REE) and lithium project in the United States. Its flagship asset is the Round Top deposit in West Texas, a large, polymetallic concentration of light and heavy rare earth elements, lithium and other co-products.

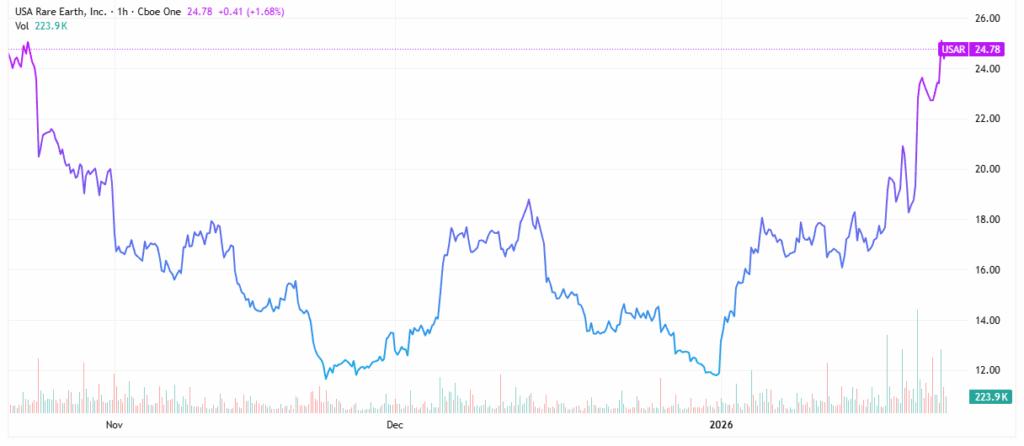

That illustrates the risk and the reward of USAR stock. The company is not profitable, nor is it generating revenue. Nevertheless, shares of are exploding higher, up over 70% in the 30 days ending Jan. 23.

Fueling that upside, the company just got a buy rating from analysts at Benchmark, with a price target of $15. Benchmark noted that USAR’s plans to construct a 1,600-metric-ton-per-annum oxide processing facility in Lacq, which is scheduled for commissioning in late 20, will help strengthen the supply chain for rare earth in Europe.

“The French government will provide substantial subsidies for the project, covering 45% of eligible equipment costs and €130 million for real estate expenses,” added Investing.com.

In addition, USAR just selected Fluor Corp and WSP Global as its Engineering, Procurement and Construction Management (EPCM) partners for its Round Top Rare Earth Project in Texas. “Fluor and WSP are key partners with the experience and expertise required to move Round Top toward commercial delivery,” said Alex Moyes, Vice President of Mining & Processing at USA Rare Earth, as noted in a press release.

“Their teams know how to deliver complex mining and processing projects, and that matters as we work to bring a secure, domestic supply of heavy rare earth elements, inclusive of yttrium, into production, along with critical technology metals such as hafnium, zirconium, and gallium.”

Rare Earth Stocks #2: MP Materials

MP Materials Corporation (NYSE: MP) operates as a vertically integrated producer of rare earth materials in North America. The company owns and manages the Mountain Pass Rare Earth Mine and Processing Facility in California, the only commercially viable rare earth mining and processing site in the United States

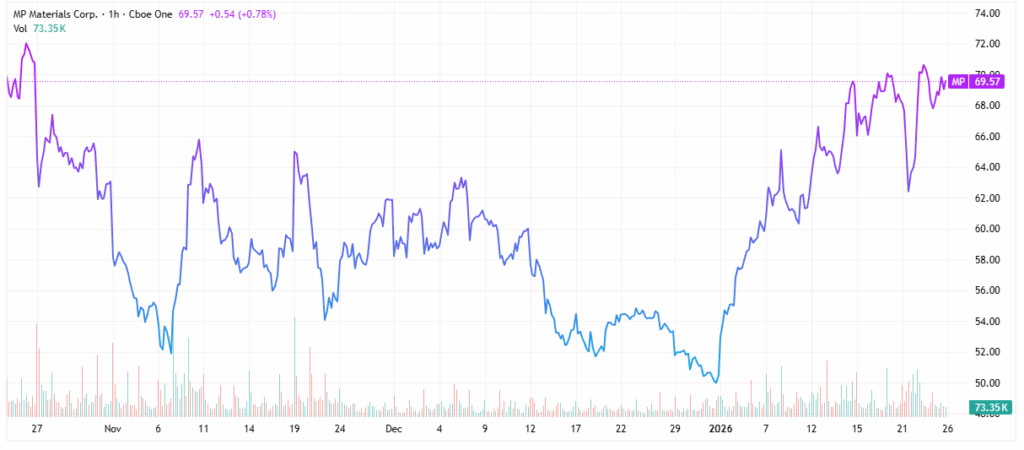

That means that, unlike USA Rare Earths, MP Materials is generating revenue. However, it’s not yet profitable. But like USAR, MP stock is off to a strong start in 2026, up 23% in the 30 days ending Jan. 23.

Analysts are taking notice. In fact, on Jan. 13, analysts at William Blair launched a buy rating for MP Materials (MP).

We also have to consider MP Materials has become a powerhouse stock after announcing a deal with the U.S. Department of Defense in July 2025, which would help accelerate the build-out of an end-to-end U.S. rare earth magnet supply chain and reduce foreign dependency.

As noted in a company press release, “Rare earth magnets are one of the most strategically important components in advanced technology systems spanning defense and commercial applications. Yet today, the U.S. relies almost entirely on foreign sources. This strategic partnership builds on MP Materials’ operational foundation to catalyze domestic production, strengthen industrial resilience, and secure critical supply chains for high-growth industries and future dual-use applications.”

Rare Earth Stocks #3: VanEck Rare Earth and Strategic Metals ETF

Of course, you may want exposure to rare earth stocks without choosing individual stocks. One of the most popular options for fund investors is the VanEck Rare Earth and Strategic Metals ETF (NYSEARCA: REMX).

With an expense ratio of 0.58%, the VanEck Rare Earth and Strategic Metals ETF (REMX) attempts to replicate the performance of the MVIS Global Rare Earth/Strategic Metals Index, which is intended to track the overall performance of companies involved in producing, refining, and recycling of rare earth and strategic metals and minerals. Some of its 30 holdings include MP Materials, Lynas Rare Earths, Albemarle, Pilbara Minerals, and Ganfeng Lithium.

A Long-Term Bet on Strategic Materials

Rare earth stocks aren’t a short-term trade driven by hype—they’re tied to structural changes in global supply chains. As the U.S. and its allies invest in domestic production to support EVs, clean energy, and defense systems, companies with rare earth exposure could see sustained demand growth. Whether investors prefer individual stocks like USAR and MP or diversified exposure through REMX, the theme offers a compelling way to invest in national security and next-generation technology.

Leave a Reply