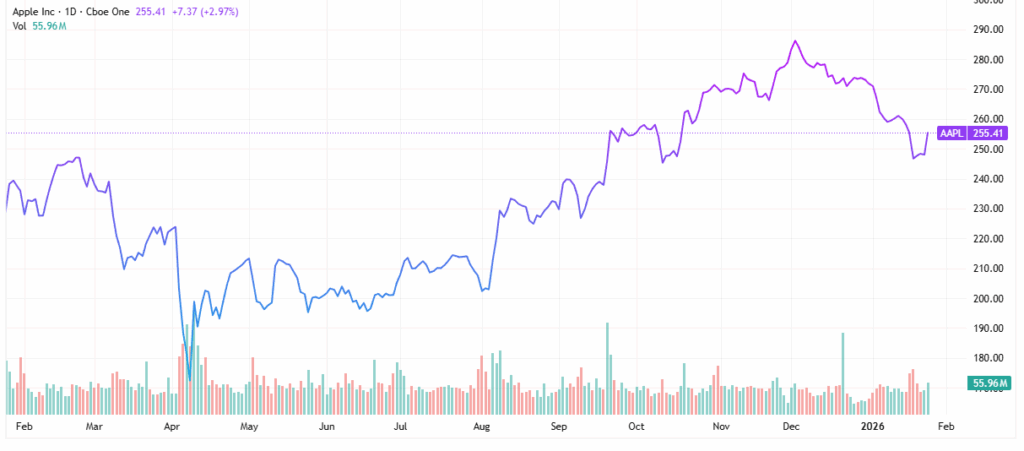

Apple Inc. (NASDAQ: AAPL) is running ahead of earnings on Thursday, after JPMorgan Chase & Co. (NYSE: JPM) boosted its price target on stronger iPhone demand.

Table of Contents

In fact, the firm reiterated its overweight rating on Apple and raised its price target to $315 from $305 ahead of Apple’s first-quarter earnings report on Thursday.

“We see a positive set up for the shares heading into F1Q26 (Dec-end) earnings print as AAPL shares are trading at 30x NTM (next 12 months) P/E, below the peak multiple that is typical for the shares heading into a key iPhone product cycle (previous peak of ~32x into 5G cycle), in combination with the modest upsides in relation to both F1Q26 print and the F2Q26 outlook,” added the firm, as quoted by CNBC.

One bullish analyst rating is good. Two is better, and three is a pattern. That’s the case with Apple.

Evercore ISI added Apple to its Tactical Outperform list, arguing that strong iPhone demand positions the company for strong earnings. The firm reiterated an Outperform rating and a $330 price target on Apple stock. Evercore expects iPhone revenue to climb 17% year over year, which would be well above calls for 11% growth.

Analysts at Citigroup Inc. (NYSE: C) say that the surge in demand for iPhone 17 models carried through the end of the year. The firm expects to see Apple beat earnings, thanks to the sale of 82 million iPhone units, which was ahead of consensus estimates.

Apple has a chance to move markets when it reports earnings on Jan. 29 after the market closes. However, you’ll also want to pay attention to these two stocks, which are also drawing bullish analyst attention.

Meta Platforms: Expectations for Confirmation of CapEx Spend

Meta Platforms Inc. (NASDAQ: META) has been rocketing higher heading into earnings on Thursday. The stock is up over 9% in the five trading days ending Jan. 26.

Analysts expect Meta to generate earnings of $8.29 per share, an increase of 3.4% from $8.02 per share reported year over year. For the current year, analysts forecast the company to report an EPS of $29.40, a 23.2% increase from $23.86 reported for FY 2024. EPS is expected to grow 4.2% year over year to $30.63 in fiscal 2026.

With this report, we’re looking for growth in its investments in data centers and hardware. That’s in addition to what it’s spending on R&D, which jumped about 50% over the last few years, as the company aggressively invests in artificial intelligence.

Analysts at Bank of America (NYSE: BAC) just reiterated a buy rating on the stock with an $810 price target. The firm expects fourth-quarter revenue of $59.2 billion and earnings per share of $8.27, above consensus estimates of $58.3 billion and $8.20, respectively.

For the first quarter of 2026, the firm expects revenue of $52.3 billion and EPS of $6.31, compared to Street expectations of $51.2 billion and $6.29. The firm anticipates Meta will guide to first-quarter revenue between $50 to $52.5 billion, representing 18 to 24% year-over-year growth.

Can PayPal Show That Growth is Strengthening?

In contrast to the first two names, PayPal Inc. (NASDAQ: PYPL) is limping into earnings, down just over 3% in 2026. The fintech giant won’t report this week, but it’s fourth-quarter 2025 earnings report, which will be released on Feb. 3, will be closely watched.

After four consecutive quarters of beating estimates, the company continues to attract attention. This time around, the company is expected to post EPS of between $1.29 and $1.34 on sales of about $8.76 billion, which would show modest year-over-year (YoY) growth.

For the full fiscal year 2025, the company is expected to post EPS of $5.36, up about 15% year over year. For fiscal 2026, EPS is expected to jump 9.3% year over year to $5.86.

However, there are concerns about slowing growth and competitive pressure. In fact, in the last reported quarter, active accounts grew only about 1% year-over-year, while total payment transactions declined 5%. Plus, there were signs that users weren’t transacting as often.

Analysts have a consensus price target of $71.44 on PYPL stock, a 21% gain from its closing price on Jan. 26. If PayPal can show that those numbers are turning around, the stock could have much more upside.

Analysts Can Lead You to What Earnings Season Will Reveal for Apple and Others

Apple appears well-positioned heading into its earnings release, supported by strong iPhone demand and rising analyst confidence. Meta Platforms also enters its report with solid expectations, fueled by continued advertising strength and aggressive investments in artificial intelligence. Meanwhile, PayPal faces a more mixed outlook, with earnings growth expected but lingering concerns around user engagement and transaction volumes.

Leave a Reply