NVIDIA Corp. (NASDAQ: NVDA) has been one of the strongest-performing tech stocks in the last two years. Its growth is due to the artificial intelligence (AI) boom that is being be fueled by capex spending by major hyperscalers like Microsoft (NASDAQ: MSFT) and Meta Platforms (NASDAQ: META).

Table of Contents

This surge in AI infrastructure spending is a potential multi-trillion-dollar opportunity. And it’s still in the early innings. That’s being confirmed by NVIDIA’s recent earnings reports, which continue to show blowout earnings and guidance.

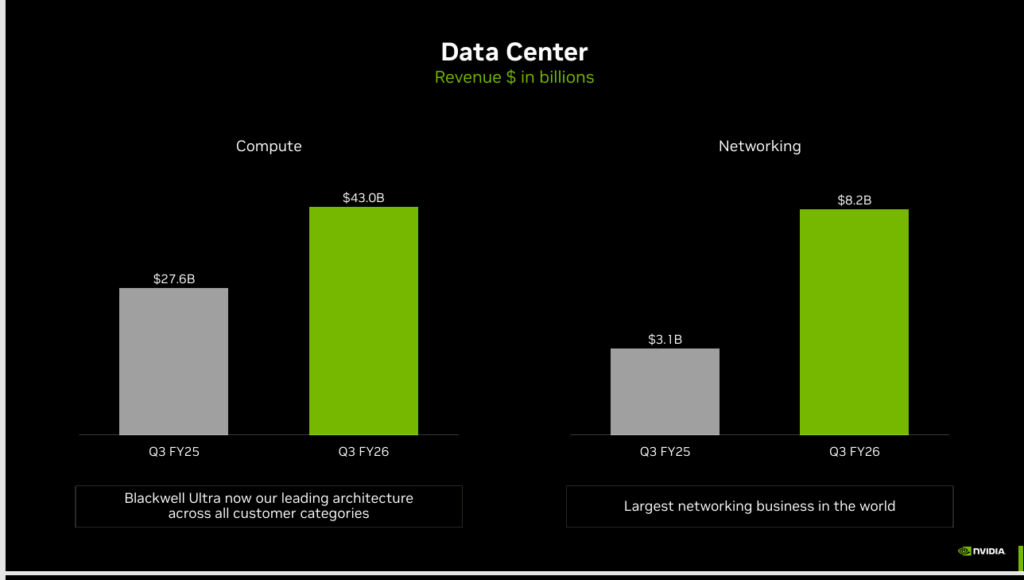

In fact, in its third quarter of 2025, NVIDIA posted earnings per share (EPS) of $1.30, which beat estimates by four cents. Revenue of $57 billion, up 62.5% year over year, beat by $1.91 billion. Data center revenue of $51.2 billion increased 25% quarter over quarter and 66% year over year.

And it was the forward guidance that really got analysts excited. Moving forward, NVIDIA expects to generate $65 billion in revenue, which would be above expectations of $61.98 billion.

Could NVDA Stock Reach $350?

In the 30 days ending December 4, NVDA stock has tumbled 7.7%. That’s brought the price down to $183.38. That’s down from its split-adjusted, 52-week high around $207 on October 31.

Some of the sell-off is due to concerns about valuation. There’s a broader concern about the potential of an “AI bubble.” The thinking is that demand for AI applications may not meet the current demand for all the NVIDIA GPUs the hyperscalers are purchasing.

However, that’s not a concern for Loop Capital’s Ananda Baruah who has forecasted that NVDA stock could rally to $350. The thinking is that the tech giant is at the forefront of the AI demand boom, which shows no signs of slowing.

Goldman Sachs also recently reitered its Buy rating on NVDA stock and raised its price target to $250 following NVIDIA’s impressive earnings. Adding to the list, Evercore ISI analysts raised their price target to $352 with an Outperform rating. The firm cited accelerating revenue growth and improvements in product availability.

Don’t Pay Much Attention to AI Bubble Talk

The risk to the NVIDIA bull thesis stems from the concern about the emerging AI bubble.

Sure, over the last few weeks, Nvidia dipped slipped. But most of that was because of AI bubble talk, which I don’t buy into. Neither does Goldman Sachs, which says the AI story is just getting started.

Even Mary Callahan Erdoes, CEO at JPMorgan Asset and Wealth Management, dispelled worries over valuation, saying that AI is presenting opportunities not fully appreciated or understood yet,” as noted by CNBC. “AI itself is not a bubble. That’s a crazy concept… We are on the precipice of a major, major revolution in a way that companies operate.”

The Artificial Intelligence Boom is Still Accelerating

Forecasts now place AI’s valuation at between $1.7 and $3.5 trillion by the early 2030s, with the most aggressive estimates topping $7 trillion by 2035. Fueling momentum, some of the largest tech companies are investing billions in AI capital expenditures.

- Alphabet Inc. (NASDAQ: GOOGL) raised its 2025 capex outlook to $91 billion to $93 billion.

- Microsoft is increasing its spending 74% to $34.9 billion

- Meta nearly doubled capex to $19.37 billion, far above expectations

- Amazon (NASDAQ: AMZN) projects $125 billion in 2025 capex, with more increases planned for 2026

The spending shows no sign of slowing down. Analysts at UBS now expects global AI capex to hit $571 billion in 2026, and potentially to $3 trillion by 2030.

Why You Should Go Long on NVDA

The bull case for NVIDIA comes down to supply and demand. If demand for the company’s GPUs continues as expected, the company’s runway for growth will be nearly unlimited. Competition will continue to grow in coming years, but with its current market share advantage, NVIDIA will be the go-to provider for years to coe.

In short, you can confidently go long on NVDA stock for the long term.

Leave a Reply