It’s been a strong year for hot AI ETFs (exchange-traded funds). That’s because the artificial intelligence (AI) boom is still accelerating.

Table of Contents

The global AI market surpassed $230 billion in 2024. But it was just getting warmed up. Analysts now see a clear path to multi-trillion-dollar expansion—and the next five years may deliver the strongest gains yet.

Forecasts now place AI’s value between $1.7 and $3.5 trillion by the early 2030s, with the most aggressive estimates topping $7 trillion by 2035. And judging by the surge in corporate investment, the market is expecting the valuation to be near the high end of those projections.

In fact, some of the largest tech companies are sending a clear message that the AI boom is far from over. Just look at recent capex spending:

- Alphabet Inc. (NASDAQ: GOOGL) raised its 2025 capex outlook to $91 billion to $93 billion.

- Microsoft Corp. (NASDAQ: MSFT) is increasing its spending by 74% to $34.9 billion.

- Meta Platforms Inc. (NASDAQ: META) nearly doubled capex to $19.37 billion, far above expectations.

- Amazon.com Inc. (NASDAQ: AMZN) projects $125 billion in 2025 capex.

For investors, these numbers are impossible to ignore. Even better, analysts at UBS now expect global AI capex to hit $571B in 2026, with a runway to $3 trillion by 2030.

So, how can you invest in the AI story, even after all of the momentum?

You can always jump into individual stocks such as NVIDIA Corp. (NASDAQ: NVDA), Advanced Micro Devices Inc. (NASDAQ: AMD), Palantir Technologies Inc. (NASDAQ: PLTR), and Taiwan Semiconductor Manufacturing Co. (NYSE: TSM).

In fact, investing in all of them isn’t a bad idea at all.

However, each of these stocks, and many others like them, have grown so far and so fast that they present valuation concerns. And as the market has been reminding investors, high-priced stocks can drop as fast as they can rise.

That’s what makes ETFs a popular and less volatile choice. If you want good exposure, consider one of these three hot AI ETFs.

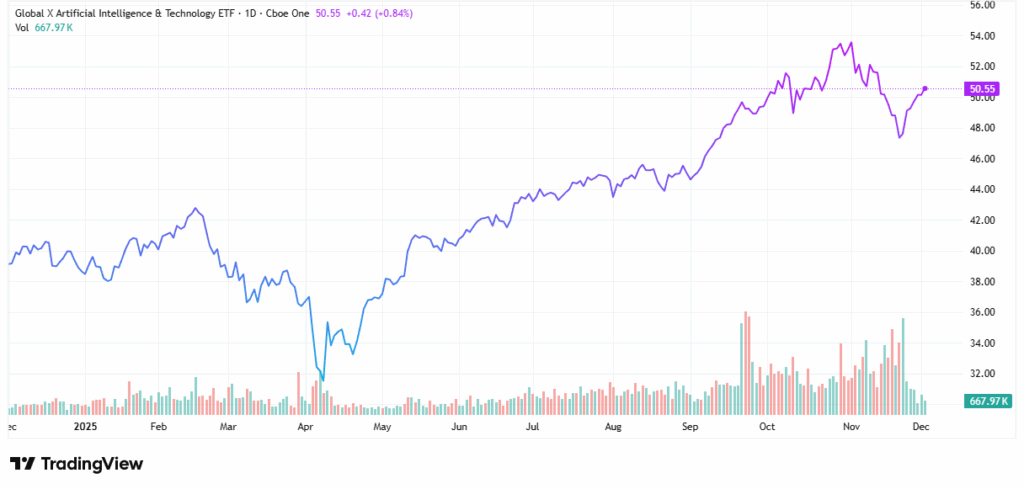

Hot AI ETFs for 2026: Global X Artificial Intelligence & Technology ETF

The Global X Artificial Intelligence & Technology ETF (AIQ) is up about 30% in 2025. That performance illustrates both sides of the ETF story. On the one hand, a 30% gain is impressive in any year. However, it may leave some investors wanting, particularly as some of the fund’s underlying names have delivered far better performance.

With an expense ratio of 0.68%, the ETF invests in companies that are likely to benefit from the further development and application of artificial intelligence (AI) technology.

Some of its top holdings include Palantir, Oracle Co. (NYSE: ORCL), Broadcom Inc. (NASDAQ: AVGO), Netflix Inc. (NASDAQ: NFLX), Nvidia, Microsoft and Meta Platforms.

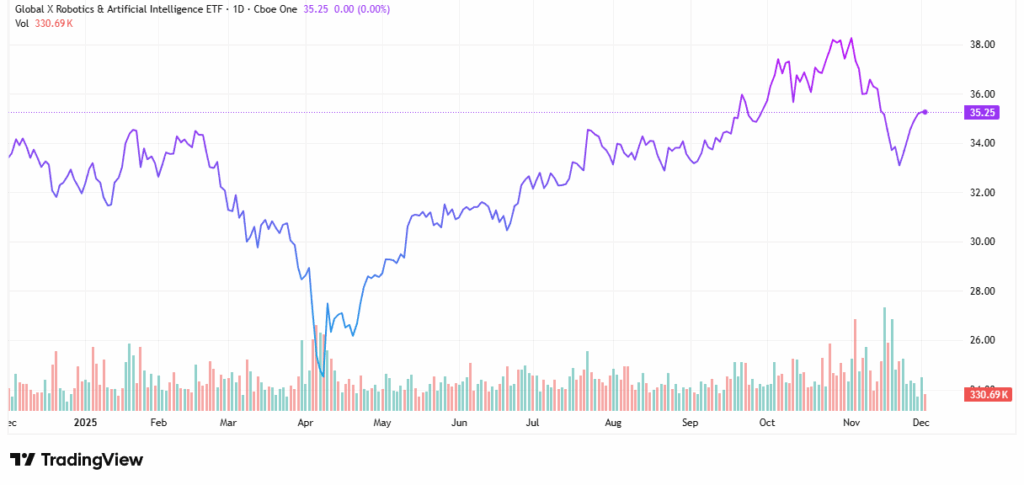

Hot AI ETFs for 2026: Global X Robotics and Artificial Intelligence ETF

Another one of the top AI ETFs to consider is the Global X Robotics and Artificial Intelligence ETF (BOTZ). The fund is up about 10.3% in 2025 as of this writing. The fund provides market-cap selected and weighted exposure to companies involved in the development and production of robots or artificial intelligence.

With an expense ratio of 0.68%, the ETF invests in companies that should benefit from the increased adoption of robotics and AI. Some of its 49 holdings include Nvidia, Keyence, DynaTrace, SMC Corp., Intuitive Surgical, Upstart Holdings, and C3.ai.

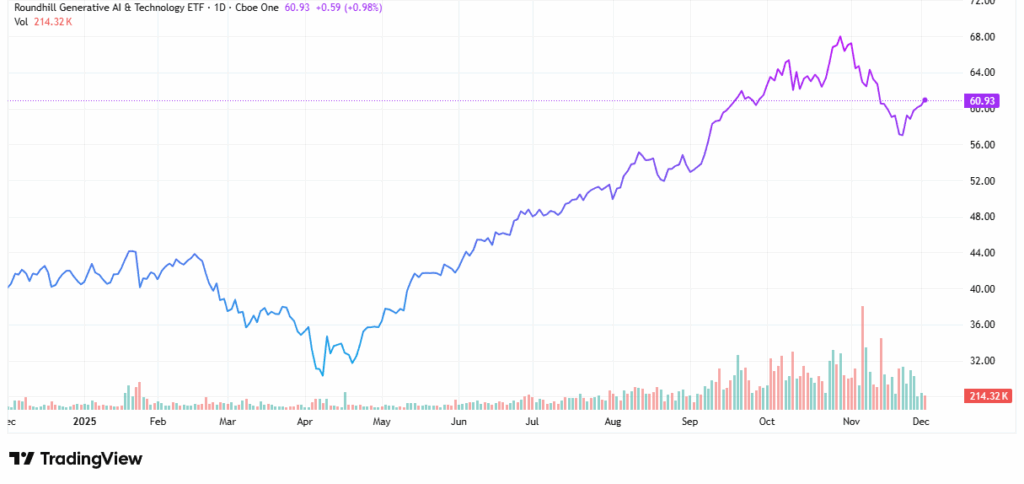

Hot AI ETFs for 2026: Roundhill Generative AI & Technology ETF

As its name suggests, the Roundhill Generative AI & Technology ETF (CHAT) is a relative baby among ETFs, having only been publicly trading since 2023. Still, the ETF has doubled in that time and is up over 55% in 2025 alone.

With an expense ratio of 0.75%, the Roundhill Generative AI & Technology ETF is the world’s first generative AI ETF. Some of its 38 holdings include Nvidia, Alphabet, Meta Platforms, Microsoft, Oracle, Palantir Technologies and Alibaba Group Holding.

Leave a Reply