For some investors, getting involved with sector stocks means buying an exchange-traded fund that holds a basket of stocks in the sector. That protects you from the risk of owning individual stocks.

Table of Contents

However, many investors wonder what’s the fun in that? They enjoy stock picking and the hunt for promising sector stocks.

One metric to look for is insider buying. Insiders know their company the best. So, if they’re buying, there’s often a good reason for it. While it’s important for you to perform your own due diligence, I’m happy to get you started by looking at three sector stocks with heavy insider buying.

Sector Stocks to Buy: DraftKings

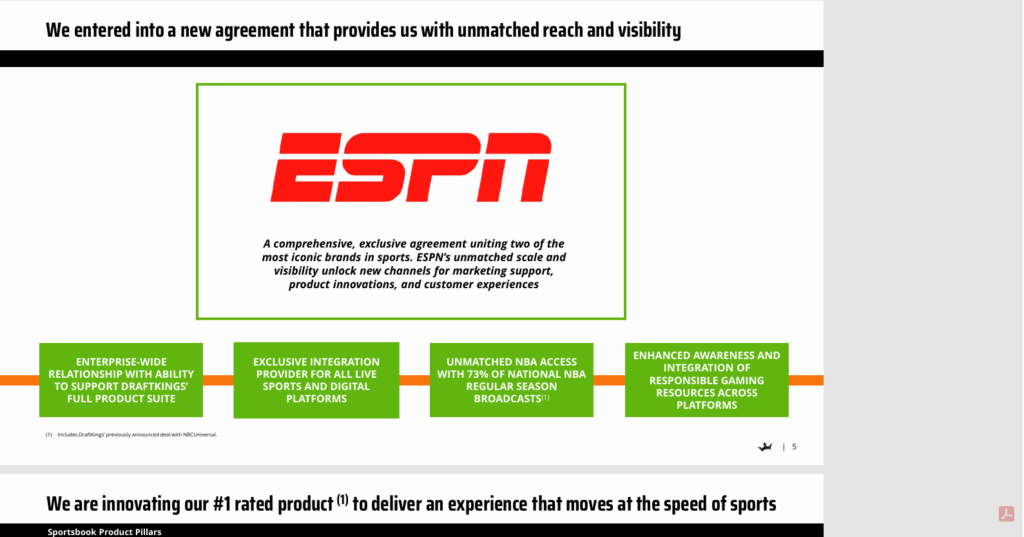

DraftKings Inc. (NASDAQ: DKNG) has had a strong two-year run as sports betting becomes legal in an increasing number of states. However, the rise of prediction markets has sent DKNG stock back to reality, or maybe into oversold territory.

That’s certainly what the company insiders believe. With DKNG stock down 35% in the last three months as of this writing, two DKNG insiders saw the drop as a buy opportunity.

Metro-Goldwyn Meyer (MGM) CEO Harry Sloan, who has been on the board of DraftKings since early 2020, bought 25,000 shares for about $30.30 each, or $757,500.

And Director Gregory Wendt made his first purchase since joining the board in late October. Wendt bought 10,000 shares for $30.27 each, or a total of $302,700.

These insiders may be betting on the company’s exclusive agreement with ESPN to propel it to greater heights. Time will tell if it’s a good bet.

Sector Stocks to Buy: Norwegian Cruise Lines

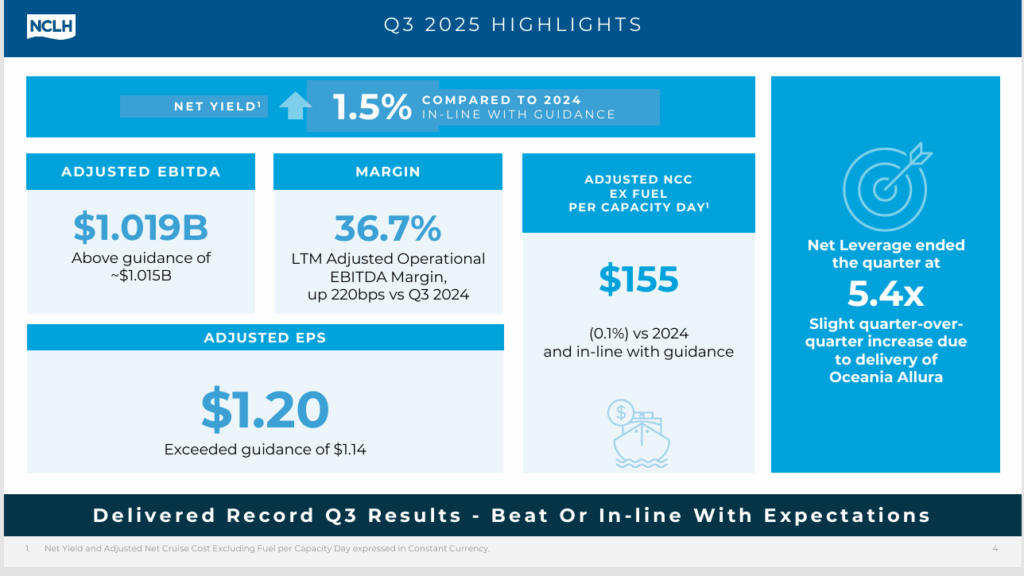

Cruise line stocks were on fire heading into 2025. But concerns about tariffs and the end of the experience trade, has put many of these stocks into choppy seas.

That may be creating an opportunity with Norwegian Cruise Line Holdings (NYSE: NCLH). The stock gapped lower from approximately $22 to $18.24 after the company delivered disappointing earnings.

However, that didn’t deter three insiders from buying the stock. On November 6, executive vice president (EVP) and chief financial officer (CFO) Mark Kempra bought $197,051 worth of stock. Chief Luxury Officer Jason Montague bought $252,020 worth of the stock. And the President and CEO, Harry Sommer picked up $462,932 worth of the NCLH stock.

At $18.56 a share, NCLH is oversold at support dating back to June. It’s also oversold on RSI, MACD, and Williams’ %R. The last time it became this oversold, NCLH ran from a low of about $15 a share to a high of about $27 a share.

Sector Stocks to Buy: Intuitive Machines

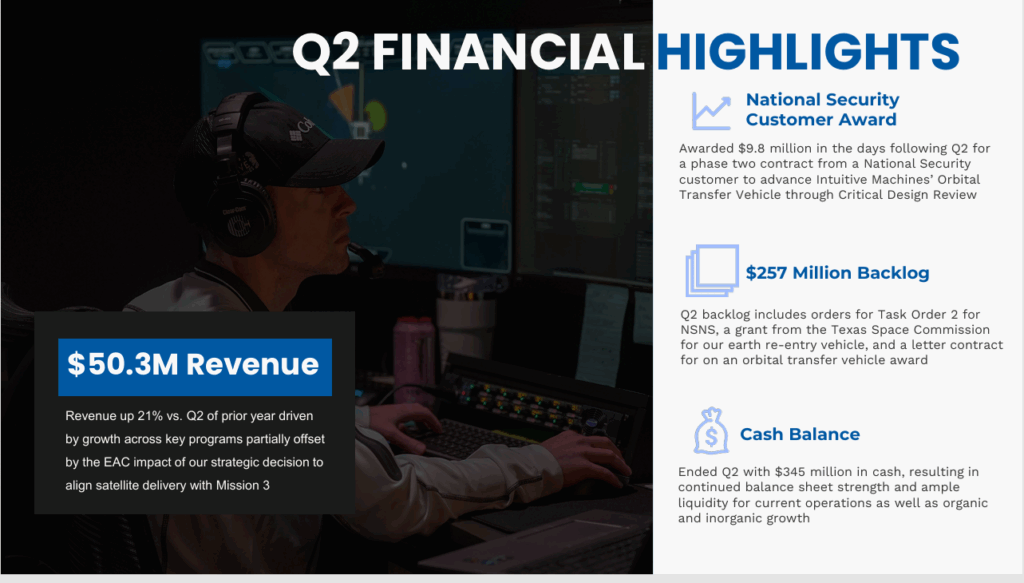

Intuitive Machines Inc. (NASDAQ: LUNR) is one of the intriguing stocks in the emerging space sector. The company made headlines for landing a vehicle on the moon’s surface in 2024.

That seems like a long time ago for investors. LUNR stock is down over 51% in the last 12 months. However, after the stock slipped from a mid-October high of around $14, director Michael Blitzer bought 141,080 shares on November 12 for about $1.3 million. On November 13, he bought 100,000 shares of LUNR for about $883,230.

Analyst sentiment supports the buys. Stifel just initiated coverage of the LUNR stock with a buy rating with an $18 price target. “The firm highlighted Intuitive Machines’ early-mover advantage in the emerging lunar market, noting the company has established advantaged positions in multiple verticals including delivery services and lunar communication,” according to Investing.com.

Analysts at Deutsche Bank upgraded LUNR to a buy rating with a price target of $18, as well. The firm sees an attractive set-up for the next three to six months, supported by clear commercial catalysts. The firm also believes LUNR trades at a sizable discount to its peers.

If You Remember Nothing Else…

Remember, insiders sell stocks for many reasons. But they only buy for one reason. That is, they believe their company’s stock is undervalued. That’s why when you detect unusually heavy insider buying, it’s usually a signal that the stock may be worth a closer look.

Leave a Reply