Forget the iPhone (cover your ears, Tim Cook), if you’re part of the Apple Inc. (NASDAQ: AAPL) ecosystem, you should be hoping for some shares of AAPL stock for the holidays. The stock is down a fraction the day after the company delivered what was deemed a mixed earnings report.

Table of Contents

As is usually the case with Apple, beauty is in the eye of the beholder. To paraphrase a familiar quote attributed to Henry Ford, “whether you’re a bull or a bear, you’re right.” However, if you’re a long-term investor, it’s always paid to be bullish on AAPL stock, and there’s nothing about this report that should make you feel otherwise.

The headline numbers only tell part of the story. Revenue of $102.47 billion beat estimates for $102.25 billion and was 8% higher on a year-over-year (YoY) basis. Earnings per share (EPS) of $1.85 also beat estimates for $1.77 by 4.5% and were 12% YoY.

The company also posted a record $28.8 billion in revenue from its Services business. That was up 15% YoY. Apple expects the Services business to grow at a mid-teens rate.

Even the company’s Mac segment made a strong showing. Revenue of $8.7 billion was 13% higher YoY. Apple pointed to the popularity of its MacBook Air. The company was not as bullish about growth in this category as it will not have the benefit of new launches like it did in 2024.

That leaves the iPhone, and that’s where the bears will say the report was mixed. But again, that depends on who you ask.

Apple Says it Couldn’t Keep Up with Demand

Despite the overall strength in Apple’s report, the company reported supply constraints that held back iPhone 17 sales in the quarter, particularly in China.

Wait, I thought high demand was a good thing? It is, but that’s not what investors took from the report. Once again, being bullish or bearish on the iPhone is a matter of perspective.

The bears will say that there’s not much that’s “special” about the iPhone 17. Therefore, much of the demand is driven by consumers who “have to” upgrade, not from genuine excitement for the phone itself. This argument would say that the growth trajectory will be short-lived.

On the other hand, the bulls will counter that the company recorded record revenue of $49.02 billion in iPhone sales for the quarter. Keep in mind, the iPhone 17 had only been out for a couple of weeks. Additionally, the company anticipates that supply will catch up in the current quarter, while forecasting overall sales to grow at a faster-than-anticipated pace.

A Quiet Advantage in the AI Arms Race

But what about AI? That’s the broken record question as it relates to Apple. Many analysts have labeled artificial intelligence as Apple’s Achilles’ heels. They say it’s a black hole of missed opportunity while rivals like Microsoft Corp. (NASDAQ: MSFT) and Alphabet (NASDAQ: GOOGL) pour billions into model development. But that view misses the essence of Apple’s strategy. The company’s greatest asset isn’t an LLM, it’s the ecosystem.

Apple’s walled garden connects more than two billion active devices across iPhone, Mac, Watch, and Services, forming a customer base that values privacy, integration, and ease of use more than bleeding-edge AI. That ecosystem gives Apple pricing power, retention, and recurring revenue—all without chasing the AI arms race.

Instead of building its own generative model from scratch, Apple is leveraging strategic partnerships to efficiently gain AI capabilities. Through its collaboration with Alphabet, Apple will integrate Gemini models into iOS, Safari, and Siri, effectively renting world-class AI without the massive capital outlay or risk. It’s a classic Apple move: let others fight over technology leadership while it focuses on user experience, design, and monetization.

Apple’s AI story is about integration, not invention. On-device intelligence powered by Apple Silicon keeps data private, fast, and local—an advantage that aligns with the company’s brand and deepens user loyalty. As the market fixates on who builds the biggest model, the company continues to build the most valuable ecosystem. That could make its understated approach to AI one of its smartest long-term bets.

Was the Growth Already Priced In?

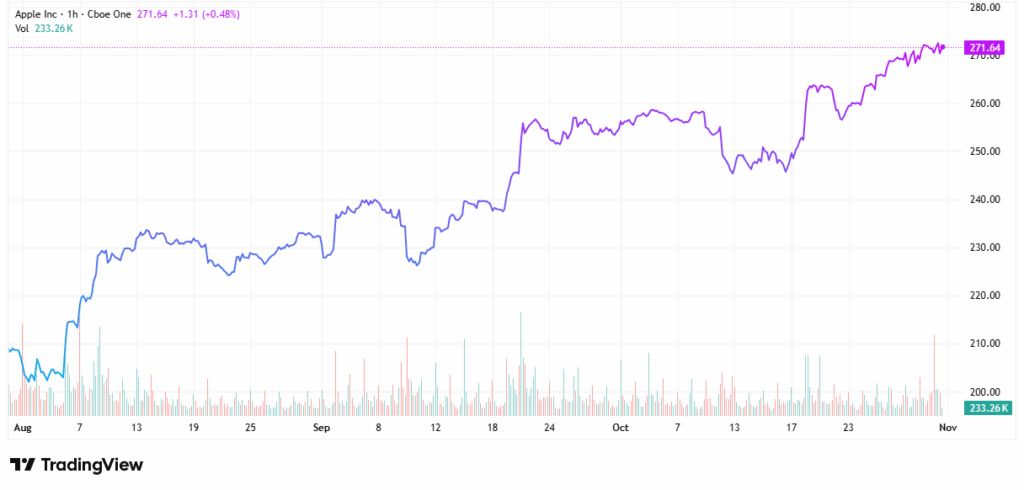

A more accurate argument for the bears to sink their teeth into is that AAPL stock is up more than 30% in the last three months. That’s a significant gain, which means investors could say they had the right to expect more.

If that’s the case, then analysts would be holding the line on the stock. But the opposite is occurring. Since the report, approximately a dozen analysts have raised their price target for AAPL stock. Many of those price targets have a “3” handle. The highest comes from Melius, which has a $345 price target for AAPL stock.

That means that analysts, who listened to the company’s earnings call, believe there’s stronger growth ahead. That means that you should look at any post-earnings weakness as a gift, then give yourself one heading into the holiday season.

Leave a Reply