Whether you’re looking for a swing trade, momentum buy, or long-term investment, you should keep an eye on stock buybacks. A company buys back its stock as a way to increase shareholder value.

Table of Contents

When a company buys back its own stock, the total number of outstanding shares decreases. The principles of supply and demand dictate that stock buybacks will increase the value of a stock. Fewer shares available to buy increases the value of the outstanding shares.

However, stock buybacks are also a way for companies to reinvest in future growth. That certainly seems like the case for these three companies that recently announced significant share buyback programs.

Lyft: Should You Ride With This Ride-Sharing Stock?

Lyft Inc. (NASDAQ: LYFT) increased its stock buyback program to $750 million in May 2025. “The company, which is expanding beyond major U.S. cities into smaller markets, said it intends to use $500 million of the authorization within the next 12 months,” added Reuters.

At the time of the announcement, management said it intended to buy back about $200 million in the next three months.

Even better, “Q1 marked Lyft’s 16th consecutive quarter of double-digit year-on-year gross bookings growth,” said CEO David Risher, adding that in the last week of March, rides reached the highest weekly levels in the company’s history, making 2025 the strongest start in Lyft’s history, according to Seeking Alpha.

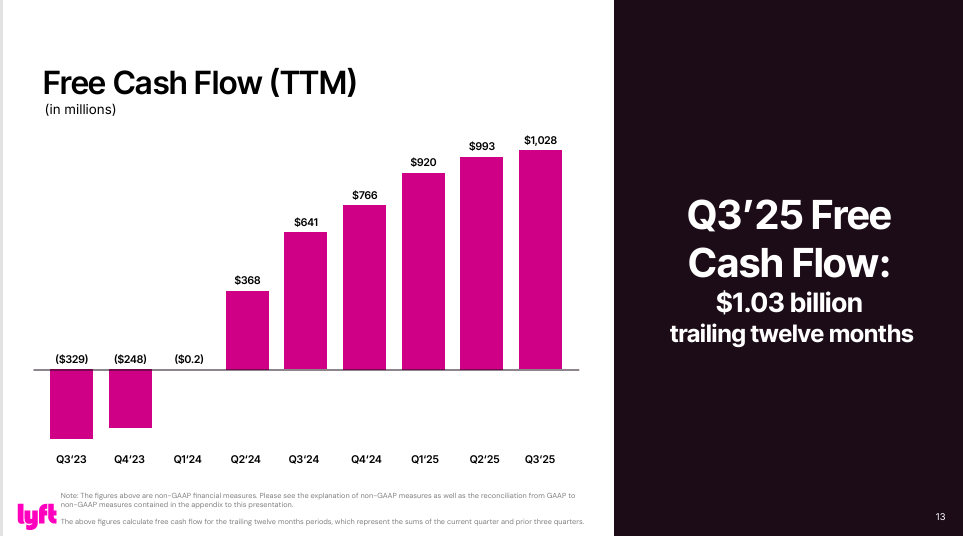

Plus, free cash flow more than doubled from last year to $280.7 million in the first quarter and reached nearly $1 billion for the trailing 12 months. This is an important consideration because it means the stock buybacks are coming from a position of strength.

General Motors: Doubling Down on Future Growth

General Motors (NYSE: GM) just raised its quarterly dividend by 25% to 15 cents a share, and initiated a new $6 billion share buyback program. The company bought back $1.5 billion of stock in the third quarter.

Since 2023, the company has announced $16 billion in stock buyback programs, which resulted in buying back more than a billion outstanding shares.

“We feel confident in our business plan, our balance sheet remains strong, and we will be agile if we need to respond to changes in public policy,” CFO Paul Jacobson said, as quoted by CNBC. “The repurchase authorization our board approved continues a commitment to our capital allocation policy.”

Despite concerns over soft demand for both electric vehicles and internal combustion engine (ICE) vehicles, GM stock is up approximately 33% in 2025. As of this writing, the stock is trading slightly above its consensus price target of $70. However, analysts have been increasing their price targets. And at 6x forward earnings, the stock has an attractive valuation.

Block is a Turnaround in the Making

Block (NYSE: XYZ) is a financial technology (fintech) company that is in the process of diversifying away from its legacy point-of-sale (POS) business and launching more services tied to its Cash App, as well as offering artificial intelligence tools to sellers.

Block just authorized a $5 billion stock buyback. It also forecasted adjusted EPS of $5.50 by 2028, which is ahead of estimates of $4.76 a share. For 2026, the payments company anticipates adjusted earnings per share will be $3.20, four cents above Wall Street targets.

Management delivered “an articulation of the [near-term/long-term] vision paired with enough operational detail to credibly support the turnaround and growth narrative through 2028, culminating in a ‘mic drop’ moment for Amrita Ahuja (“CFO”) as she delivered a very clear and impressive financial presentation,” Evercore ISI analysts said, as quoted by Seeking Alpha.

The Bottom Line on Stock Buybacks

Critics of stock buybacks will say that they can be a way for a company to disguise its lack of growth. That means they’re giving shareholders growth via buybacks because they have reached a mature phase of their business cycle.

However, as you can see with these three companies, when stock buybacks are combined with the potential for future growth, they can provide traders and investors with asymmetric opportunities.

Leave a Reply