PayPal Holdings Inc. (NASDAQ: PYPL) delivered a solid earnings report, but PYPL stock is down about 11% the day after the report. Earnings season delivers some positive and negative surprises. In the case of PayPal, investors were looking for spectacular, not solid, returns from a company that was once a leading disruptor among financial technology stocks.

Table of Contents

The Good and the Bad in PayPal’s Earnings Report

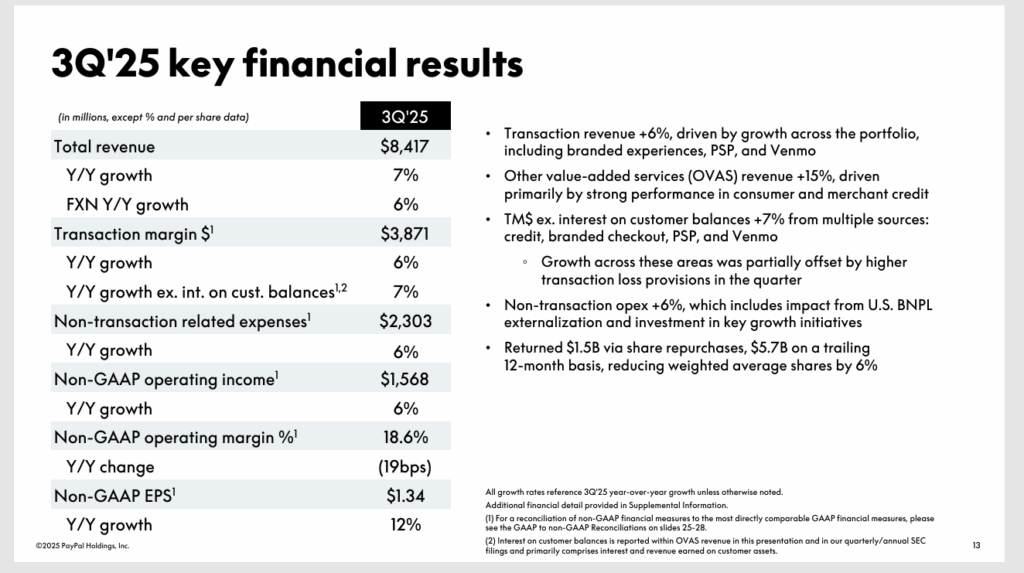

Revenue of $8.42 billion was 2.2% higher than estimates of $8.23 billion and came in higher than the $7.85 billion it recorded in the same quarter in 2024.

On the bottom line, there was a similar and stronger story. Earnings per share of $1.34 came in 11% above estimates for $1.21. That was also about the same percentage growth as the $1.20 it reported in the prior year quarter. PayPal also raised its full-year EPS guidance to a range of 15% to 16%, well above the prior target of 11% to 14%.

That’s all positive news. However, it seems that investors are locked into some of the more underwhelming data points that include:

- Transaction volume growth of 8% (7% currency-neutral)

- Active accounts grew only 1%, while monthly active accounts increased just 2%

- Total payment transactions declined 5% due to strategic pruning of lower-value PSP business

- Growth rates, while improving, still modest compared to fintech competitors

All of this points to a situation that PayPal has been wrestling with for some time. It’s a company that is no longer unique and is struggling to keep up with more nimble competitors.

PayPal is Betting on the Future

The bull case for PayPal centers around the company’s ability to swiftly catch up to its competitors. To that end, PayPal announced progress on five key strategic initiatives.

First, it launched “Agentic Commerce Services.” As the name implies, this is a platform that uses agentic AI to help merchants sell through AI platforms. This positions the company as a payment infrastructure for AI-powered shopping assistants. It also gives PayPal the ability to capture the emerging commerce channel as AI agents make purchases.

PayPal also reported on the progress of its PYUSD stablecoin, which now has a $2.5 billion market capitalization. The company is also introducing “Pay with Crypto,” which is part of the company’s plans to reimagine global monetary movement with blockchain technology.

Third, PayPal launched PayPal Everywhere that is one part of a larger omnichannel expansion strategy that includes debit card and tap-to-pay growth.

Fourth, the company announced that is Buy Now, Pay Later (BNPL) business is scaling, announcing expectations of approximately $40 billion in BNPL TPV for 2025 with volume and accounts both growing over 20%.

And last, but not least, PayPal announced PayPal Ads Manager. This advertising platform creates a new revenue stream from merchant advertising by allowing small businesses to generate their own campaigns.

The Market is Weighing the Risk More Than the Reward

PayPal is in the midst of a transition. That may pay off in future quarters. But for now, investors are looking to sell first. There are two areas of concern.

Topping the list is profit growth concerns. The company’s transaction loss rate increased by three basis points to 9%, driven by higher provisions and the impact of the company’s August service disruption. The company’s non-transaction operating expenses grew 6%, including the impact of BNPL externalization and growth investments. All of this weighed on the company’s operating margin, which was down 19% year-over-year.

Investors are also weighing execution risks. As listed above, PayPal has many growth initiatives underway, but many are still in the early stages. These will still require significant investment that will likely affect earnings. And that’s happening at a time when competitive pressure is only intensifying.

PYPL Stock Now Pays a Dividend, But Is It a White Flag?

One highlight of PayPal’s report is that the company announced its first-ever dividend. On December 10, shareholders of record on November 19 will receive a cash dividend of 14 cents per share. The dividend yield is 0.77%, so PYPL stock isn’t a yield trap by any means. However, growth-oriented investors may wonder if the company is conceding that its high-growth days are behind it.

To be clear, the presence of a dividend, by itself, doesn’t mean a growth stock has become a value stock. Companies like Microsoft and Apple are good examples of high-growth companies that pay dividends. Both companies are so cash-rich that they can afford to pay dividends and still spend on the growth of their respective businesses as needed.

And with strong free cash flow between $6 billion and $7 billion, the dividend is safe. Plus, it’s being initiated at the same time the company announced approximately $6 billion in share repurchases.

However, in PayPal’s own words, the company’s focus is on “investing for growth AND returning capital” suggests it’s looking to perform a balancing act. That could be a tacit signal the company’s hypergrowth days are behind it.

Nevertheless, analysts assign PYPL stock a consensus price target of $83.50, which would be a 19% gain from its current level. Also, at around 14.8x earnings, the stock is trading at a discount to its historic averages.

Leave a Reply