Mindblown: a blog about philosophy.

-

Expensive but Worth It? 3 High P/E Stocks with Long-Term Upside

High P/E stocks are not for every investor, and the valuation risk is real. But these stocks have credible paths to growi into their current valuations

-

Costco Stock Drops on Strong Q2 Earnings: Is the Dividend Enough?

Costco stock looks to have limited upside despite a thriving business. Is a reliable dividend enough to offset the high share price and lofty valuation?

-

CrowdStrike (CRWD) Stock May Offer Respite Amid the Geopolitical Crisis

While the market sludges forward in a muddy environment, CrowdStrike may suddenly have the relevance boost it has been seeking all along.

-

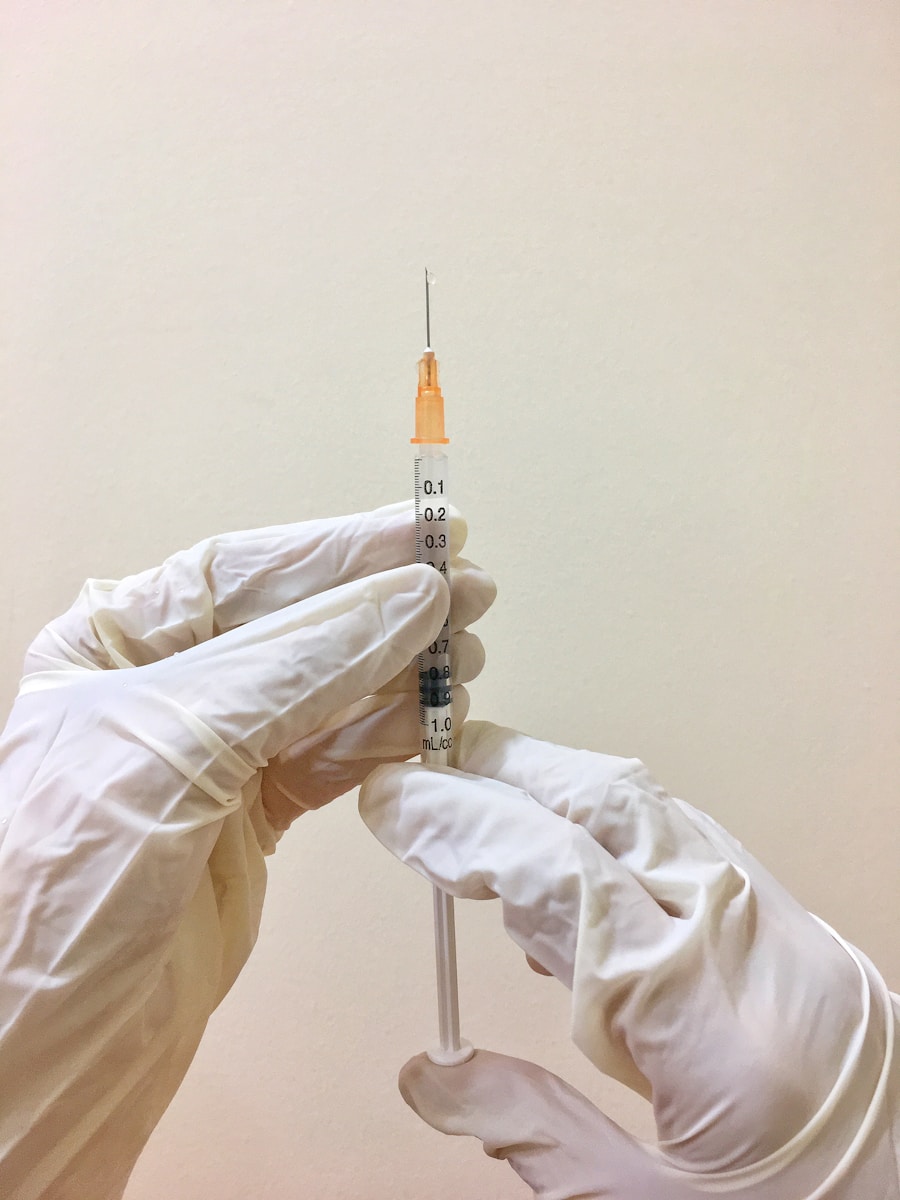

Why ‘COVID Darling’ Novavax (NVAX) Stock Is on a Comeback Trail

After a sizable collapse following the global pandemic, NVAX stock may be one of the more intriguing high-risk wagers for market gamblers to consider.

-

Broadcom Stock Surges After Blowout Q1 Earnings — Can It Hold the Gains?

Broadcom (AVGO) stock is surging after earnings, but how the stock trades tomorrow will say more about the market’s mood than about Broadcom’s business

-

ROST vs. TGT: Which Retail Stock Wins in 2026?

Heading into earnings, the contrast between ROST and TGT couldn’t have been more striking. Strong reports from both may change investors’ outlook.

-

The SPY ETF Just Flashed a Warning Ahead of Costco’s (COST) Q2 Earnings

Investors will want to take heed of the smart money’s risk positioning and prepare themselves for a possible rough surprise from COST stock.

-

The Smart Investor’s Guide to Overheated Volatility

Seasoned investors know volatility is emotional. When volatility stops rising on bad news, that’s often the first sign that panic is burning out.

-

Broadcom (AVGO) Can Help Restore AI Confidence with a Strong Q1 Report

Although Broadcom has struggled for traction this year, another positive disclosure could help steady the platform for AVGO stock.

-

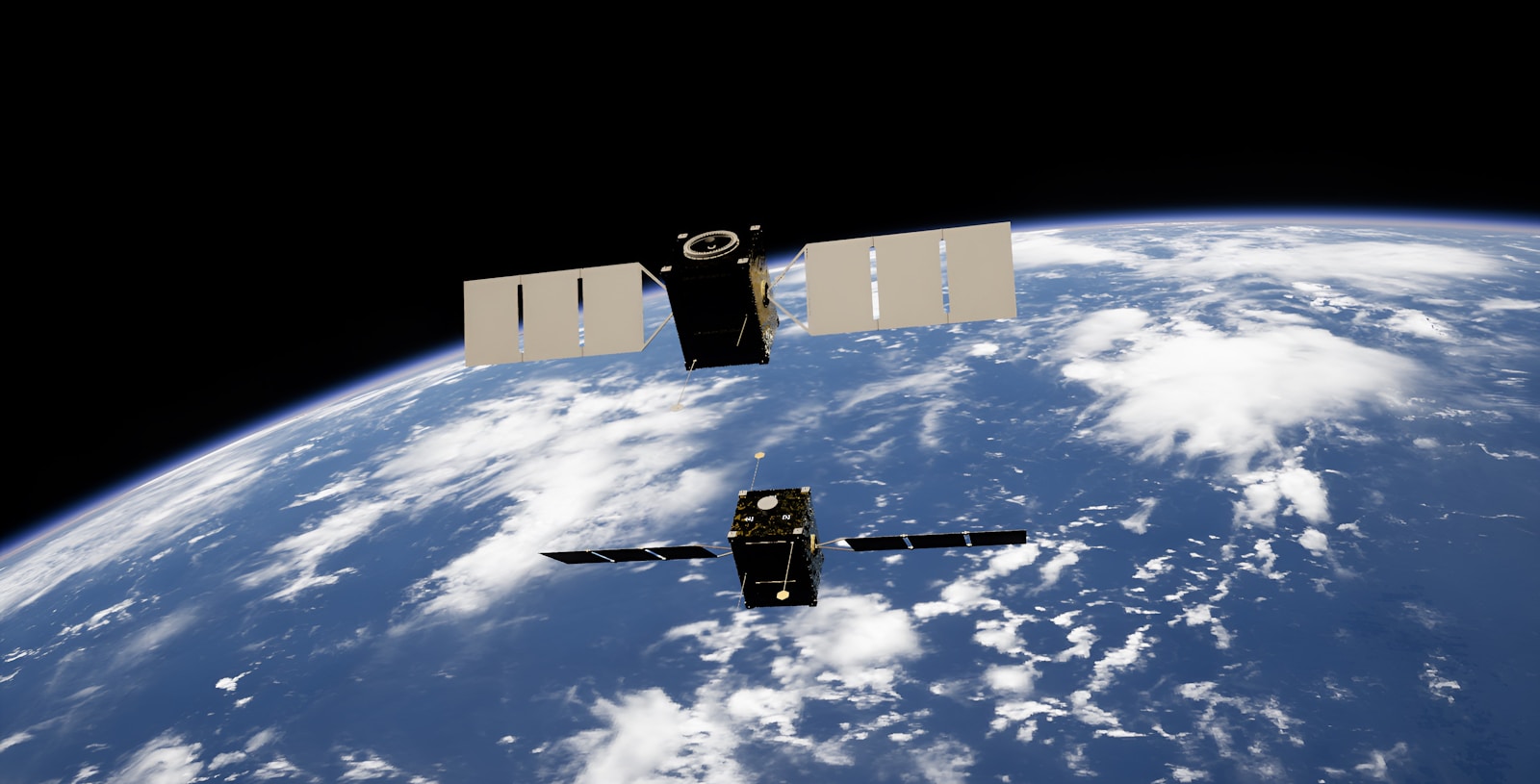

Could ASTS SpaceMobile Be the Next Palantir?

ASTS has become what traders increasingly call a “yeah, but” stock. The company is checking off a remarkable number of boxes, but analysts keep pumping the brakes

Got any book recommendations?